How Alphabet (NASDAQ:GOOG.L) is Involved in the Few Real Growth Industries

This article was originally published on Simply Wall St News

Scanning for good companies, means looking for smart decision-making in a market that has growth opportunities. It seems that Alphabet's (NASDAQ:GOOG.L) is in a good place to address both metrics. The company is addressing one of the few market segments that have organic growth still implied - the cloud. In this article, first we will analyze the growth prospects for Alphabet, and we will also see how good is their decision track-record, based on their returns.

The two main segments in which the company earns are Google Services and Google Cloud.

Google Services includes products and services such as Ads, Android, Chrome, Google Maps, Google Play, Search, and YouTube. This segment accounts for about 92% of revenues in the last 6 months. The bulk of this income is from Google Search, while YouTube also contributes a medium amount.

Google Cloud includes Google’s infrastructure and data analytics platforms, collaboration tools, and other services for enterprise customers. This segment is newer, and the one Google is aggressively developing for enterprise customers and innovators. The cloud accounts for some 8% of revenues in the last 6 months.

Google Cloud is still unprofitable and developing. In their last 6 months, they reduced their operating loss from US$-3.16b to US$-1.6b. This improvement in EBIT indicates that their cloud service is moving in a positive direction and that the company is serious about becoming a major cloud provider.

Check out our latest analysis for Alphabet

The cloud is incidentally where the majority of the future growth potential comes from, and Google is in an excellent position to execute. This service has the potential to become the new utility of the 21century, where companies and possibly individuals can "plug-in" in order to get valuable services such as storage, databases, analytics, networking and other innovations that we are unable to estimate as of today.

The cloud is attractive because it is dependent both on infrastructure investments and innovation from engineers. This gives Alphabet a head start, because it has the know-how and one of the highest cloud infrastructure quality in the world. The company is constantly developing software and making it accessible for clients of all sizes to access the service.

Now let's see how good has the company been in regard to making profitable decisions.

Return On Capital Employed (ROCE): What is it?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Alphabet is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.22 = US$63b ÷ (US$335b - US$56b) (Based on the trailing twelve months to June 2021).

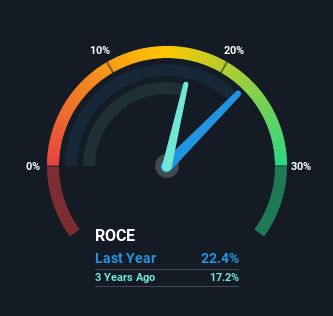

Thus, Alphabet has an ROCE of 22%. That's a fantastic return, and not only that, it outpaces the average of 7.1% earned by companies in a similar industry.

The data shows that returns on capital have increased substantially over the last five years to 22%. The amount of capital employed has increased, too, by 104%.

An increasing base of capital employed and a growing return of capital indicates that the company is getting better at selecting projects that are profitable and have a return above their cost of capital.

The fact that the ROCE grew from 17% to 22.4% in the last three years shows that the company is both doing something right and better.

Key Takeaways

The company has been deriving most of its profits from search and advertising. It has recently embarked on a massive campaign to push the cloud as a major source of income, and it seems that currently the prospects are looking good. Technology has a lot of potential to service big and small customers, and Google has great barriers to entry in regard to infrastructure and know-how.

Alphabet has proven it can reinvest in the business and generate higher returns on that capital employed, which is terrific. And a remarkable 247% total return over the last five years tells us that investors are expecting more good things to come in the future.

Before going further, we need to know what value we're getting for the current share price. That's where you can check out our FREE intrinsic value estimation that compares the share price and estimated value.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance