Alpine Income Property Trust's (NYSE:PINE) investors will be pleased with their 17% return over the last year

On average, over time, stock markets tend to rise higher. This makes investing attractive. But if when you choose to buy stocks, some of them will be below average performers. For example, the Alpine Income Property Trust, Inc. (NYSE:PINE), share price is up over the last year, but its gain of 10% trails the market return. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

View our latest analysis for Alpine Income Property Trust

We don't think that Alpine Income Property Trust's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over the last twelve months, Alpine Income Property Trust's revenue grew by 44%. That's a fairly respectable growth rate. The share price gain of 10% in that time is better than nothing, but far from outlandish Arguably, the market (previously) expected stronger growth from the company. However, if you can reasonably expect profits in the next few years, this stock might belong on your watchlist.

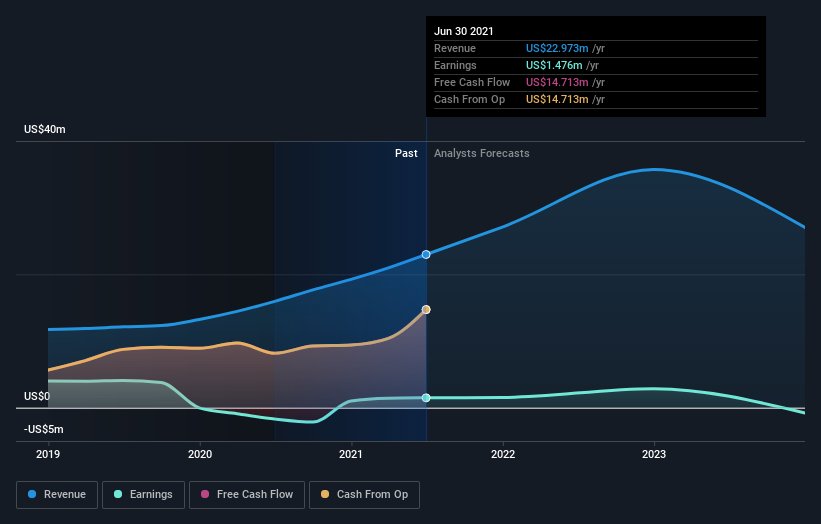

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Alpine Income Property Trust has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Alpine Income Property Trust in this interactive graph of future profit estimates.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Alpine Income Property Trust's TSR for the last 1 year was 17%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Alpine Income Property Trust shareholders have gained 17% for the year (even including dividends). The bad news is that's no better than the average market return, which was roughly 36%. That's a lot better than the more recent three month gain of 0.2%, implying that share price has plateaued recently, for now. It's not uncommon to see a company's share price between updates to shareholders. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 5 warning signs we've spotted with Alpine Income Property Trust (including 2 which are concerning) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance