Anaplan (PLAN) to Report Q4 Earnings: What's in the Cards?

Anaplan PLAN is set to report fourth-quarter fiscal 2020 results on Feb 27.

Anaplan expects fourth-quarter revenues between $96.5 million and $97.5 million. The consensus mark for revenues currently stands at $97 million, suggesting growth of 40% from the figure reported in the year-ago quarter.

For the quarter, the Zacks Consensus Estimate for loss has been steady at 11 cents per share over the past 30 days.

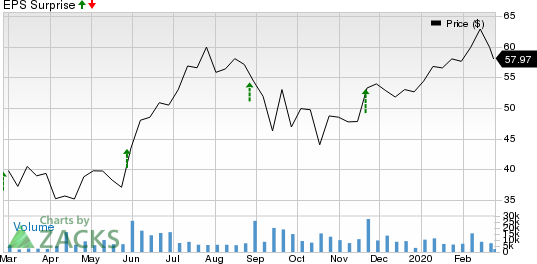

Notably, the company’s earnings beat the Zacks Consensus Estimate over the trailing four quarters, the average positive surprise being 28.8%.

Let’s see how things have shaped up for this announcement.

Anaplan, Inc. Price and EPS Surprise

Anaplan, Inc. price-eps-surprise | Anaplan, Inc. Quote

Key Factors to Consider

Expansion of Anaplan’s user base is expected to have benefited its fourth-quarter performance. Solid demand for the company’s Connected Planning solution, owing to the ongoing digital transformation among global enterprises, is expected to have aided the dollar-based network expansion rate, which was 123% in the last reported quarter.

Notably, at the end of the fiscal third quarter, the company served 324 customers with more than $250K in annual recurring revenues, which reflected impressive year-over-year growth of 42%.

The momentum most likely continued in the to-be-reported quarter driven by higher use cases of Anaplan’s solutions in adjacent business areas like supply chain, HR and finance, among others.

During the third quarter, the company inked 41 deals with Deloitte, Anaplan’s Global Partner of 2019. The company’s expanded partner base is expected to have boosted its top-line growth in the to-be-reported quarter.

Moreover, the launch of Anaplan’s updated platform user experience and mobile app in October is expected to have improved customer engagement in the fiscal fourth quarter.

What Our Model Says

According to the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Anaplan carries a Zacks Rank #3 and has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks That Warrant a Look

Here are three stocks you may want to consider, as our model shows that these have the right combination of elements to deliver an earnings beat this season.

ANSYS, Inc. ANSS has an Earnings ESP of +2.01% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Baidu, Inc. BIDU has an Earnings ESP of +38.81% and a Zacks Rank #3.

Square, Inc. SQ has an Earnings ESP of +3.59% and a Zacks Rank #3.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

ANSYS, Inc. (ANSS) : Free Stock Analysis Report

Square, Inc. (SQ) : Free Stock Analysis Report

Anaplan, Inc. (PLAN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance