Amazon (AMZN) Boosts Delivery Game With AmazonFresh in Tampa

Amazon.com Inc. AMZN is firing on all cylinders to expand presence in the e-commerce space on the back of strengthening delivery system.

The retail giant has rolled out a robust delivery service, AmazonFresh, in Tampa.

AmazonFresh will allow Tampa shoppers to order meat, eggs, seafood, produce and a variety of other fresh items through the company’s Fresh platform within an hour or two. They can now get the items delivered at their doorsteps at an ultrafast speed without an additional charge of $14.99 per month. This reduction of time and cost holds immense significance in today’s fast-paced world.

Reportedly, Amazon Fresh will operate from a separate fulfillment center that will be located at 4769 Oak Fair Blvd. in Tampa.

AmazonFresh is likely to aid the company in attracting customers to its platform, which in turn will boost the Prime adoption rate.

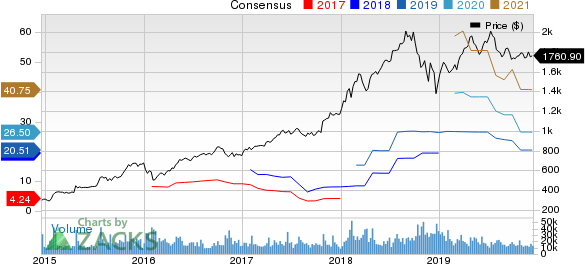

Amazon.com, Inc. Price and Consensus

Strengthening Delivery Services

Amazon’s strong focus on enhancement of its quick delivery services remains a key catalyst.

The latest move bodes well for Amazon, which is working toward expanding AmazonFresh. The service is also available in Indianapolis, Houston, Minneapolis, Phoenix and Las Vegas. The move also strengthened the company’s same-day delivery service, which is much in demand in this fast-paced world.

Apart from AmazonFresh, it introduced a two-hour delivery service of natural and organic products such as meat and seafood, fresh produce and staples from the Whole Foods Market to additional cities in the United States. The cities are Lexington, Little Rock, Charlottesville, Asheville, Columbia, Manchester, Savannah, Naples and Mobile.

All these above-mentioned endeavors are expected to bolster its presence in the U.S. e-commerce and retail space.

Prime: Key Catalyst

Amazon’s strong focus on advancement of Prime services is acting as a tailwind. The company’s Prime-enabled grocery delivery and pick-up services are bolstering its footprint in the grocery retail space.

Further, expanding movie and video content portfolio on Prime Video is another major positive that helps the company in attracting shoppers to join the Prime program.

Moreover, Prime benefits that include strong loyalty system, customer-friendly offers, and robust same-day and two-hour delivery services remain the key to attract shoppers to its e-commerce platform.

We believe that these Prime endeavors are likely to continue aiding Amazon’s dominance in the e-commerce space.

Zacks Rank & Stocks to Consider

Currently, Amazon carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader technology sector include MACOM Technology Solutions Holdings, Inc. MTSI, Itron, Inc. ITRI and ASOS PLS ADR ASOMY, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth for MACOM Technology, Itron and ASOS PLS ADR is currently projected at 15%, 25% and 8%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through Q3 2019, while the S&P 500 gained +39.6%, five of our strategies returned +51.8%, +57.5%, +96.9%, +119.0%, and even +158.9%.

This outperformance has not just been a recent phenomenon. From 2000 – Q3 2019, while the S&P averaged +5.6% per year, our top strategies averaged up to +54.1% per year.

See their latest picks free >>

Click to get this free report Amazon.com, Inc. (AMZN) : Free Stock Analysis Report MACOM Technology Solutions Holdings, Inc. (MTSI) : Free Stock Analysis Report Itron, Inc. (ITRI) : Free Stock Analysis Report ASOS PLS ADR (ASOMY) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo Finance

Yahoo Finance