American Airlines Q1 2024 Earnings: Misses EPS Estimates Amidst Record Revenue

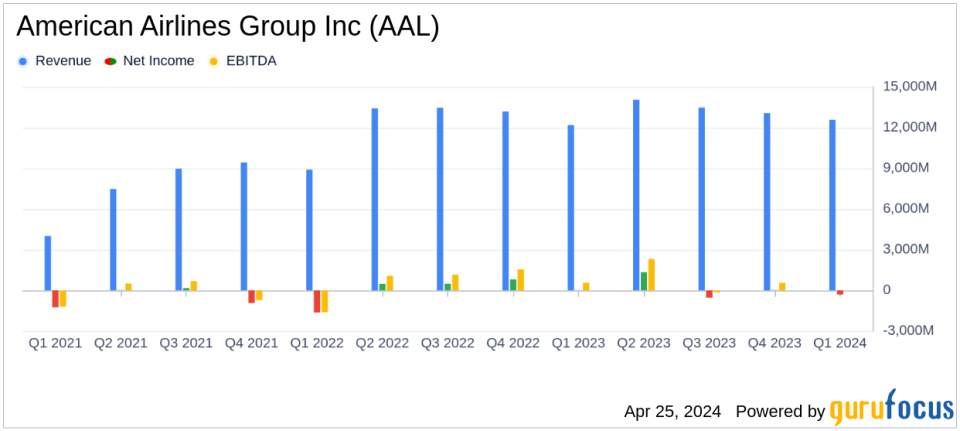

Revenue: Reported a record first-quarter revenue of approximately $12.6 billion, meeting the estimated revenue of $12,601.56 million.

Net Loss: Reported a net loss of $312 million, significantly below the estimated net loss of $189.06 million.

Earnings Per Share (EPS): Reported an EPS of -$0.48, falling short of the estimated EPS of -$0.29.

Free Cash Flow: Generated $1.4 billion in free cash flow during the quarter.

Debt Reduction: Reduced total debt by nearly $950 million, progressing towards the 2025 debt reduction goal.

Operating Cash Flow: Achieved operating cash flow of $2.2 billion in the first quarter.

Future Outlook: Expects second-quarter 2024 adjusted EPS to be between $1.15 and $1.45, and full-year adjusted EPS to be between $2.25 and $3.25.

American Airlines Group Inc (NASDAQ:AAL) disclosed its first-quarter financial results on April 25, 2024, revealing a mixed financial performance with record-breaking revenue yet a deeper net loss than anticipated. The airline reported a first-quarter revenue of approximately $12.6 billion, surpassing the estimated $12.601 billion. However, it encountered a net loss of $312 million, or $0.48 per diluted share, which did not align with the forecasted loss of $189.06 million, or $0.29 per share. The detailed earnings can be viewed in their 8-K filing.

American Airlines, recognized as the world's largest airline by several metrics, including fleet size and revenue passenger miles, operates major hubs across the United States and maintains a significant presence in the Latin American market. The company has recently completed a major fleet renewal, positioning itself with the youngest fleet among U.S. legacy carriers.

Operational and Financial Highlights

The airline's operational performance was notably strong, achieving the highest ever first-quarter completion factor, despite challenges such as air traffic control issues and adverse weather conditions. This operational efficiency helped drive the record revenue figures. However, the increased cost of fuel significantly impacted the financial outcomes, contributing to the net loss. American Airlines also made substantial progress in reducing its total debt, cutting it down by nearly $950 million during the quarter, aligning with its strategic goal of reducing total debt by $15 billion by the end of 2025.

Strategic Financial Management

Despite the net loss, American Airlines demonstrated robust cash flow management. The company generated $2.2 billion in operating cash flow and $1.4 billion in free cash flow. These figures reflect the airline's ability to generate liquidity, which is crucial for ongoing capital management and debt reduction efforts.

Looking Ahead

For the upcoming second quarter of 2024, American Airlines anticipates adjusted earnings per share to be between $1.15 and $1.45. The full-year outlook remains optimistic, with earnings projected to be between $2.25 and $3.25 per diluted share. This guidance suggests confidence in the airline's commercial strategies and operational adjustments aimed at navigating current market dynamics.

Overall, while American Airlines faces short-term financial hurdles, primarily due to external factors like fuel costs, its strategic initiatives around operational efficiency and debt reduction provide a foundation for financial stability and growth. Investors and stakeholders will likely watch closely how these strategies unfold in the coming quarters.

Investor and Analyst Perspectives

Given the mixed financial results, investors might exhibit cautious optimism. The record revenue indicates strong operational capabilities and market demand, while the deeper than expected net loss highlights ongoing challenges in cost management, particularly with volatile fuel prices. The strategic debt reduction and promising guidance for the coming quarters might balance concerns, painting a picture of a resilient airline poised for recovery.

For more detailed financial analysis and future updates on American Airlines Group Inc, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from American Airlines Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance