Ally Financial (ALLY) Gains on Q1 Earnings Beat, Costs Rise Y/Y

Shares of Ally Financial ALLY gained 6.7% following the release of its first-quarter 2024 results. Adjusted earnings of 45 cents per share surpassed the Zacks Consensus Estimate of 33 cents. However, the bottom line reflects a decline of 45.1% from the year-ago quarter.

Results were primarily aided by an improvement in other revenues. However, a decline in net financing revenues, along with higher expenses and provisions, were the undermining factors.

After considering non-recurring items, net income available to common shareholders (on a GAAP basis) was $129 million compared with $291 million in the prior-year quarter.

Revenues Decline, Expenses Rise

Total GAAP net revenues were $1.99 billion, down 5.4% from the prior-year quarter. However, the top line surpassed the Zacks Consensus Estimate of $1.96 billion.

Net financing revenues were down 9.1% from the prior-year quarter to $1.46 billion. The decline was primarily due to a drastic rise in interest on deposits. Our estimate for net financing revenues was $1.44 billion.

The adjusted net interest margin was 3.16%, down 38 basis points year over year.

Total other revenues were $530 million, up 6.4% from the prior-year quarter. We projected other revenues of $518.9 million.

Total non-interest expenses increased 3.3% year over year to $1.31 billion. The upswing stemmed from higher insurance losses and loss-adjustment expenses, and other operating expenses. Our estimate for expenses was $1.27 billion.

The adjusted efficiency ratio was 60.2%, up from 55.8% in the year-ago period. A rise in the efficiency ratio indicates a deterioration in profitability.

Credit Quality: Mixed Bag

Non-performing loans were $1.25 billion as of Mar 31, 2024, down 9.5% year over year. Our estimate for the metric was $1.43 billion.

In the reported quarter, the company recorded net charge-offs of $539 million, up 31.8% from the prior-year quarter. We had projected net charge-offs of $532.2 million. The company also reported a provision for loan losses of $507 million, up 13.7% from the prior-year quarter. Our estimate for provisions was $587.8 million.

Loan Balances Decline, Deposits Increase Marginally

As of Mar 31, 2024, total net finance receivables and loans amounted to $134.4 billion, down 1.1% from the prior-quarter end. Our estimate for the metric was $132.8 billion. Deposits increased marginally from the prior-quarter end to $155.1 billion. We projected deposits of $153.5 billion.

Capital Ratios Mixed

As of Mar 31, 2024, the total capital ratio was 12.5%, unchanged from the prior-year quarter. The tier I capital ratio was 10.8%, up from 10.7% as of Mar 31, 2023.

Share Repurchase Update

In the reported quarter, the company did not repurchase any shares.

Our View

Ally Financial’s initiatives to diversify its revenue base will likely keep aiding profitability. Given a solid balance sheet, the company is well-poised to expand through acquisitions. In March, it completed the divestiture of its point-of-sale financing business — Ally Lending — to Synchrony. The move reflects ALLY's commitment to optimizing its capital allocation and prioritizing resources toward high-growth areas.

Rising expenses (mainly due to its inorganic growth efforts) and higher provisions will likely hurt ALLY’s bottom-line growth in the near term.

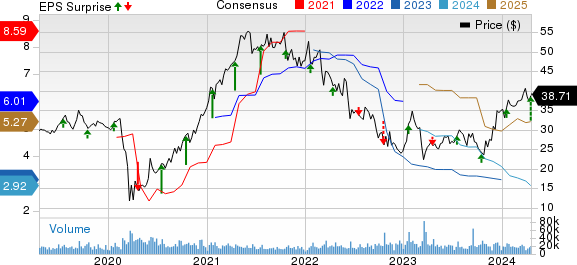

Ally Financial Inc. Price, Consensus and EPS Surprise

Ally Financial Inc. price-consensus-eps-surprise-chart | Ally Financial Inc. Quote

Currently, Ally Financial carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

State Street’s STT first-quarter 2024 adjusted earnings of $1.69 per share surpassed the Zacks Consensus Estimate of $1.48. The bottom line increased 11.2% from the prior-year quarter.

STT’s results were primarily aided by growth in fee revenues and lower provisions. Also, the company witnessed improvements in the total assets under custody and assets under management balances. However, lower NIR and higher expenses were major headwinds.

Wells Fargo’s WFC first-quarter 2024 adjusted earnings per share of $1.26 surpassed the Zacks Consensus Estimate of $1.10. The adjusted figure excludes the impacts of expenses from the FDIC special assessment. In the prior-year quarter, the company reported earnings per share of $1.23.

Results benefited from higher non-interest income. An improvement in capital ratios and a decline in provisions were other positives. However, the decrease in net interest income and loan balances and an increase in expenses were the undermining factors for WFC.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

State Street Corporation (STT) : Free Stock Analysis Report

Ally Financial Inc. (ALLY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance