Amarin's (AMRN) Q4 Earnings and Revenues Beat Estimates

Amarin Corporation Plc AMRN reported adjusted earnings of 2 cents per share in fourth-quarter 2022, beating the Zacks Consensus Estimate of 1 cent. Our model estimates was breakeven. The company recorded adjusted earnings of 6 cents per share in the year-ago quarter.

Adjusted earnings exclude non-cash stock-based compensation expense and restructuring expense.

Revenues in the reported quarter, primarily driven from its cardiovascular drug, Vascepa, were down 38% year over year to $90.2 million. Sales were hurt due to lower sales of Vascepa, Amarin’s sole marketed drug — an approved adjunct to diet for treating severe hypertriglyceridemia or elevated triglyceride (TG) levels. The fourth quarter revenues beat both the Zacks Consensus Estimate and our model estimates of $87 million and $88.1 million, respectively.

The company continues to avoid revenue guidance for 2023 due to uncertainty related to the COVID-19 pandemic and generic competition for its sole marketed drug, Vascepa, in the United States. The avoidance can also be attributed to challenges in achieving market access reimbursement for Vazkepa in Europe.

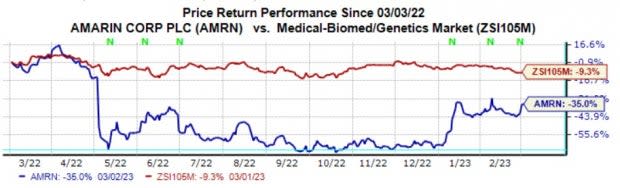

The stock has declined 35% in the past year compared with the industry’ 9.3% decline.

Image Source: Zacks Investment Research

Quarter in Details

U.S product revenues from Vascepa in the fourth quarter were $88 million, almost in line with the year-ago figure. Lower volumes were due to rising generic competition that hurt sales of Vascepa in the United States.

The drug’s sales in the United States beat our model estimates of $85.5 million for the quarter.

International product revenues were $1.5 million compared with $1.3 million in the previous quarter. Product revenues in the European market increased to $0.3 million from $0.7 million in the previous quarter, reflecting early revenues from the U.K. In Europe, Vazkepa is now available in five markets and Amarin is conducting price negotiations with another five markets. Amarin expects to get reimbursement decisions for Vazkepa in most markets. It also anticipates launch in major markets by the end of 2023.

Amarin has secured six international regulatory approvals during 2022, including Australia, Hong Kong, Bahrain, Puerto Rico, Saudi Arabia and Switzerland. New Zealand, as seventh, was secured in January 2023.

Licensing and royalty revenues were $0.7 million in the fourth quarter compared with $0.8 million in the year-ago period. However, the figure missed our model estimates of $1.2 million. The royalty revenues were generated from sales of Vascepa, recorded by its partners in Canada, China and the Middle East.

The company ended the quarter with cash and investments of $310.6 million compared with $306 million as of Sep 30, 2022.

The adjusted SG&A expenses (including non-cash stock-based compensation) in the fourth quarter were $68.1 million, down 26% year over year. The adjusted research and development (R&D) expenses (including non-cash stock-based compensation) were $5.2 million, down 10% year over year. The decline in adjusted SG&A and R&D expenses was driven by the company’s comprehensive cost reduction and restructuring plans in June 2022. However, lower SG&A expenses were partially offset by investments in Europe to support commercial operations.

Amarin announced a comprehensive cost savings program in June 2022, which targeted $100 million in cost savings. This initiative was in response to the rising generic competition for Vascepa in the United States. Following the program’s implementation, Amarin now plans to exceed those figures and keep 2023 operating expenses in the $290-$305 million range. As the U.S. business revenues stabilize, Amarin reiterates its belief that current cash and investments and other assets will be adequate to support continued operations, including European launch activities.

Full-Year Results

Amarin generated total revenues of $369.1 million in 2022, down 36.8% year over year.

The company reported full-year 2022 adjusted loss of 12 cents per share against the previous year’s adjusted earnings of 14 cents per share.

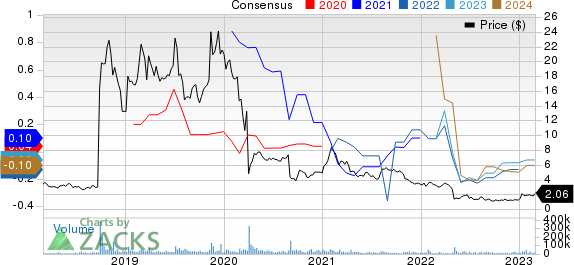

Amarin Corporation PLC Price and Consensus

Amarin Corporation PLC price-consensus-chart | Amarin Corporation PLC Quote

Zacks Rank and Other Stocks to Consider

Amarin currently holds a Zacks Rank #2 (Buy). Some other top-ranked stocks in the same sector are Allogene Therapeutics ALLO, CRISPR Therapeutics CRSP and Arcus Biosciences RCUS) all holding a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Loss per share estimates for Allogene Therapeutics have narrowed by 9 cents for 2023 and 6 cents for 2024, in the past 60 days.

ALLO’s earnings beat estimates in two of the last four quarters and missed the mark in the other two, the average negative surprise being 16.78%. Allogene Therapeutics’ shares have declined 26.3% in the past year.

CRISPR Therapeutics’ 2023 earnings per share (EPS) estimates have increased from $1.10 to $1.13 in the past 60 days. CRSP’s shares have plunged 12% in the past year.

CRSP’s earnings beat estimates in two of the last four quarters and missed the mark in the other two, the average negative surprise being 4.1%.

Arcus Biosciences’ loss per share estimates for 2023 and 2024 have narrowed by 18 cents, in the past 60 days.

RCUS’s earnings beat estimates in two of the last four quarters, missed the mark in one and met the same in another, the average negative surprise being 48.83%. RCUS’s shares have fallen 51.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amarin Corporation PLC (AMRN) : Free Stock Analysis Report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report

Arcus Biosciences, Inc. (RCUS) : Free Stock Analysis Report

Allogene Therapeutics, Inc. (ALLO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance