Amazon spells black Friday for Australian retailers, but an early boon for consumers

It looks as though Black Friday will be the day when the US online behemoth Amazon opens its Australian site, sparking what is likely to be a major price war in the retail market.

Amazon said 10 days ago its launch in Australia was “very close”. This week it reportedly sent emails to suppliers indicating it would have a soft launch on Thursday and formally begin trading on Friday. This coincides with the post-Thanksgiving shopping spree Black Friday, the biggest single day in the US retail calendar.

If the deals already being offered for Black Friday in America are any guide, Australian consumers can expect some deep discounting on a wide range of items. Some offers include 25% to 40% off Kindles, $500 off Canon SLR cameras and 70% off fitness trackers.

The Australian site, amazon.com.au, is up and running but is now only offering Kindle titles. But products such as laptops, cables and modems can be found via the site’s search engine as the company prepares for takeoff.

For consumers, the arrival of Amazon almost certainly means a new wave of deep discounting in the lead-up to Christmas and continuing during the traditional sales period in January.

It also potentially means that Australian retailers will sharpen up their service and their online presences as they come to terms with a local version of Amazon on their doorstep.

But while consumers will benefit in the short term, the question is what will be the long-term impacts? And will it ultimately be good or bad for Australia?

With the local retail sector already struggling with weak consumer sentiment, stagnant wage growth and higher energy bills, the arrival of Amazon is being seen as the next tsunami to hit it. Only 6% to 7% of sales take place online in Australia, compared with 15% to 16% in the US.

The Seattle-based company announced in April that it was coming to Australia and bringing its full set of offerings: Amazon Prime Now, Amazon MarketPlace and eventually Amazon Pantry and AmazonFresh.

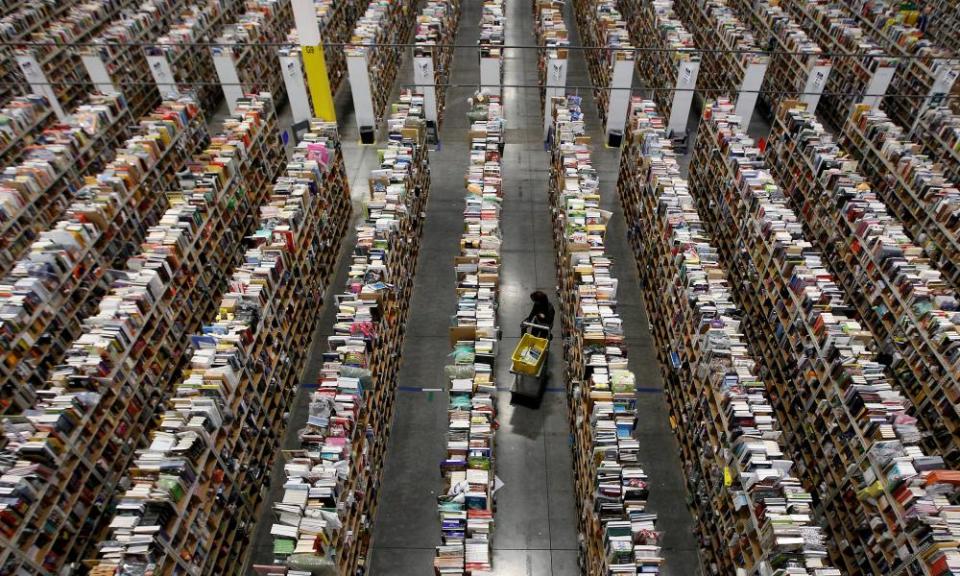

In July it began setting up its first distribution centre in Dandenong, Melbourne.

Retailers are expecting it to begin with discounted offerings in electronic goods, books, small appliances and fashion as it seeks to lure Australian shoppers to its platform.

Kim Do, a senior industry analyst at Ibisworld, which specialises in the retail sector, said the retailers that would feel it most were companies such as Harvey Norman, JB Hi-Fi, Kogan, Good Guys and the big department stores.

“It is products such as domestic appliances like kettles, toasters, etc which are easily comparable online that will be attractive on Amazon,” she said. “Larger appliances like fridges, etc – most people want to look at them.”

The arrival laid down a challenge to bricks-and-mortar retailers, she said, which would need to build on a reputation for service as a way of keeping customers.

In fashion, Do said Amazon might struggle to compete with the huge range and two-hour delivery of online retailers such as The Iconic.

There was speculation that Amazon might delay the introduction of Amazon Prime, which guarantees two-day delivery, until it has more distribution centres. “The sparseness of Australia’s population is a challenge for Amazon,” Do said.

Bookshops have already experienced the Amazon effect when it launched in the US in 1994, undercutting prices in the Australian market.

But Amazon will need to tread warily if it starts a price war. The new “effects test”, which makes it an offence to engage in behaviour that has the effect of driving a competitor out of business, as opposed to intending to do it, has just come into law.

“We have the benefit of seeing that happened in the US and UK, so we should be able to be more proactive,” said Joel Becker, chief executive of the Australian Booksellers Association, adding that shops would still have to improve their service.

Amazon was also likely to shake up not just conventional retailers, but also marketplace sites such as eBay and Gumtree.

Two weeks ago hundreds of Australian merchants attended a seminar in Sydney to hear from Amazon executives who told them a third-party marketplace would be available upon launch. Retailers will pay $49.95 plus GST each month to sell on Amazon, plus 6% to 15% of each item sold.

The small business ombudsman, Kate Carnell, said the arrival of Amazon offered both threats and opportunities for small business.

Amazon Marketplace offered a potentially powerful platform for them, she said, and could help cut the cost of postage and transport which could be crippling for small companies operating their own online portals.

“But nothing comes for nothing, and so they need to be aware of the fine print,” she warned, particularly if small businesses planned to build up stock to meet the expected surge in sales.

Carnell has already contacted Amazon to remind them of Australia’s contract laws, which apply not just to consumers but to small businesses with fewer than 20 employees.

She said the the US version of its marketplace contract raised red flags because it gave Amazon wide-ranging rights to terminate a contract with a small business at any time and for any reason. This would probably fall foul of the Australian law, she said.

Yahoo Finance

Yahoo Finance