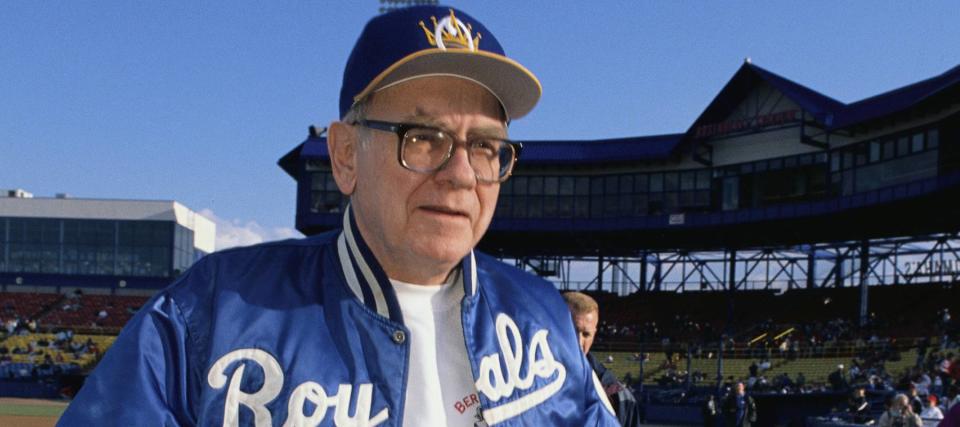

'I am playing in extra innings': Warren Buffett gets real about death — his own and Charlie Munger's — and how his children plan to execute his will. Here are 3 estate tips to ease the burden

Last November, in a Thanksgiving letter to shareholders, Berkshire Hathaway chairman and CEO Warren Buffett struck what proved to be a somewhat darkly prophetic note.

“At 93 [years old], I feel good but fully realize I am playing in extra innings,” he stated in the letter, published Nov. 21.

It’s a message that resonates even more now after the death of his long-time friend and business partner Charlie Munger at age 99 just days later on Nov. 28.

Buffett has since penned a full tribute to Munger, as part of this year's Berkshire shareholder letter, in which Munger is remembered as the "architect" of the storied firm he and Buffett built.

"Charlie never sought to take credit for his role as creator but instead let me take the bows and receive the accolades," Buffett wrote. "In reality, Charlie was the 'architect' of the present Berkshire, and I acted as the 'general contractor' to carry out the day-by-day construction of his vision."

Don't miss

Anything can happen in 2024. Try these 5 easy money hacks to help you make and save thousands of dollars in the new year (they will only take seconds)

Don't let high car insurance rates drain your bank account — find how you can pay as little as $29 a month

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

In the November letter, Buffett said his three children — who range in age from 65 to 70 — share his opinion that “dynastic wealth, though both legal and common in much of the world including the United States, is not desirable.”

His children are the executors of his will and the named trustees of the charitable trust that will receive 99%-plus of Buffett’s wealth after his death. The 93-year-old noted: “They were not fully prepared for this awesome responsibility in 2006, but they are now.”

After a lifetime of building immense wealth — and giving much of it away — Buffett seems to be at ease and in alignment with his children about his end-of-life plans.

Here are three ways to help your loved ones so they can grieve your loss in peace.

Write a will

While having a will in place won’t protect your loved ones from the emotional distress of your death, preparing some basic documents can shield them from any extra financial anxiety, stress and uncertainty.

A will is the bedrock of a strong estate plan. While the laws governing these documents vary by state, there are several basic elements that should be included:

Personal information: You should include your full legal name (and any other aliases you go by), date of birth, address and the names of your immediate family.

Last will and testament language: Also known as testamentary intent, this legal language declares that your document is a valid will that should be carried out.

Assets: Since your will details who gets which of your belongings after you die, you should list any money, personal belongings, real estate and other high-value assets that you want to distribute.

Beneficiaries: Your beneficiaries are the people who will receive your assets when you die. They can be your family members, friends, charities, businesses, or even a trust — but you need to be specific about who gets what.

Executor: You should pick someone to carry out the terms of your will and manage any unresolved affairs, like paying bills and taxes. If you don’t name an executor, someone will have to apply to handle your estate via probate court, or the court will name an executor.

Guardianship: If you have children under the age of 18 or any disabled or elderly dependents, you can appoint them a legal guardian.

Signatures: You’ll need to sign your will and most states also require witness signatures. And remember, you should update your will as your life changes, like say you get married, divorced or become a parent.

You can get help from an estate lawyer but it comes at a cost. On average, a flat fee for a simple will ranges between $300 to $400, according to Willful, but the fee can climb beyond $1,000 if your will is complex.

Read more: A Pennsylvania trio bought a $100K abandoned school and turned it into a 31-unit apartment — but here's a much simpler way to earn real estate riches without a mountain of red tape

Trust in trusts

Buffett has made use of trusts — including the testamentary trust his three children must administer after his death — and so can you.

One way to save your loved ones from potential financial and legal woes is to put all of your assets — including your bank accounts, investments, life insurance and real estate — into a living trust, or revocable living trust, and name your children or loved ones as the beneficiaries of that trust.

A living trust allows you to manage your assets in your own name for as long as you’re able. The word “revocable” means the trust can be undone or changed.

You’ll have to name a “successor trustee” — which can be a family member, friend, a private fiduciary or even a bank — who can take over managing your assets in case of reduced mental faculties or death.

You can amend or change a revocable living trust at any time. Any income earned by the trust's assets goes to you and is taxable, but the assets themselves don’t transfer from the trust to your beneficiaries until you die.

The key benefit of setting up a trust like this is that your beneficiaries can avoid probate, which is the costly and time-consuming process, often in court, of transferring assets when someone dies.

Consult with a professional

Estate planning is complex. Even with the best intentions, you could easily miss something that will increase the burden on your family members and beneficiaries when you pass away.

To ensure all the necessary boxes are ticked, consider connecting with an accountant and lawyer to help you take a true inventory of your assets and possessions and draw up the necessary legal documents to allow for the swift distribution of your assets.

If your estate is sizable, you may also want to consider working with a tax professional as part of your estate planning process. They can help you plan for taxes, determine whether or not you will incur taxes based on where you live and mitigate the taxes your beneficiaries pay.

Finally, talk your estate plan through with your loved ones. As Buffett noted, he didn’t feel his kids were ready for the responsibility of administering his will nearly 20 years ago, but he’s now confident that the three will “act unanimously.”

What to read next

Robert Kiyosaki warns 401(k)s and IRAs will be 'toast' after the 'biggest crash in history' — protect yourself now with these shockproof assets

Jeff Bezos and Oprah Winfrey invest millions in this rare asset to keep their riches safe — How to ride their coattails even if you're not super rich

Millions of Americans drowning in debt as interest rates climb — use this free tool today to pay off your credit card fast and save thousands in interest

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Yahoo Finance

Yahoo Finance