Analysts are just starting to understand how coronavirus could hit corporate profits: Morning Brief

Friday, March 6, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

And the impacts go beyond the obvious

The stock market is in turmoil.

Since the three major indexes hit record highs on February 19, these indexes have declined as much as 12% and all three indexes have moved more than 2% during each of this week’s four trading sessions.

And these big price moves in indexes and individual stocks have left analysts scrambling to make sense of where actual business results could be headed in the next few quarters. And the impacts go well beyond just airlines, cruise companies, and companies with big exposure to China.

Analysts at Bank of America Global Research said Thursday that Google (GOOGL) faces a potential $1.5 billion revenue hit over the next two quarters as a result of lower spending from online travel agencies, or OTAs.

BofA estimates that OTAs spent about $5.7 billion with Google in 2019 and that the company’s total exposure to the travel industry is about 11% of its gross ad revenue, or around $14 billion.

Before coronavirus, BofA expected Google’s travel ad spend would grow about 10%. Now, the firm sees travel-related ad spend down around 7% in the first quarter and just over 10% in the second quarter.

In its note, BofA writes that, “Our model assumes trends improve after April, but remain under pressure until June, and are back to normal by July.” In other words, coronavirus is still being modeled as a temporary impact. And BofA expects prevailing trends that put Google at the center of a growing industry will be back in place by the second half of the year and that travel spend will rebound in 2021.

All analysts, of course, must make assumptions about future business conditions as part of any analysis. But coronavirus and its impacts are far more uncertain than guesstimating future financial impacts from exchange rate fluctuations, for instance.

And while the analyst toolkit right now sees coronavirus impacts fading in a few months and pent-up demand bolstering some industries in the second half of the year and beyond, the stock market is pricing in less rosy scenarios.

Over the past two weeks, dozens of companies have cut or removed their financial guidance as a result of impacts from coronavirus.

Last Thursday, Booking Holdings (BKNG) lowered its guidance for the first quarter, saying it expects total gross bookings will be down 8%-13% in Q1 as a result of already observed trends related to coronavirus. The company said this a range “wider than typically provided given the high level of uncertainty in forecasting the coronavirus and its associated impact on the company and the travel industry generally.”

Booking added that, “It is not possible to predict where, and to what degree, outbreaks of the coronavirus will disrupt travel patterns.”

And this wide range of outcomes — or a range of outcomes that in some cases can’t be modeled at all — is why investors have grown so skittish, so quickly.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him at @MylesUdland

What to watch today

Economy

8:30 a.m. ET: Change in non-farm payrolls, February: +175,000 vs. +225,000 in January

8:30 a.m. ET: Unemployment rate, February: 3.6%, vs. 3.6% in January

8:30 a.m. ET: Avg. hourly earnings, MoM, February: +0.3%, vs. +0.2% in January

8:30 a.m. ET: Avg. hourly earnings, YoY, February: +3.0%, vs. +3.1% in January

10:00 a.m. ET: Wholesale inventories, MoM, January final: -0.2% expected, -0.2% prior

3:00 p.m. ET: Consumer credit, January: $16.5 billion vs. $22.06 billion prior

Top News

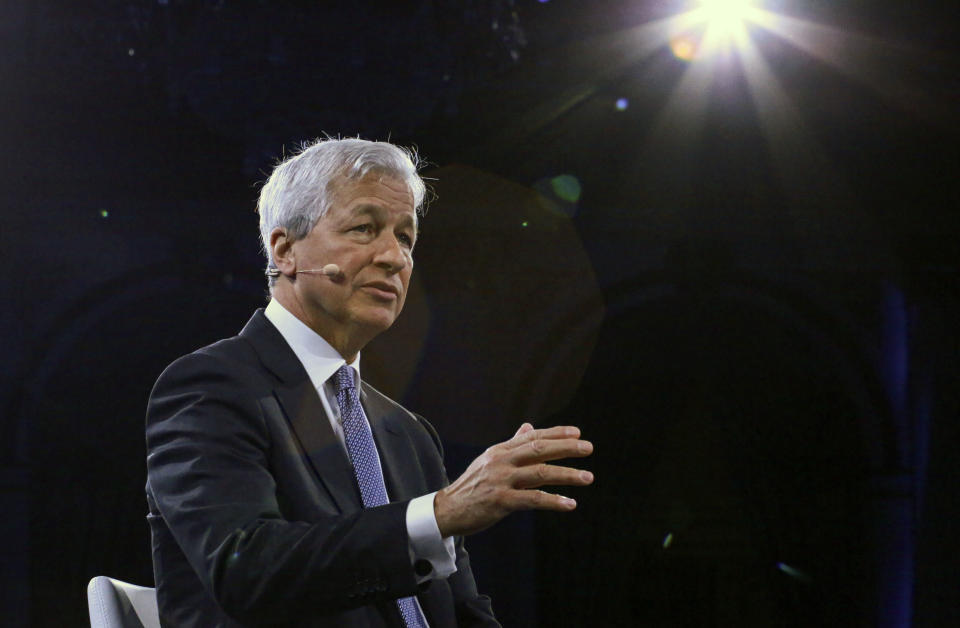

JPMorgan CEO Jamie Dimon recovering after emergency heart surgery [Reuters]

U.S. Treasury yields slide to new record lows [Reuters]

9 key dates when we'll have economic data on coronavirus effects [Yahoo Finance]

YAHOO FINANCE HIGHLIGHTS

Voters don’t want the Sanders-Warren revolution

Facebook, Google, and Amazon have characteristics of 'monopolies,' says Finder.com co-founder

HP CEO: Xerox's offer will have to address these 3 things

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay

Yahoo Finance

Yahoo Finance