Will Amazon (AMZN) See Strong Prime Day Momentum?

Amazon’s AMZN forthcoming annual event Prime Day is not likely to be as hit as it has been over the past years.

AMZN’s investment in the event seems lower than the previous years’ level. Moreover, discounts on many products during the event do not look as generous as what Amazon usually offers.

This might cause Amazon’s loss of momentum among the customers during the underlined event.

Consequently, contributions from Prime Day 2022 to its third-quarter sales might be lower than those in the prior years. This does not bode well for Amazon, which is already battered by a slowdown in online shopping activities as the pre-pandemic levels resumed.

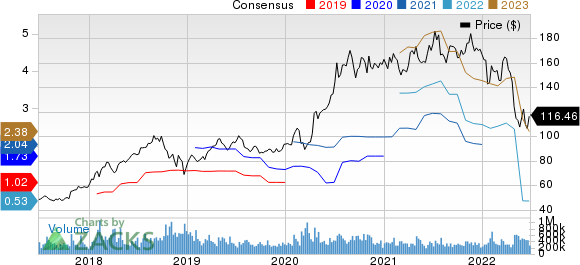

Amazon.com, Inc. Price and Consensus

Amazon.com, Inc. price-consensus-chart | Amazon.com, Inc. Quote

We note that a weak Prime Day momentum might hurt investors’ sentiment.

Shares of Amazon were down 30.1% in the year-to-date period, lagging the Zacks Retail-Wholesale sector’s decline of 23.7%.

Amazon’s Stance

Nevertheless, the e-commerce giant is gearing up to offer various products across several brands at "throwaway prices" during Prime Day 2022.

Amazon is holding the event in 20 nations, among which Poland and Sweden are the countries where Prime Day will be held for the first time. This remains a major positive as AMZN will be able to gain further traction among the customers in these countries on the back of lucrative deals.

In addition, Amazon has already started offering early deals with great discounts on various products, which are expected to drive its momentum among the Prime shoppers.

Strong rewards for Amazon Prime Rewards Visa Card users, new Amazon Fresh Stores Prime Benefit and special buy now, pay later offers are expected to aid AMZN in attracting new Prime subscribers.

All these factors are anticipated to aid Amazon in maximizing its revenues. Per an Insider Intelligence report, sales from Prime Day are expected to touch $7.76 billion in the United States, which is approximately 17% above the level of last year’s event.

Strong Fundamentals

We believe that the upcoming Prime Day event bodes well with Amazon’s growing initiatives to strengthen its Prime program, thereby expanding its subscriber base.

Amazon’s robust delivery network remains a major positive for the event as it aids AMZN in delivering an enhanced shopping experience by ensuring ultrafast delivery of items to Prime members.

Expansion of the overall content portfolio and an increasing number of original content on Prime Video are some of the key factors behind the Prime momentum and are likely to continue accelerating the Prime engagement.

This apart, Amazon’s consistent efforts to strengthen its other Prime services, including Prime Music, Prime Gaming, Prime Reading and Amazon Photos remain noteworthy.

However, rising inflationary pressures, increasing fulfillment costs, unfavorable foreign exchange headwinds and rising staffing costs remain major overhangs for Amazon.

Zacks Rank & Stocks to Consider

Currently, Amazon carries a Zacks Rank #5 (Strong Sell).

Investors interested in the retail-wholesale sector can consider better-ranked companies like AutoNation AN, Arcos Dorados ARCO and Burberry Group BURBY. While AutoNation sports a Zacks Rank #1 (Strong Buy), Arcos Dorados and Burberry Group have a Zacks Rank #2 (Buy) at present. You can see the complete list of today's Zacks #1 Rank stocks here.

AutoNation has lost 0.5% in the year-to-date period. The long-term earnings growth rate for the ANstock is currently projected at 24.7%.

Arcos Dorados has gained 18.5% in the year-to-date period. The long-term earnings growth rate for the ARCOstock is currently projected at 34.4%.

Burberry Group has lost 14.9% in the year-to-date period. The long-term earnings growth rate for the BURBYstock is currently projected at 13.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

AutoNation, Inc. (AN) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

Burberry Group PLC (BURBY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance