American Electric Power Co Inc (AEP) Surpasses Analyst Estimates with Strong Q1 2024 Performance

GAAP Earnings Per Share (EPS): Reported at $1.91, significantly exceeding the estimated $1.26.

Operating EPS: Reported at $1.27, slightly above the estimate of $1.26.

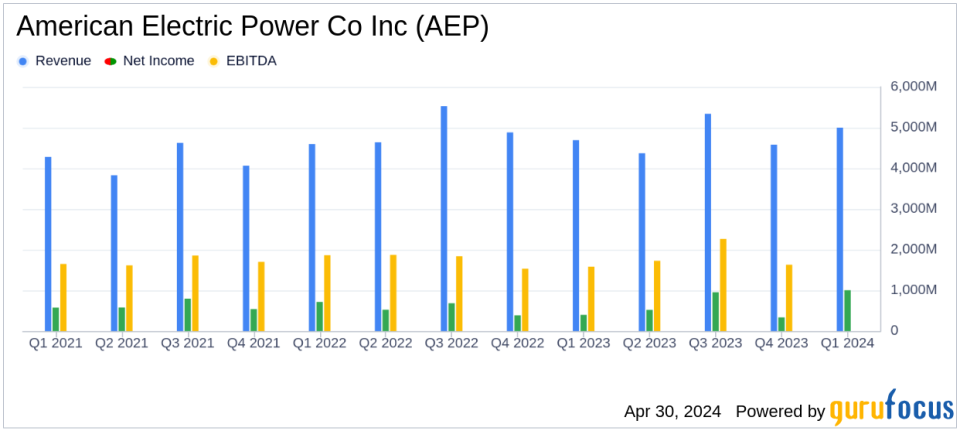

Revenue: Reported at $5.0 billion, falling short of the estimated $5.02 billion.

Net Income: GAAP net income reached $1.003 billion, far surpassing the estimated $655.11 million.

Operating Net Income: Reported at $670.4 million, exceeding the estimated $655.11 million.

Commercial Load Growth: Achieved a 10.5% year-over-year increase, supporting revenue growth.

Guidance: 2024 operating earnings guidance reaffirmed at $5.53 to $5.73 per share, indicating stable future expectations.

American Electric Power Co Inc (NASDAQ:AEP) released its 8-K filing on April 30, 2024, revealing a robust financial performance for the first quarter of 2024. AEP reported GAAP earnings of $1.91 per share and operating earnings of $1.27 per share, significantly surpassing the analyst estimates of $1.26 per share. The company's revenue reached $5.0 billion, also exceeding the forecast of $5020.67 million.

American Electric Power, one of the largest regulated utilities in the United States, serves over 5 million customers across 11 states. The company's diverse energy portfolio includes significant investments in coal, natural gas, renewable energy, and hydro sources. AEP's strategic focus on infrastructure investment and economic development has been pivotal in driving its financial success.

Quarterly Performance Highlights

The first quarter of 2024 saw AEP achieve GAAP earnings of $1 billion, a substantial increase from $397 million in the same quarter the previous year. This performance was bolstered by a 10.5% year-over-year increase in commercial load, reflecting the company's focus on economic development and customer engagement. Notably, AEP's industry-leading transmission network attracted significant investment, particularly from data centers and industrial customers in Indiana, Ohio, and Texas.

Despite challenges such as mild weather conditions and inflationary pressures, AEP has effectively managed its costs and continued to invest in the energy infrastructure. These investments are aimed at enhancing grid reliability and resiliency, with more than $27 billion planned for transmission and distribution systems over the next five years.

Strategic Developments and Future Outlook

AEP's strategic initiatives include the recent sale of its New Mexico solar assets and ongoing efforts to streamline operations through a voluntary workforce reduction program. These measures are intended to mitigate the impacts of inflation and interest rates, ensuring long-term sustainability and affordability for customers.

The company reaffirms its 2024 operating earnings guidance in the range of $5.53 to $5.73 per share, reflecting confidence in its operational strategy and financial planning. AEP's commitment to a sustainable energy future is underscored by its investments in regulated renewables and its goal to achieve an 80% reduction in carbon dioxide emissions by 2030.

Financial Statements and Segment Performance

A detailed review of AEP's financial segments reveals significant earnings contributions across its portfolio. The Vertically Integrated Utilities segment reported a notable increase in GAAP earnings from $261 million in Q1 2023 to $560.8 million in Q1 2024. Similarly, the Generation & Marketing segment turned a previous loss into a profit, highlighting effective management and operational efficiency.

The company's balance sheet remains robust, with strategic divestitures and careful financial management ensuring solid liquidity and financial flexibility. AEP's focus on maintaining a strong credit profile supports its extensive capital expenditure program and dividend payments, reinforcing its attractiveness to investors.

Conclusion

In conclusion, American Electric Power Co Inc's first-quarter earnings for 2024 reflect a strong financial and operational performance. The company's proactive management strategies and commitment to infrastructure investment have positioned it well for continued growth and stability. Investors and stakeholders can look forward to AEP's sustained focus on innovation, customer satisfaction, and sustainable practices as it navigates the evolving energy landscape.

For more detailed information and updates, please visit AEP's investor relations website or join their upcoming webcast discussions.

Explore the complete 8-K earnings release (here) from American Electric Power Co Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance