Analysts Just Made A Massive Upgrade To Their Wayfair Inc. (NYSE:W) Forecasts

Celebrations may be in order for Wayfair Inc. (NYSE:W) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The consensus statutory numbers for both revenue and earnings per share (EPS) increased, with their view clearly much more bullish on the company's business prospects. Wayfair has also found favour with investors, with the stock up a whopping 40% to US$188 over the past week. We'll be curious to see if these new estimates convince the market to lift the stock price higher still.

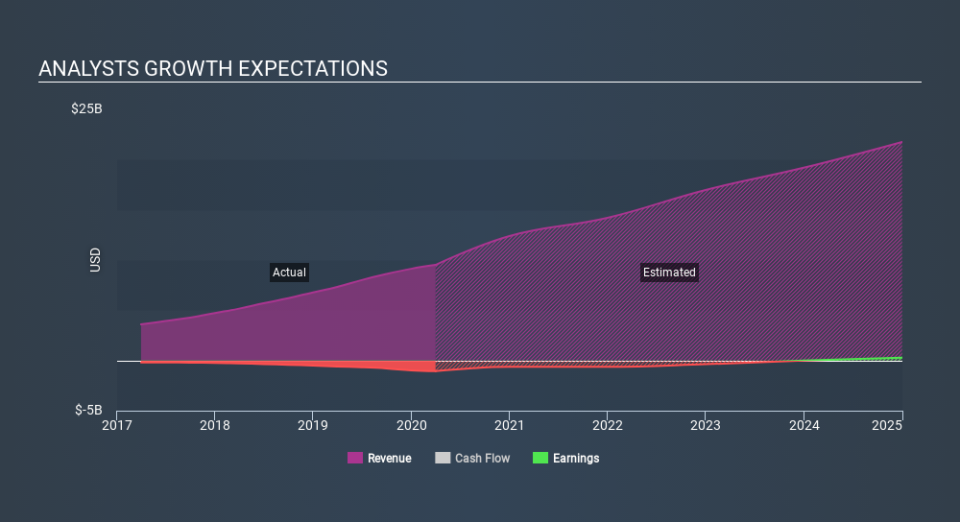

After this upgrade, Wayfair's 31 analysts are now forecasting revenues of US$12b in 2020. This would be a sizeable 30% improvement in sales compared to the last 12 months. Losses are predicted to fall substantially, shrinking 42% to US$6.72. However, before this estimates update, the consensus had been expecting revenues of US$11b and US$11.57 per share in losses. We can see there's definitely been a change in sentiment in this update, with the analysts administering a sizeable upgrade to this year's revenue estimates, while at the same time reducing their loss estimates.

Check out our latest analysis for Wayfair

It will come as no surprise to learn that the analysts have increased their price target for Wayfair 91% to US$166 on the back of these upgrades. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic Wayfair analyst has a price target of US$225 per share, while the most pessimistic values it at US$40.00. We would probably assign less value to the forecasts in this situation, because such a wide range of estimates could imply that the future of this business is difficult to value accurately. With this in mind, we wouldn't rely too heavily on the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Wayfair's past performance and to peers in the same industry. We can infer from the latest estimates that forecasts expect a continuation of Wayfair'shistorical trends, as next year's 30% revenue growth is roughly in line with 33% annual revenue growth over the past five years. Compare this with the wider industry, which analyst estimates (in aggregate) suggest will see revenues grow 17% next year. So it's pretty clear that Wayfair is forecast to grow substantially faster than its industry.

The Bottom Line

The most important thing here is that analysts reduced their loss per share estimates for this year, reflecting increased optimism around Wayfair'sprospects. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, Wayfair could be worth investigating further.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. We have estimates - from multiple Wayfair analysts - going out to 2024, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance