Amphenol (APH) Q4 Earnings Beat Estimates, Revenues Down Y/Y

Amphenol APH reported fourth-quarter 2019 adjusted earnings of 98 cents per share that beat the Zacks Consensus Estimate by 7.7% but declined 6.7% from the year-ago quarter’s figure.

Net sales decreased 3.3% year over year to $2.15 billion, which was slightly better than the consensus mark of $2 billion. Unfavorable foreign exchange impacted sales by $14 million.

Quarter Details

The year-over-year decrease in revenues was primarily due to weakness in communications end markets, particularly the mobile devices and mobile networks markets.

Interconnect Products and Assemblies (95.4% of net sales) sales declined 3.3% from the year-ago quarter to $2.05 billion. Moreover, Cable Products and Solutions sales were $99.7 million, down 2.5% year over year.

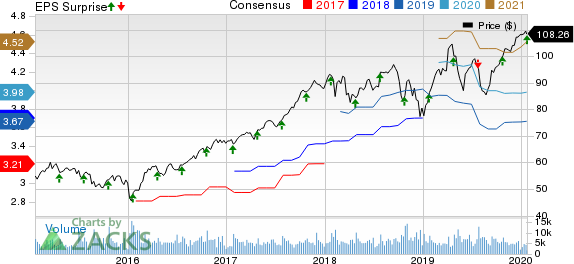

Amphenol Corporation Price, Consensus and EPS Surprise

Amphenol Corporation price-consensus-eps-surprise-chart | Amphenol Corporation Quote

Gross margin contracted 60 basis points (bps) on a year-over-year basis to 31.6%.

Selling, general and administrative expenses (SG&A), as a percentage of revenues, increased 40 bps to 11.6%.

Adjusted operating margin contracted 100 bps on a year-over-year basis to 20%.

Segment-wise, Interconnect Products and Assemblies operating margin shrank 80 bps to 22%, while Cable Products and Solutions operating margin contracted 190 bps to 10%.

Balance Sheet and Cash Flow

As of Dec 31, 2019, Amphenol had cash and cash equivalents worth $908.6 million, lower than $986.7 million as of Sep 30.

Cash flow from operations was $424 million compared with $412 million in the previous quarter.

During the quarter, the company repurchased 0.4 million shares for $43 million.

Guidance

For the first quarter of 2020, Amphenol projects sales between $1.960 billion and $2 billion.

Adjusted earnings are expected between 85 cents and 87 cents per share.

For 2020, Amphenol expects sales between $8.240 billion and $8.400 billion (flat to up 2% on a year-over-year basis).

Moreover, the company expects adjusted earnings of $3.76-$3.84 per share, which indicates a year-over-year increase of 1-3%.

Zacks Rank & Other Stocks to Consider

Currently, Amphenol has a Zacks Rank #2 (Buy).

Apple AAPL, Waters Corporation WAT and Amkor Technology AMKR are a few similar-ranked stocks in the broader computer and technology sector. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Apple, Waters Corporation and Amkor Technology are set to report quarterly results on Jan 28, Feb 4 and Feb 10, respectively.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.6% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Amkor Technology, Inc. (AMKR) : Free Stock Analysis Report

Amphenol Corporation (APH) : Free Stock Analysis Report

Waters Corporation (WAT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance