Analysts Just Made A Major Revision To Their DBV Technologies S.A. (EPA:DBV) Revenue Forecasts

The analysts covering DBV Technologies S.A. (EPA:DBV) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

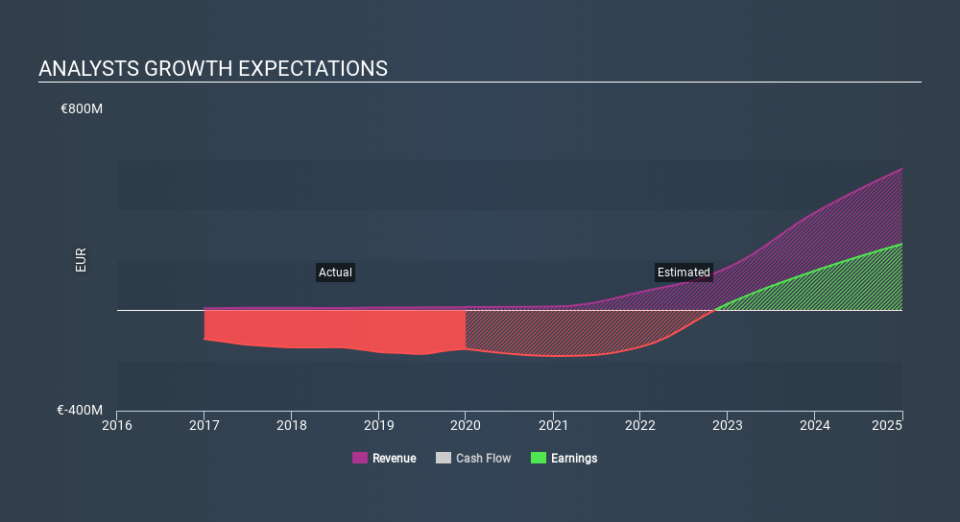

Following the downgrade, the most recent consensus for DBV Technologies from its seven analysts is for revenues of €14m in 2020 which, if met, would be a decent 8.9% increase on its sales over the past 12 months. Losses are presumed to reduce, shrinking 14% from last year to €3.58. Yet prior to the latest estimates, the analysts had been forecasting revenues of €16m and losses of €3.58 per share in 2020. So there's definitely been a change in sentiment in this update, with the analysts administering a substantial haircut to this year's revenue estimates, while at the same time holding losses per share steady.

See our latest analysis for DBV Technologies

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We would highlight that DBV Technologies' revenue growth is expected to slow, with forecast 8.9% increase next year well below the historical 18% p.a. growth over the last five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 31% per year. Factoring in the forecast slowdown in growth, it seems obvious that DBV Technologies is also expected to grow slower than other industry participants.

The Bottom Line

Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on DBV Technologies after today.

There might be good reason for analyst bearishness towards DBV Technologies, like a short cash runway. For more information, you can click here to discover this and the 2 other warning signs we've identified.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance