Alphabet's Google Boosts Cloud Offerings With AppSheet Buyout

Alphabet’s GOOGL division Google is on a buying spree. The company recently acquired a Seattle-based, no-code application development platform, AppSheet. The terms of the deal have not yet been disclosed.

AppSheet has been integrating artificial intelligence and natural language processing technology to speed up the development of apps.

Notably, AppSheet is now part of Google Cloud.

The acquisition is inline with the company’s cloud strategy to enhance the application development and automation space. The deal will enable businesses to create their own data-based apps without the need for a team of developers.

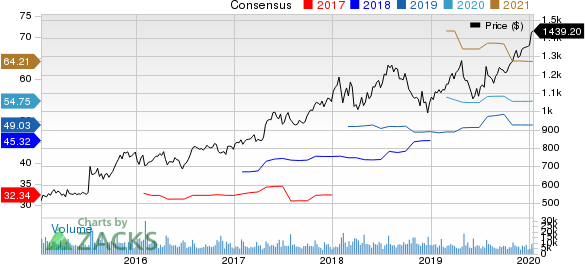

Alphabet Inc. Price and Consensus

Buyout to Aid Enterprise Customer Momentum

In today’s digital world, mobile apps can make businesses more productive. Therefore, AppSheet, which develops no-code enterprise applications, will help expand Google’s customer base.

The AppSheet software is already being integrated with Google Sheets and Google Forms to help enterprises easily create mobile applications. Additionally, it will continue to work with other tools, including AWS DynamoDB, Salesforce, Office 365, Box and others.

The integration of AppSheet will strengthen Google Cloud’s products and service offerings. Moreover, the buyout bodes well for the company’s continued focus on enhancing capabilities in enterprise automation.

Hence, the latest acquisition will help Google gain traction among enterprise customers, which in turn will strengthen its market position.

Bottom Line

Enterprise customer base is crucial to cloud service providers, as their spending toward modernizing software as well as infrastructure is increasing.

Enterprises are rapidly shifting focus from traditional application software to software as a service (SaaS), which is expected to contribute to the public cloud spending globally.

Given this upbeat scenario, not only Google but also Amazon AMZN and Microsoft MSFT are making every effort to improve service offerings to reach customers, thereby intensifying the cloud competition.

We believe the latest acquisition of AppSheet to aid Google in delivering an enhanced experience to enterprise customers.

Currently, Alphabet carries a Zacks Rank #2 (Buy). Another top-ranked stock in the broader technology sector includes Match Group, Inc. MTCH, carrying a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for Match Group is currently projected at 16.3%.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, SherazMian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

See 5 Stocks Set to Double>>

Click to get this free report Amazon.com, Inc. (AMZN) : Free Stock Analysis Report Match Group, Inc. (MTCH) : Free Stock Analysis Report Alphabet Inc. (GOOGL) : Free Stock Analysis Report Microsoft Corporation (MSFT) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo Finance

Yahoo Finance