In an amazing coincidence, the latest Bank of England 'stress test' scenario looks like a world in which Brexit has gone badly

REUTERS/Kirsty Wigglesworth/Pool

The Bank of England is going to "stress test" financial institutions in the UK to see if they can withstand a sharp rise in inflation, interest rates, and unemployment during a period of reduced global trade and high consumer credit.

By amazing coincidence — and surely it's only a coincidence! — this scenario is what you might expect in a worst-case scenario after Brexit: A falling currency, rising prices, and reduced access to international imports and exports.

It's also another signal that the BoE is worried about what will happen to unsecured British consumer debt when the economy goes into a recession.

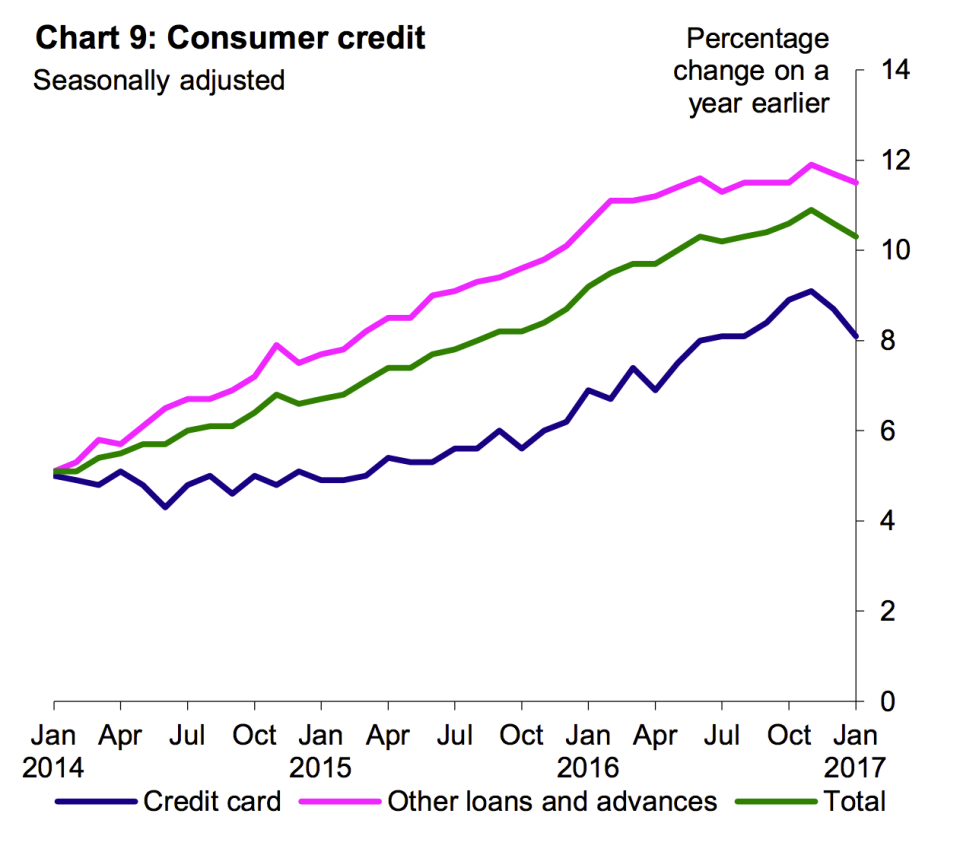

Here is the most recent BoE chart:

Bank of England

There has been a pullback in recent months but "the level of UK household indebtedness remains high by historical standards," the BoE said in its stress test scenario document.

Because the BoE's base interest rate is currently 0.25%, the cost of servicing that debt is low. But in a high-inflation situation that would change. The BoE's stress scenario is this:

"GDP contracts by 4.7%."

"Unemployment rises by 4.7 percentage points to peak at 9.5% — a greater rise than that observed following the 2008 financial crisis."

"Bank Rate is assumed to rise to 4% by the end of 2017."

"Global trade stagnates and the ratio of world trade to GDP falls to its lowest level since 2003."

So what happens when Britain's highly indebted consumers suddenly lose their jobs and find their debt payments going up because of rising interest and inflation driven by new trade barriers?

The BoE, obviously, wants to know if banks can deal with defaults in a speculative world where people can't afford the debt they have taken.

In the real world, we're already seeing consumers wind down their economic activity. These charts show "broad money" held by households and lending to those households — both of them saw sharp recent contractions:

Bank of England

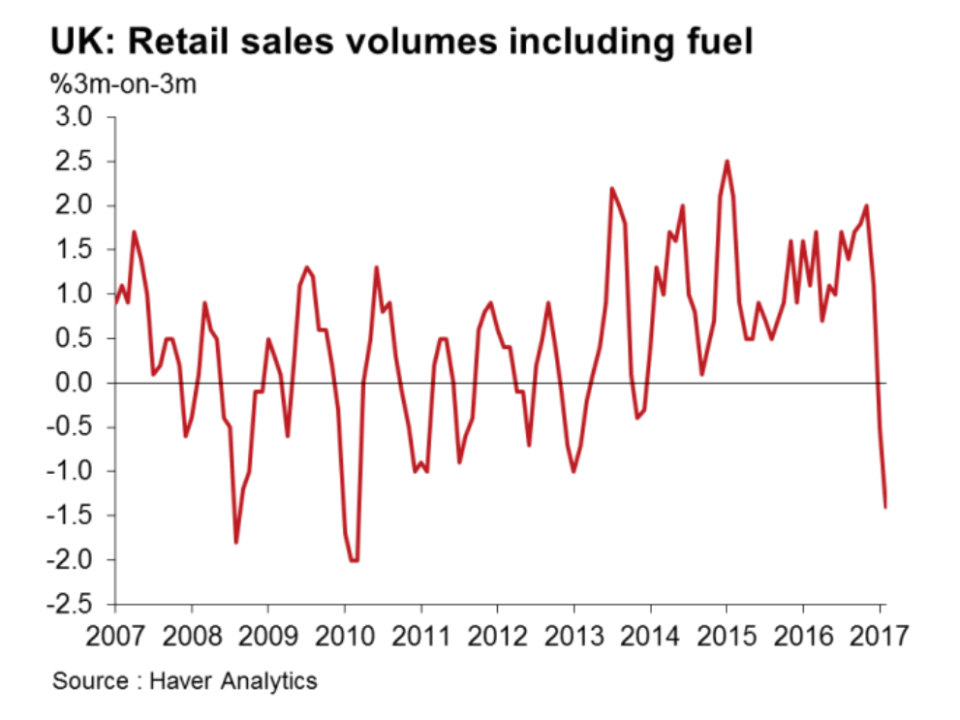

It looks like the British consumer is already battening down the hatches and preparing for the worst. That's why you're now seeing retail sales charts that look like this:

Oxford Economics

It is also why only 29% of UK consumers think the economy will fare better after Brexit.

The BoE wants to know how banks will handle distressed consumer debt but it looks like consumers are already signalling their answer: They don't like the look of the future and are reducing their economic activity accordingly.

That is not a good sign.

NOW WATCH: A financial planner explains why starting a new job is the best time to negotiate salary

See Also:

Yahoo Finance

Yahoo Finance