Amazon Boosts India Presence With New Jobs Amid Coronavirus

Amazon AMZN is leaving no stone unturned to bolster presence in India. This is evident from its latest announcement of creating new jobs in the country.

Reportedly, the company’s India unit is striving to hire 50,000 temporary workers in the country due to increasing demand for its products amid coronavirus-induced lockdown.

India, which has been under lockdown since 25 Mar, has seen easing of restrictions in each successive phase. As a result, e-commerce companies can now deliver non-essential products.

The new workers to be recruited will work in Amazon's fulfillment centers in a bid to enhance the delivery network for fulfilling increasing demand.

The temporary jobs are expected to scale up the retail giant’s productivity level in this crisis period. Consequently, this will aid the performance of Amazon’s Indian business unit.

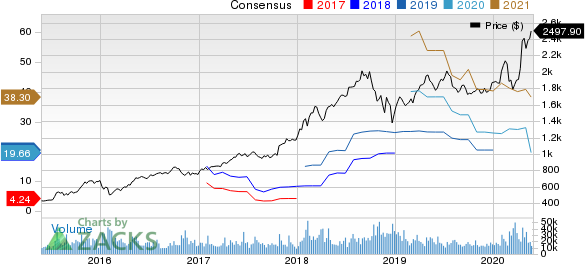

Amazon.com, Inc. Price and Consensus

Amazon.com, Inc. price-consensus-chart | Amazon.com, Inc. Quote

E-Commerce Prospects in India

There is increased demand for delivery of food and on-demand goods at consumers’ doorstep and India is no exception to it.As consumers turn to digital options as a means to circumvent physical shopping environments, the change in behavior is evident.

According to GlobalData, a London-based data analytics firm, the e-commerce market in India is set to witness a compound annual growth rate of 19.6% between 2019 and 2023. The coronavirus pandemic will accelerate the growth of India’s e-commerce market, pushing it to ???7 trillion by 2023.

According to Indian Brand Equity Foundation, the Indian e-commerce market is expected to grow to $200 billion by 2026 from $38.5 billion in 2017, driven by rising smartphone penetration, the launch of 4G networks and increasing consumer wealth.

We believe Amazon is ought to benefit from this growing e-commerce market in India.

Other India-Based Initiatives

This January, the e-commerce giant announced that it aims to reach the target of creating 1 million jobs in India by 2025 through investments in logistics, technology, skill development and infrastructure.

In addition to this, the company also made an announcement of $1 billion investment in India at the Smbhav summit in New Delhi. With this investment, the e-commerce giant aims at building digital centers in 100 Indian cities and villages. We believe the proposed digital centers are likely to help more than 10 million small and medium businesses to come online, which in turn, will expand their customer exposure.

Moreover, this will help Amazon in strengthening the e-commerce business in India by expanding the seller base and product offerings.

The company also entered into a long-term agreement with Future Retail that will authorize it as the official online sales channel for Future’s retail stores.

All the above-mentioned endeavors should continue to expand Amazon’s footprint in India.

Zacks Rank & Stocks to Consider

Amazon currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader technology sector include Wayfair Inc. W, eBay EBAY and Inphi Corporation IPHI, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth for Wayfair, eBay, and Inphi is currently projected at 23%, 12.4% and 37.7%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

eBay Inc. (EBAY) : Free Stock Analysis Report

Wayfair Inc. (W) : Free Stock Analysis Report

Inphi Corporation (IPHI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance