Amiad Water Systems (LON:AFS) Could Be Struggling To Allocate Capital

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. Having said that, from a first glance at Amiad Water Systems (LON:AFS) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

What is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Amiad Water Systems is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.051 = US$5.4m ÷ (US$145m - US$39m) (Based on the trailing twelve months to December 2020).

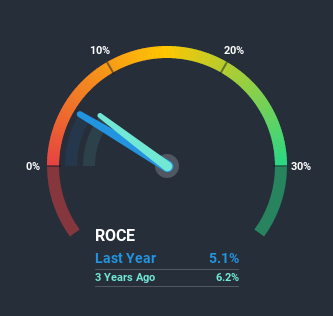

Thus, Amiad Water Systems has an ROCE of 5.1%. In absolute terms, that's a low return and it also under-performs the Machinery industry average of 8.4%.

Check out our latest analysis for Amiad Water Systems

In the above chart we have measured Amiad Water Systems' prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Amiad Water Systems here for free.

So How Is Amiad Water Systems' ROCE Trending?

We weren't thrilled with the trend because Amiad Water Systems' ROCE has reduced by 59% over the last five years, while the business employed 52% more capital. However, some of the increase in capital employed could be attributed to the recent capital raising that's been completed prior to their latest reporting period, so keep that in mind when looking at the ROCE decrease. Amiad Water Systems probably hasn't received a full year of earnings yet from the new funds it raised, so these figures should be taken with a grain of salt.

On a side note, Amiad Water Systems has done well to pay down its current liabilities to 27% of total assets. That could partly explain why the ROCE has dropped. Effectively this means their suppliers or short-term creditors are funding less of the business, which reduces some elements of risk. Since the business is basically funding more of its operations with it's own money, you could argue this has made the business less efficient at generating ROCE.

Our Take On Amiad Water Systems' ROCE

Bringing it all together, while we're somewhat encouraged by Amiad Water Systems' reinvestment in its own business, we're aware that returns are shrinking. Investors must think there's better things to come because the stock has knocked it out of the park, delivering a 106% gain to shareholders who have held over the last five years. Ultimately, if the underlying trends persist, we wouldn't hold our breath on it being a multi-bagger going forward.

If you'd like to know about the risks facing Amiad Water Systems, we've discovered 1 warning sign that you should be aware of.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance