Altimmune Inc (ALT) Reports Q1 2024 Financials: A Detailed Review

Revenue: Reported at $5K, not comparable to the analyst estimate of $0.00 million as it is essentially zero.

Net Loss: Totaled -$24.39 million for the quarter, greater than the estimated net loss of -$22.93 million.

Earnings Per Share (EPS): Recorded at -$0.34, beating the estimated -$0.37.

Cash Position: Cash, cash equivalents, and short-term investments stood at $182.1 million as of March 31, 2024.

Research and Development Expenses: Increased to $21.49 million from $17.25 million in the same period last year.

Interest Income: Rose to $2.41 million, up from $1.67 million in the prior year's corresponding quarter.

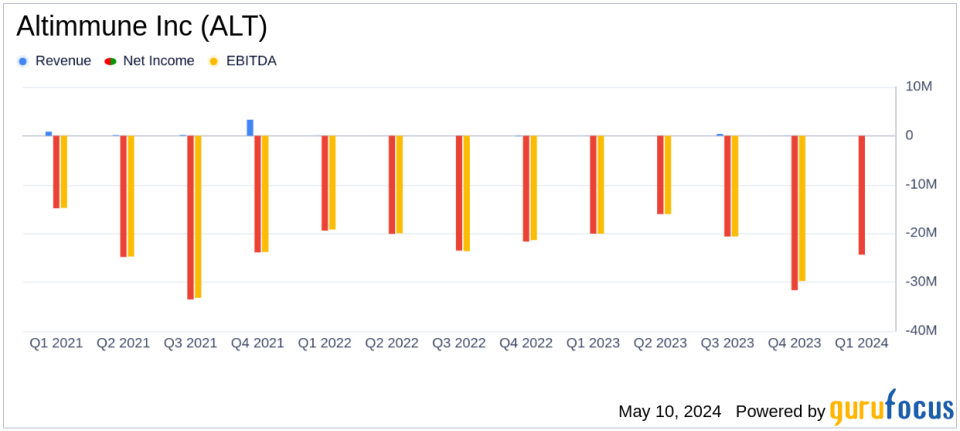

On May 9, 2024, Altimmune Inc (NASDAQ:ALT), a clinical-stage biopharmaceutical company, disclosed its financial outcomes for the first quarter ended March 31, 2024, through an 8-K filing. The company, known for its innovative peptide-based therapeutics for obesity and liver diseases, reported a net loss of $24.39 million, translating to a loss per share of $0.34, which diverges from the analyst estimates predicting a loss per share of $0.37.

Company Overview

Altimmune Inc is at the forefront of developing treatments for critical health issues including obesity and liver diseases such as non-alcoholic steatohepatitis (NASH). Their pipeline features promising candidates like pemvidutide, formerly known as ALT-801, which is being developed for both obesity and chronic hepatitis B under the brand name HepTcell.

Financial Performance and Business Highlights

The company's financial health is underscored by its robust cash reserves, with cash, cash equivalents, and short-term investments reported at $182.1 million as of March 31, 2024. Despite a challenging quarter that saw a net loss of $24.39 million, these reserves ensure that Altimmune can continue to fund its critical research and development activities. The reported revenue for the quarter was a minimal $5 thousand, consistent with the nature of a clinical-stage biopharmaceutical company which typically sees fluctuating revenues based on milestone achievements and partnership agreements.

Altimmune's research and development expenses were $21.49 million for the quarter, reflecting ongoing investments in their clinical trials, particularly the IMPACT Phase 2b trial of pemvidutide in Metabolic Dysfunction-Associated Steatohepatitis (MASH). General and administrative expenses were also up, totaling $5.31 million, as the company scales its operations in anticipation of future growth.

Strategic Developments and Future Outlook

During the quarter, Altimmune made significant progress in its clinical development programs. The company is preparing for an End-of-Phase 2 meeting with the U.S. Food and Drug Administration (FDA) concerning pemvidutide for obesity, expected in late Q3 2024. This meeting is pivotal as it will help define the pathway for Phase 3 trials and potential market entry.

"As the obesity therapeutics space evolves, increasing attention is being placed on agents that are able to drive weight loss while addressing the quality of that weight loss and the comorbidities of obesity. With significant weight loss, preservation of lean mass and reductions in serum lipids and liver fat achieved in our clinical trials, we believe that pemvidutide could differentiate itself from other therapies in this competitive market," stated Vipin K. Garg, Ph.D., President and CEO of Altimmune.

Analysis of Financial Health

The balance sheet of Altimmune reflects a decrease in total assets from $210.64 million at the end of December 2023 to $188.36 million by March 2024. This reduction is primarily due to the operational cash burn typical for clinical-stage companies in the biotech sector. The comprehensive loss of $24.55 million for the quarter also includes unrealized losses on short-term investments, indicating the volatile nature of financial markets and their impact on investment holdings.

Despite the net loss, the strategic management of resources and the promising pipeline of therapeutic candidates position Altimmune well for future successes. The company's focus on advancing its clinical programs and managing its cash effectively will be crucial as it moves towards commercialization of its products.

For more detailed information and future updates on Altimmune Inc, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Altimmune Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance