American Eagle (AEO) Slumps on Dismal Q1 Earnings, Soft View

American Eagle Outfitters, Inc. AEO reported dismal first-quarter fiscal 2022 results, wherein the top and bottom lines missed the Zacks Consensus Estimate and declined year over year.

The company’s results were impacted by lower-than-expected demand in the fiscal first quarter, which hurt the operating income. Results were also impacted by a spectacular spring season comparison last year that was aided by stimulus payments and pent-up customer demand.

Additionally, the company witnessed pressure from unseasonably cold weather throughout the quarter due to the late arrival of spring. However, the company continued to gain from the execution of the “Real Power. Real Growth.” plan.

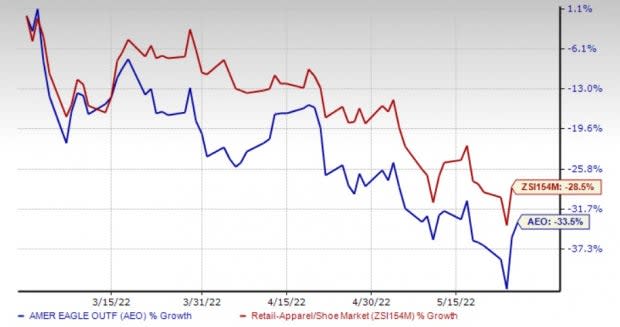

American Eagle’s shares declined 11.6% in the after-market session on May 26, thanks to the dismal first-quarter fiscal 2022 results. Shares of the Zacks Rank #3 (Hold) company have fallen 33.5% in the past three months compared with the industry’s decline of 28.5%.

Image Source: Zacks Investment Research

Q1 Details

American Eagle reported earnings of 16 cents per share, which significantly missed the Zacks Consensus Estimate of 24 cents. The bottom line declined 66.7% from adjusted earnings of 48 cents reported in first-quarter fiscal 2021. The company’s results were impacted by lower-than-expected demand in the fiscal first quarter, which hurt the operating income.

Adverse year-over-year comparisons, driven by last year’s stimulus payments and pent-up customer demand, also impacted the results. High inflation rates, increased gas prices and stronger-than-expected demand for other discretionary categories hurt the performance in the fiscal first quarter.

Total net revenues of $1,055 million increased 2% year over year but lagged the Zacks Consensus Estimate of $1,137 million. Revenue growth was aided by a 3-percentage-point contribution from supply-chain acquisitions. Brand-wise, revenues declined 6% to $686 million for AE, while it advanced 8% to $322 million for Aerie.

American Eagle Outfitters, Inc. Price, Consensus and EPS Surprise

American Eagle Outfitters, Inc. price-consensus-eps-surprise-chart | American Eagle Outfitters, Inc. Quote

The company’s digital revenues were down 6% year over year, while the same advanced 48% from the pre-pandemic levels (first-quarter fiscal 2019). Store revenues improved 2% year over year, driven by continued channel migration back to stores. Store sales were up 1% from the pre-pandemic levels.

The gross profit dropped 11% year over year to $388 million, while the gross margin contracted 540 basis points (bps) to 36.8%. This mainly resulted from a 340-bps impact of freight costs and a 120-bps impact of the recent supply-chain business acquisition. The company is on track to integrate and ramp up the supply-chain platform. The gross margin was also impacted by increased rent and delivery expenses, slightly offset by lower incentive compensation accruals.

Selling, general and administrative (SG&A) expenses rose 13% year over year to $298.8 million. As a percentage of sales, S&A expenses increased 270 bps to 28.3% due to a rise in store wages and hours, as well as increased corporate compensation, professional services and advertising expenses. This was partly negated by lower incentive compensation accruals.

Operating income in the fiscal first quarter was $41.9 million, down 68.6% from $133.4 million in the year-ago quarter. Operating income included a $35-million headwind from higher freight costs and a $12-million loss from the supply-chain acquisition. The operating margin contracted 890 bps year over year to 4%. Operating income for the Aerie brand was $43.1 million, down 38.4% year over year. The AE brand’s operating income declined 31.3% year over year to $103.9 million.

Other Financial Details

American Eagle ended first-quarter fiscal 2022 with cash and cash equivalents of $228.8 million. Total shareholders’ equity as of Apr 30, 2022, was $1,383 million. The company had total liquidity, including available credit, of $581 million at the quarter-end.

The company’s capital expenditure was $58 million in the reported quarter. It expects a capital expenditure of $275 million for fiscal 2022.

Store Update

In first-quarter fiscal 2022, the company opened 7 AE and 12 Aerie stores, while it closed 9 AE and 2 Aerie stores. The store opening for the Aerie brand included both stand-alone and Aerie OFFLINE aide-by-side formats. For AE, the company is on track with its target of rightsizing the brand store footprint.

At the end of the fiscal first quarter, American Eagle operated 1,141 stores, comprising 878 AE, 254 Aerie, five Todd Synder and four unsubscribed stores. Additionally, it operated 258 international license outlets.

Guidance

Driven by the shifts in the macro-environment, American Eagle lowered its outlook for fiscal 2022. The company now anticipates operating profit above $314 million achieved in fiscal 2019. Earlier, it had predicted an operating income of $550-$600 million for fiscal 2022. The company expects revenue growth in the low-single digits from the fiscal 2021 reported figure.

The company also expects the second half of fiscal 2022 to be better than the first half. It expects gains in the second half to be driven by better-aligned customer demand, more balanced inventory levels and a leaner expense base. This is likely to aid margins and profitability in the second half relative to the first half.

That said, the company anticipates sales growth in second-quarter fiscal 2022 to be at similar levels as the first quarter. The gross margin rate is expected to be 33%, reflecting higher markdowns to clear the spring inventory, increased freight costs and impacts from the supply-chain acquisitions.

Stocks to Consider

We have highlighted three better-ranked stocks in the Retail - Wholesale sector, namely Boot Barn BOOT, Designer Brands DBI and Fastenal FAST.

Boot Barn, a lifestyle retailer of western and work-related footwear, apparel and accessories, currently sports a Zacks Rank #1 (Strong Buy). BOOT has an expected EPS growth rate of 20% for three-five years. Shares of BOOT have declined 10.1% in the past three months. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Boot Barn’s current-year sales and earnings per share (EPS) suggests growth of 17% and 4.4%, respectively, from the year-ago period’s reported figures. BOOT has a trailing four-quarter earnings surprise of 25.2%, on average.

Designer Brands, which designs, manufactures, and retails footwear and accessories in North America, has a Zacks Rank of 2 (Buy) at present. DBI has a trailing four-quarter earnings surprise of 112.8%, on average. The stock has rallied 19.9% in the past three months.

The Zacks Consensus Estimate for Designer Brands’ current-year sales and EPS suggests growth of 6.5% and 8.8%, respectively, from the year-ago period’s reported numbers.

Fastenal, a national wholesale distributor of industrial and construction supplies, presently carries a Zacks Rank #2. FAST has a trailing four-quarter earnings surprise of 5%, on average. Shares of the company have gained 2% in the past three months.

The Zacks Consensus Estimate for Fastenal’s current-year sales and EPS suggests growth of 15.4% and 17.5%, respectively, from the year-ago period’s reported numbers. FAST has an expected EPS growth rate of 9% for three-five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fastenal Company (FAST) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

Designer Brands Inc. (DBI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance