American Water (AWK) Q1 Earnings Miss Estimates, Sales Beat

American Water Works Company AWK posted first-quarter 2023 operating earnings per share (EPS) of 91 cents, which lagged the Zacks Consensus Estimate of 92 cents by 1.09%. The bottom line improved 4.6% from the year-ago earnings of 85 cents per share.

Total Revenues

Total revenues of $938 million surpassed the Zacks Consensus Estimate of $878 million by 6.8%. The top line increased 11.4% from the year-ago figure of $842 million.

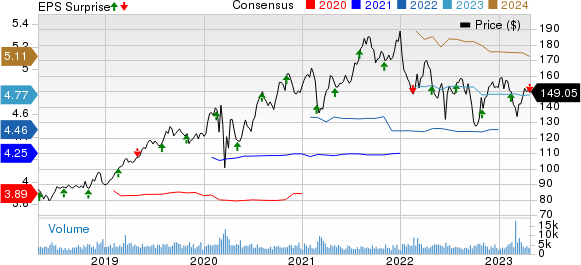

American Water Works Company, Inc. Price, Consensus and EPS Surprise

American Water Works Company, Inc. price-consensus-eps-surprise-chart | American Water Works Company, Inc. Quote

Segment Details

Regulated businesses’ revenues in first-quarter 2023 were $860 million, up 10.5% from the year-ago quarter level. The year-over-year surge in revenues was primarily due to authorized revenue increases resulting from completed general rate cases and infrastructure proceedings to recover incremental capital and acquisition investments.

Other revenues in first-quarter 2023 were $78 million compared with $64 million in the year-ago period.

Highlights of the Release

Total operating expenses for the first quarter were $643 million, up 7.9% from the year-ago quarter’s $596 million due to an increase in operating and maintenance expenses.

The operating income was $295 million, up 19.9% from the year-ago figure of $246 million. Since Jan 1, 2023, new rates approved by different commissions under which the company operates have increased the total revenues of the company annually by $279 million.

American Water Works continues to expand operations through acquisitions and organic means. Through five closed acquisitions in two states, it added 1,400 customers to its base as of Mar 31, 2023. AWK’s 27 pending acquisitions (as of Mar 31), when completed, would add another 48,200 customers.

In first-quarter 2023, American Water Works invested $538 billion in infrastructure improvements to provide quality services to its expanding customer base.

Financial Highlights

Cash and cash equivalents amounted to $213 million as of Mar 31, 2023, compared with $85 million as of Dec 31, 2022.

The total long-term debt was $10,487 million as of Dec 31, 2023, down 4.01% from $10,926 million as of Dec 31, 2022.

During the first quarter, the company issued 12.65 million shares for net proceeds of $1.7 billion, which will meet a significant portion of its planned $2 billion requirement via equity issue in the 2023-2027 period.

Guidance

American Water Works reiterated 2023 earnings guidance at $4.72-$4.82 per share. The Zacks Consensus Estimate for 2023 earnings of $4.77 per share is on par with $4.77, the mid-point of the company’s guided range. AWK reiterated long-term earnings and dividend growth in the range of 7-9%.

The company plans to invest nearly $2.9 billion across its footprint in 2023, including $0.4 billion on strategic acquisitions.

Zacks Rank

American Water Works currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Primo Water Corporation PRMW is scheduled to report first-quarter 2023 earnings on May 4. The Zacks Consensus Estimate for Primo Water’s first-quarter EPS is pegged at 11 cents, implying year-over-year growth of 22.2%.

The Zacks Consensus Estimate for PRMW’s 2023 earnings is pegged at 84 cents per share, implying year-over-year growth of 25.4%.

Essential Utilities Inc. WTRG is set to report first-quarter 2023 earnings on May 8, after the market close. The Zacks Consensus Estimate for Essential Utilities’ first-quarter EPS is pegged at 73 cents, implying a year-over-year decline of 3.9%.

The Zacks Consensus Estimate for WTRG’s 2023 earnings is pegged at $1.87 per share, implying year-over-year growth of 5.6%. WTRG’s long-term (three- to five-year) earnings growth is pegged at 6%.

American States Water Co. AWR is set to report first-quarter 2023 earnings on Mar 10, after market close. The Zacks Consensus Estimate for American States Water’s first-quarter EPS is pegged at 54 cents, suggesting year-over-year growth of 42.1%.

The Zacks Consensus Estimate for AWR’s 2023 earnings is pegged at $2.97 per share, implying year-over-year growth of 30.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Water Works Company, Inc. (AWK) : Free Stock Analysis Report

American States Water Company (AWR) : Free Stock Analysis Report

Primo Water Corporation (PRMW) : Free Stock Analysis Report

Essential Utilities Inc. (WTRG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance