Amazon Sellers, Struggling to Boost Business, Are Buying Google Ads

(Bloomberg) -- Great Oral Health has been selling dental products on Amazon.com Inc. for almost a decade, buying ads from the e-commerce giant to help it stand out on the sprawling marketplace. But lately, the company noticed that spending more on Amazon ads was doing little to drum up new business.

Most Read from Bloomberg

Short Sellers in Danger of Extinction After Crushing Stock Gains

Mnuchin Chases Wall Street Glory With His War Chest of Foreign Money

How Billionaires Bought 70% of Detroit’s Offices and Transformed the City

NYSE Fixes Issue That Showed 99% Drops, Triggered Trading Halts

So it turned to another well-known advertising company: Alphabet Inc.’s Google.

Shoppers find Great Oral Health’s ads on Google when researching solutions for bad breath, gum disease and other maladies. The results direct them to the company’s oral probiotic on Amazon, which actually pays merchants to lure customers from other sites because it would rather keep the business than lose it to Walmart.com or another competitor.

Amazon merchants have long used Google to drive shoppers to their own websites, with mixed results. Now new third-party software is helping them direct Google searchers to Amazon where they’re comfortable shopping. Sellers say the technique is boosting sales and improving their profits because Google ads are typically cheaper than Amazon’s. The credit Amazon pays for external traffic – typically 10% of the product price — sweetens the deal.

“Amazon knows Google is a monster and all shoppers are walking in those corridors,” said Ryan Duminy, a consultant with Bullseye Sellers who manages advertising for Great Oral Health.

Amazon has been selling ads for more than a decade, despite initial fears that doing so could muck up the shopping experience. Today, the Seattle-based company is a major industry player, generating $47 billion in advertising revenue last year. But it has become increasingly difficult to stand out on Amazon’s cluttered web store, prompting sellers and brands to search for marketing alternatives.

Google, which has long struggled to become a shopping destination, is only too happy to help. In an effort to attract inflation-stung consumers, the search giant rolled out a deal-finding tool in the fall. Earlier this month, Google said it is beta-testing new features that let brands upload short videos to appear in their Google search results.

But what really changed the game for Amazon sellers is the emergence of startups like Toronto-based Carbon6 and Seattle-based Ampd, which developed algorithms adept at mining Google queries for shoppers itching to buy. Searchers can be targeted by age, marital status and income, metrics that can be used to calculate the likelihood of them making a purchase. The software also filters out information seekers, who may not be ready to pull the trigger.

“The really big breakthrough is targeting likely buyers on Google and sending them to Amazon,” said Tim Jordan, chief community officer at Carbon6, whose PixelMe software helps companies hone their Google marketing campaigns. “If you send a lot of traffic from Google to Amazon and those people aren’t buying, that’s bad traffic. You don’t make any money.”

More than 70% of all purchases made on Amazon by shoppers directed there from Google advertisements are making their first purchase from that brand, making it a valuable pipeline for new customers, according to a report from Jungle Scout. More than one-third of Amazon sellers said increasing traffic to their products on Amazon from external sites such as Google is a priority this year, the report said.

Amazon, in an emailed statement, said it helps sellers reach consumers through a variety of advertising initiatives, which all continue to grow. “One of these choices is the Brand Referral Bonus program, which helps brands improve the efficiency of their non-Amazon marketing campaigns.” Ampd, which says on its website that its software has directed 12 million Google users to Amazon, declined to comment.

The software tools tend to make the most financial sense for mid- to high-priced items, since keyword costs aren’t tied closely to a product’s price. If a merchant selling a $50 item on Amazon buys the Google search term for $5 or less, it’s essentially a free ad buy since Amazon credits them $5 for the traffic referral.

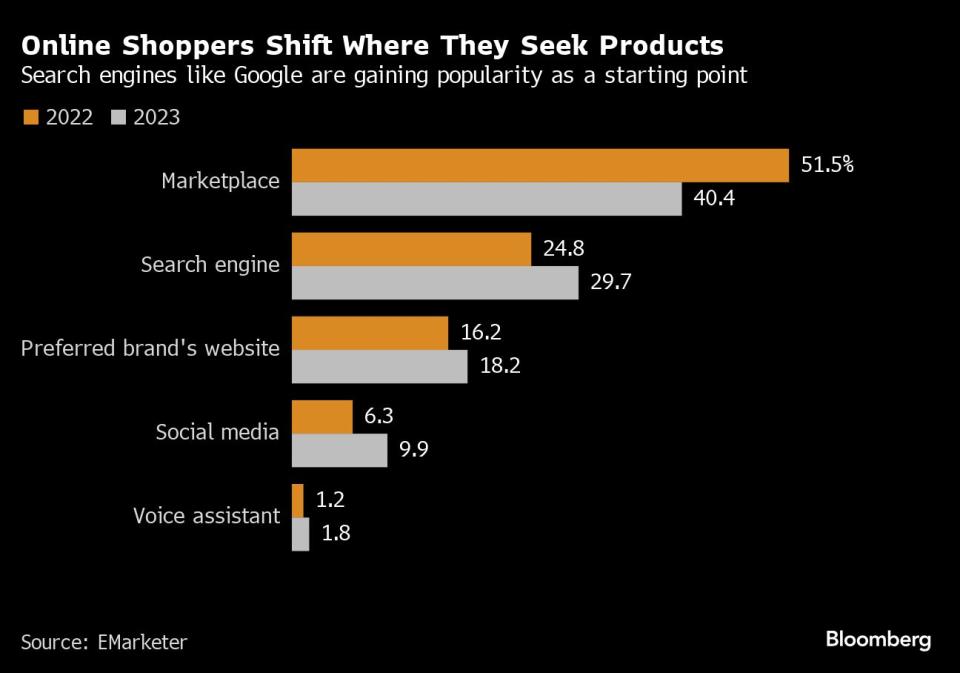

Online sellers are also responding to a decisive shift in consumer behavior. As recently as 2022, almost 52% of US shopping journeys began on online marketplaces such as Amazon.com, according to an annual survey by EMarketer. Last year, only 40% of shopping trips started there. Almost 30% of shoppers began their shopping on search engines like Google, up from 25% in the previous year.

EMarketer analyst Sky Canaves says deal-hunting shoppers are site-hopping rather than limiting themselves to one marketplace. The proliferation of advertising on Amazon also makes it harder for them to find what they want, she said. “Consumers are looking to save and stretch their dollars wherever possible,” Canaves said. “They may find it easier to compare prices and find deals across retailers via search versus on marketplaces.”

With more shoppers using search engines to find products, it makes sense for Amazon sellers to advertise there.

Most Read from Bloomberg Businessweek

The Budget Geeks Who Helped Solve an American Economic Puzzle

Startup Brings New Hope to the Pursuit of Reviving Frozen Bodies

Disney Is Banking On Sequels to Help Get Pixar Back on Track

How Rage, Boredom and WallStreetBets Created a New Generation of Young American Traders

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance