59% of US households are Amazon Prime members, according to analyst

Amazon’s (AMZN) reach with the American consumer is staggering.

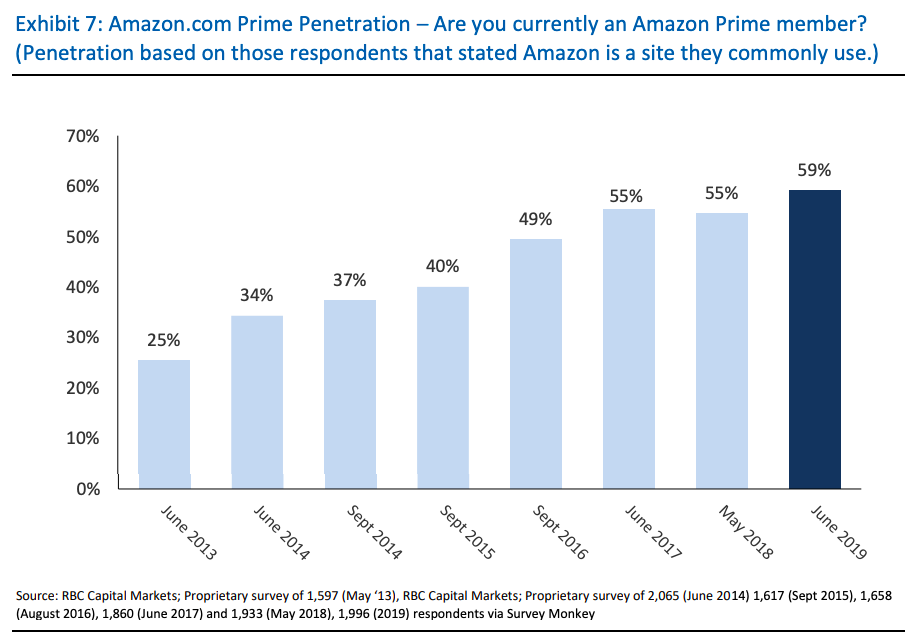

"Over the last six years, we have seen penetration of Amazon Prime rise from 25% in June 2013 to 59% today," RBC analyst Mark Mahaney wrote in June. "While memberships remained about flat last year, we saw a material rise in penetration this year. Amazon last reported the company has 100 [million] Prime subscribers globally."

Mahaney called Prime "one of the three greatest deals in America" alongside McDonald's Happy Meal and a monthly Netflix (NFLX) subscription. An Amazon Prime subscription costs $119 per year, or $12.99 per month.

This year, Amazon will host Prime Day on July 15 and July 16, giving Prime members special deals for a full 48 hours.

RBC analysts view Prime as a flywheel that will attract more members, leading to more items and sellers, and result in more retail revenue growth, which all make Prime more attractive for bringing on new members.

Prime members are "materially more loyal" and tend to purchase more often and with a higher spend than non-members.

“When we look at Spend, Purchase Frequency, Intent to Spend & Satisfaction, we see a large gap between Prime and non-Prime customers—e.g., 78% of Prime [subscribers] shop on Amazon 2x-3x per month vs. only 20% of non-Prime customers, and 50% of Prime [subscribers] spent over $800/year vs. 14% of non-Prime customers,” Mahaney wrote.

In a research note to clients in June, Mahaney and his team explained the methodology behind the 59% household penetration figure for Prime: "Amazon disclosed it had 285 [million] Active Customers (with a Paid Purchase) on the Q1:16 call but has not updated the number since. We’ll assume this number is solidly over 300 [million] today. There are about 128 [million] households in the U.S. and at 59% penetration, we believe Amazon may have ~75 [million] U.S. Prime subscribers, of its 100 [million-plus] Prime customers globally."

RBC reiterated its outperform rating for the stock and its price target of $2,300, about 20% above current levels.

This post was originally published on June 21, 2019.

—

Julia La Roche is a reporter at Yahoo Finance. Follow her on Twitter.

Walmart will start delivering groceries to your fridge, even when you’re not home

What Walmart CEO Doug McMillon tells people who want his job

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance