Altair Engineering Inc (ALTR) Surpasses Analyst Revenue Forecasts in Q1 2024

Software Revenue: Reached $158.4 million, marking a 5.9% increase year-over-year, exceeding the previous year's $149.6 million.

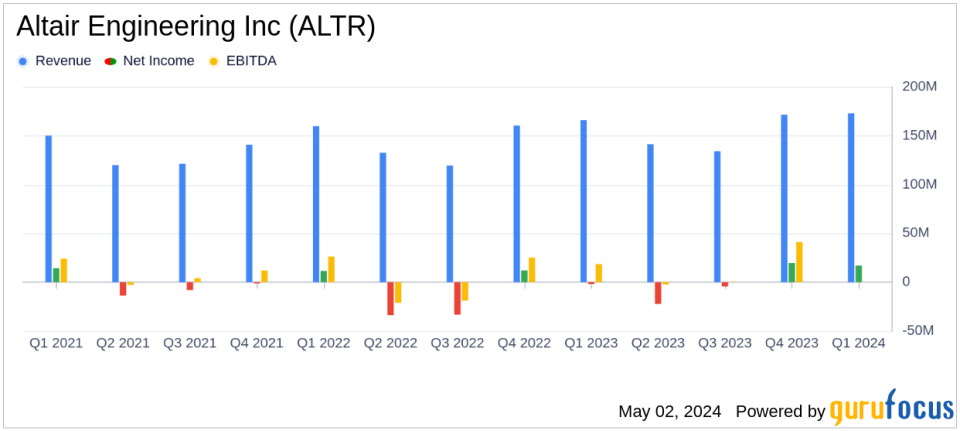

Total Revenue: Grew to $172.9 million, up 4.1% from $166.0 million in the first quarter of 2023, surpassing the estimated $169.28 million.

Net Income: Reported at $16.5 million, a significant recovery from a net loss of $2.0 million in the same quarter last year, but below the estimated $30.28 million.

Earnings Per Share (EPS): Recorded at $0.20 per diluted share, recovering from a net loss per share of $0.02 last year, yet below the estimated EPS of $0.34.

Adjusted EBITDA: Increased by 6.4% to $45.8 million from $43.1 million in the first quarter of 2023, demonstrating improved profitability.

Free Cash Flow: Improved to $70.7 million, up from $57.5 million in the previous year, indicating stronger cash generation efficiency.

Operating Cash Flow: Rose to $73.5 million compared to $59.2 million in the first quarter of 2023, reflecting better operational management.

On May 2, 2024, Altair Engineering Inc (NASDAQ:ALTR) announced its financial results for the first quarter ended March 31, 2024, revealing a significant outperformance in both software and total revenues compared to the previous year. The company's detailed financial outcomes can be viewed in their 8-K filing. This quarter marks a notable turnaround with a net income of $16.5 million, a stark contrast to the net loss of $2.0 million reported in the first quarter of 2023.

Company Overview

Altair Engineering Inc is a global technology firm that provides software and cloud solutions in simulation, high-performance computing (HPC), data analytics, and AI. The company operates primarily through its software segment, which contributes the majority of its revenue, complemented by client engineering services.

Financial Highlights

The first quarter of 2024 was marked by a 5.9% year-over-year increase in software revenue, reaching $158.4 million. Total revenue also rose by 4.1% to $172.9 million. Both figures represent record highs for the company in a quarterly period. The growth was supported by robust performance across all major geographies and multiple verticals, reflecting strong execution and the increasing adoption of Altair's solutions.

Net income for the quarter was significantly improved at $16.5 million, compared to a net loss the previous year, with a net income margin of 9.6%. Non-GAAP net income also saw a healthy increase of 13.9% to $36.2 million. Furthermore, the company reported a strong cash position, with cash provided by operating activities at $73.5 million and free cash flow at $70.7 million.

Operational and Strategic Developments

Altair's leadership attributed the impressive results to the strength of their product portfolio and strategic initiatives that enhance computational intelligence capabilities for clients. Adjusted EBITDA increased by 6.4% to $45.8 million, with an adjusted EBITDA margin of 26.5%, indicating efficient management and operational execution.

Future Outlook

Looking ahead, Altair provided guidance for the second quarter and full year 2024, projecting continued revenue growth and improvements in software revenue. For the full year, the company expects software revenue between $590 million and $600 million and total revenue between $652 million and $662 million. These forecasts reflect Altair's confidence in its business model and market opportunities.

Analysis

The positive financial results and optimistic future guidance suggest that Altair is well-positioned to maintain its growth trajectory. The company's ability to exceed analyst expectations, particularly in terms of revenue, underscores the effectiveness of its strategic initiatives and the robust demand for its advanced computational and AI solutions.

Altair's performance is particularly noteworthy given the competitive nature of the technology sector, where innovation and client engagement are critical. The company's focus on enhancing its software offerings and expanding its global reach are likely to continue driving its financial and operational success.

For detailed financial figures and future projections, interested parties are encouraged to refer to Altair's official filings and forthcoming financial communications.

Conclusion

Altair Engineering Inc's first quarter of 2024 sets a positive tone for the year, with record revenues and a strong rebound in profitability. As the company continues to execute its growth strategies, investors and stakeholders can look forward to potentially rewarding outcomes aligned with the evolving dynamics of the global tech landscape.

Explore the complete 8-K earnings release (here) from Altair Engineering Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance