Alpine (ALPN) Surges 37% on $4.9B Buyout Offer From Vertex

Alpine Immune Sciences ALPN signed a definitive agreement with Vertex Pharmaceuticals VRTX. Per the terms, the pharma giant will acquire all outstanding shares of Alpine for $65 per share in cash, aggregating to $4.9 billion.

A clinical-stage pharmaceutical company, Alpine is engaged in the development of multi-functional therapies targeting both autoimmune and inflammatory diseases.

The acquisition will also include Alpine’s lead asset, povetacicept (formerly ALPN-303), designed to target two proteins, namely BAFF and APRIL, which are jointly responsible for the cause of multiple serious autoimmune diseases. This drug is set to enter late-stage development for the treatment of IgA nephropathy (IgAN) in the second half of 2024.

Alpine is also developing acazicolcept (formerly ALPN-101) in a mid-stage study for systemic lupus erythematosus (SLE) in collaboration with AbbVie.

The transaction, expected to be completed in the second quarter of 2024, is subject to customary closing conditions and clearance from regulatory authorities. Alpine’s and Vertex’sboard of directors have already approved this transaction.

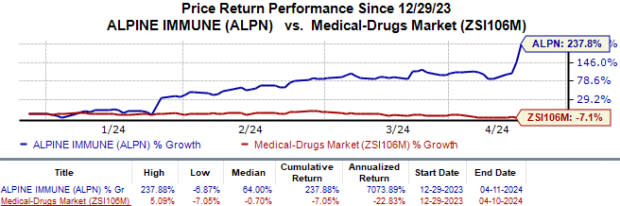

Following this news announcement, Alpine’s shares rallied 36.9% on Apr 11. Year to date, the stock has skyrocketed 237.9% against the industry’s 7.1% fall.

Image Source: Zacks Investment Research

Alpine lacks a steady revenue stream due to a lack of approved drugs. The company is dependent on its pipeline candidates for growth. An acquisition by a big pharma giant like Vertex, which has high reserves of cash flow, would enable ALPN to ramp up the development of its pipeline. Once the pipeline candidates are approved for marketing, Alpine will have access to Vertex’s larger and well-established commercial supply chain and network distribution.

Once the acquisition is completed, Vertex will add povetacicept to its pipeline. Vertex believes the deal to be a strategic fit for its existing business, taking into consideration its ambition of using scientific innovation to develop therapies targeting serious diseases with high unmet needs.

IgAN is a progressive, rare kidney disease that generally affects young adults and currently lacks targeted treatment options. Per management, an estimated 130,000 people in the United States suffer from this disease. Although there are some FDA-approved therapies like Calliditas Therapeutics’ Tarpeyo and Travere Therapeutics’ Filspari, which are approved to treat IgAN symptoms, there are currently no therapies that target the underlying cause of the disease.

Apart from IgAN, Vertex also intends to develop povetacicept for multiple serious diseases, including other autoimmune kidney diseases and autoimmune cytopenias.

Once added, povetacicept will be one of the many kidney disease drugs being developed by Vertex. VRTX is also developing two other pipeline candidates targeting kidney diseases. Earlier this month, Vertex initiated the late-stage portion of phase II/III AMPLITUDE study evaluating inaxaplin (VX-147) in APOL1-mediated kidney disease (AMKD), a genetic disorder affecting kidney function.

Last month, the FDA cleared Vertex’s investigational new drug application to begin clinical development of its pipeline candidate, VX-407, for treating autosomal dominant polycystic kidney disease (ADPKD). An early-stage study evaluating this drug in healthy volunteers was initiated last month. Per Vertex, ADPKD is the 10th disease area in its clinical pipeline.

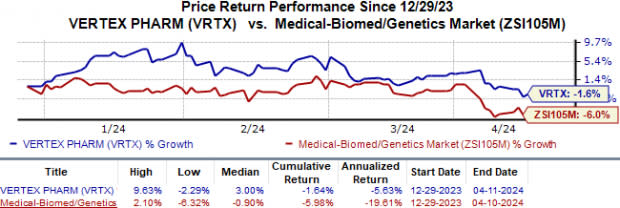

Year to date, shares of Vertex have lost 1.6% compared with the industry’s 6.0% fall.

Image Source: Zacks Investment Research

Though Vertex enjoys a dominant position in the cystic fibrosis (CF) market, it has seen success in the development of its non-CF pipeline candidates lately. Many of these non-CF candidates represent multibillion-dollar opportunities.

Last year in December, the FDA approved Vertex and partner CRISPR Therapeutics’ CRSP Casgevy (exagamglogene autotemcel) for the treatment of sickle cell disease (SCD) for patients aged 12 years and older with recurrent vaso-occlusive crises. Following this approval, Casgevy became the first gene therapy utilizing the Nobel prize-winning CRISPR technology.

In January, Vertex/CRISPR announced that the FDA expanded the label of their one-shot gene therapy, Casgevy, to treat transfusion-dependent beta thalassemia (TDT) in patients aged 12 years and older. The CRSP-partnered therapy also won approval in both indications this year across multiple other regions, including Europe, the Kingdom of Saudi Arabia and Bahrain.

Notably, the share price of Vera Therapeutics VERA also benefitted from the Alpine acquisition news. Following the acquisition announcement, the share of Vera rose 17.3% on Thursday. Like Alpine, Vera is developing its lead pipeline drug atacicept, which also targets both BAFF and APRIL, as a treatment for various autoimmune diseases, including IgAN.

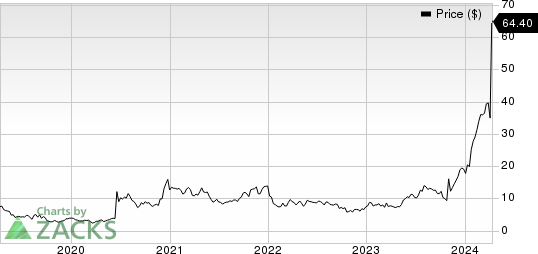

Alpine Immune Sciences, Inc. Price

Alpine Immune Sciences, Inc. price | Alpine Immune Sciences, Inc. Quote

Vertex Pharmaceuticals Incorporated Price

Vertex Pharmaceuticals Incorporated price | Vertex Pharmaceuticals Incorporated Quote

Zacks Rank

Alpine and Vertex carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report

Alpine Immune Sciences, Inc. (ALPN) : Free Stock Analysis Report

Vera Therapeutics, Inc. (VERA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance