AMD's Second-Gen EPYC Processors to Power New NVIDIA System

Advanced Micro Devices, Inc. AMD recently announced that the second-gen AMD EPYC processors have been selected by semiconductor giant, NVIDIA NVDA to provide more processing power to customers.

Notably, NVIDIA’s new DGX A100 high-performance computing system will leverage second-gen EPYC processors’ high core count to deliver optimal performance to enterprises. This will consequently help the enterprises to speed-up complex AI workloads like data analytics, training, and inference.

Notably, the latest second-gen AMD EPYC processors feature up to 64 cores and 128 lanes of PCIe 4 interconnectivity in a single x86 data center processor. The NVIDIA DGX A100 system will utilize two of these processors, running at speeds up to 3.4 GHz, to deliver 5 petaflops of AI performance.

The NVIDIA deal is a major win for AMD and highlights the strength of high-performance computing capabilities of its processors.

Moreover, the growing adoption of second-gen EPYC processors is expected to bolster AMD’s revenues in the upcoming days and boost investors’ confidence in the stock.

Notably, shares of AMD have returned 15.5% in the year-to-date period compared with the industry’s rise of 4.2%.

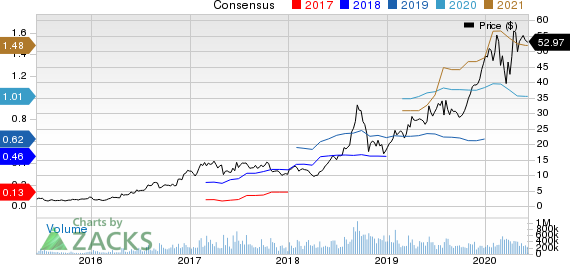

Advanced Micro Devices, Inc. Price and Consensus

Advanced Micro Devices, Inc. price-consensus-chart | Advanced Micro Devices, Inc. Quote

Strong Traction for EPYC Processors Bode Well

AMD has been witnessing growing momentum for its second-gen EPYC server processors in recent times, among companies like Amazon AMZN, Oracle ORCL and Hewlett Packard Enterprise (HPE) for their high-performance computing needs.

Recently, Amazon’s cloud division, Amazon Web Services ("AWS"), the leading cloud computing platform, announced that AMD’s second-gen EPYC processors are powering its new Elastic Compute Cloud (EC2) C5a instances. The instances will leverage the processor’s solid specifications to deliver optimal performance to customers at low costs.

Oracle has also implemented the second-gen AMD EPYC 7742 processor to power its new Oracle Cloud Infrastructure Compute E3 platform. The platform will utilize the processor’s high-performance computing capabilities to support high bandwidth workloads like big data and Oracle business applications.

Further, HPE selected second-gen EPYC processors to enhance performance of its SimpliVity 325 Gen 10 HCI solution. The solution doubles the number of virtual desktops supported per server from 300 to 600, which provides organizations with a 50% lower cost per remote worker.

These major deal wins are a testament to growing clout of AMD’s second-gen EPYC processors and are expected to drive the company’s top-line growth in the quarters ahead.

Moreover, this trend is likely to continue, driven by rapid adoption of the high-performance computing solutions. Notably, the high-performance computing market is expected to witness a CAGR of 6.1% by between 2020 and 2025, per Mordor Intelligence data. Further, the emergence of technologies like IoT and AI, as well increasing use of high-performance computing in the healthcare sector is driving growth, which adds on to the positives.

Persistent Risks

AMD, which currently carries a Zack Rank #4 (Sell), is likely to be affected by COVID-19 induced supply-chain constraints and broader macroeconomic weakness prevailing in the market. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Also, increasing expenses on product development are expected to limit margin expansion. Further, stiff competition from Intel is likely to lead to pricing pressure and dampen profitability in the near term. In March, Intel launched the second-gen Intel Xeon Gold 6256 and Gold 6250 to strengthen its enterprise CPU portfolio.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance