American Vanguard (AVD) Q1 Earnings Beat, Sales Miss Estimates

American Vanguard Corporation AVD logged earnings of 6 cents per share in the first quarter of 2024 compared with earnings of 7 cents a year ago.

Barring one-time items, adjusted earnings came in at 9 cents for the quarter. It beat the Zacks Consensus Estimate of 8 cents.

Revenues were $135.1 million for the reported quarter, up around 8% year over year. It missed the Zacks Consensus Estimate of $141.2 million. The company saw growth in all three businesses, U.S. Crop, U.S. Non-crop and International, in the reported quarter.

American Vanguard Corporation Price, Consensus and EPS Surprise

American Vanguard Corporation price-consensus-eps-surprise-chart | American Vanguard Corporation Quote

Sales by Regions

Revenues from American Vanguard’s U.S. crop business in the reported quarter went up 9% year over year to around $67.3 million. Within the U.S. Crop business, it recorded strong sales of granular soil insecticides, herbicides and cotton and peanut products.

Sales from the U.S. non-crop business rose around 28% year over year to around $17.8 million. AVD saw significantly higher sales, driven by mosquito adulticides, pest strips and OHP products for nursery and ornamental uses.

Revenues from international businesses were up 2% year over year to around $50.1 million. Sales were aided by Mexico and APAC.

Financials

American Vanguard ended the quarter with cash and cash equivalents of roughly $13.7 million, up around 20% sequentially. Long-term debt was around $187 million, up around 34% sequentially.

Outlook

AVD noted that it is seeing stable market conditions with a strong farm economy and a more relaxed procurement approach within the distribution channel compared to a year ago.

It now expects net sales growth of between 6% and 9% year over year for 2024. The company also anticipates full-year adjusted EBITDA in the band of $60-$70 million.

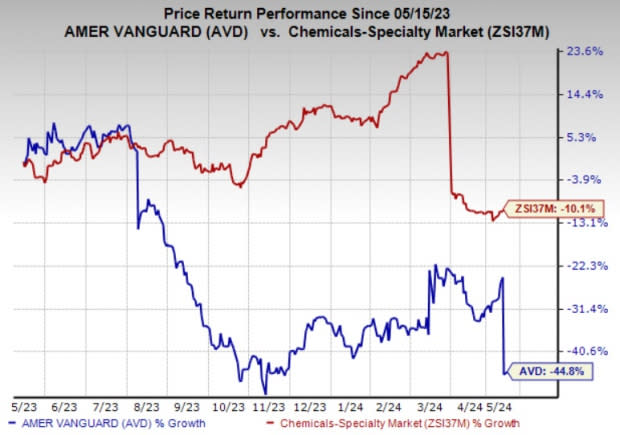

Price Performance

American Vanguard’s shares have lost 44.8% in a year against a 10.1% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Other Specialty Chemicals Releases

AVD currently carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Celanese Corporation CE logged adjusted earnings for the first quarter of $2.08 per share, up 3.5% from $2.01 reported a year ago. The bottom line surpassed the Zacks Consensus Estimate of $1.91.

Celanese sees adjusted earnings in the band of $2.60 to $3 per share for the second quarter of 2024. CE expects to deliver higher earnings performance in the second quarter and into the second half of 2024.

Ingevity Corporation NGVT reported adjusted earnings of 52 cents per share for the first quarter, down from $1.09 in the year-ago quarter. The figure beat the Zacks Consensus Estimate of 37 cents.

NGVT sees its sales for 2024 in the band of $1.4-$1.55 billion and adjusted EBITDA in the range of $365-$390 million.

Element Solutions Inc’s ESI adjusted earnings of 34 cents per share for the first quarter beat the Zacks Consensus Estimate of 32 cents.

ESI now expects adjusted EBITDA in the range of $515-$530 million for 2024. For second-quarter 2024, it sees adjusted EBITDA to be around $125 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Element Solutions Inc. (ESI) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

American Vanguard Corporation (AVD) : Free Stock Analysis Report

Ingevity Corporation (NGVT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance