Anatomy of Success: YY Inc. (YY)

The Zacks methodology is one that is designed to provide investors—whether they are beginners to the market or have decades of knowledge—with the best chances to find strong stocks at any given moment. To do this, we have designed the Zacks Rank, a system which harnesses the power of earnings estimate revisions to find companies on the rise.

If the Zacks Rank is saying a particular stock is a #1 (Strong Buy), we believe that company is poised to outperform the market over the next one to three months. But we realize that this is not an easy task, and that is why just 5% of the thousands of companies tracked by Zacks earn the top designation at one time.

In the story below, you will learn about one particular company that helped show the strength of the Zacks Rank. If investors had followed our ranking system when it flagged this trendy Chinese tech stock, they would have witnessed massive profits.

YY Inc. (YY)

YY is Chinese social network platform, offering users voice, text, and audio services. The company operates YY.com, YY Client, and Duowan.com. YY is best known for its virtual currency, which users earn through activities like karaoke and tutorial videos and can be converted to real cash.

YY has been flagged by the Zacks Rank a few times over the past year or so, with the stock notching two extended runs on the #1 (Strong Buy) list that coincided with massive upward share price movements.

The first of these stretches lasted from April 14 through the week of June 14, 2017. During this period, YY reported strong earnings results, posting adjusted profits of $1.40 per share—more than 50 cents above estimates—and notching EPS growth of 97%. This strong earnings report helped the stock soar about 34% during its three-month run on our top list.

The other notable #1 (Strong Buy) run for YY occurred from Aug. 25 through Oct. 6, 2017. YY moved back onto the #1 list just a few weeks after crushing EPS estimates once again and reporting earnings growth of 53%, and it stayed there for so long thanks to continued bullish analyst sentiment. During these weeks, YY gained 17%.

Investors will also note that YY is currently sporting a Zacks Rank #1 (Strong Buy)—again thanks to a strong earnings report. The Chinese tech giant actually just reported its latest results last week, and investors were certainly pleased.

In its most recent quarter, YY saw adjusted earnings of $1.72 per share, handily beating the Zacks Consensus Estimate of $1.56 and improving about 23% from the year-ago period. Revenues of $518 million also comfortably surpassed our consensus estimate of $491 million and surged about 43% year over year.

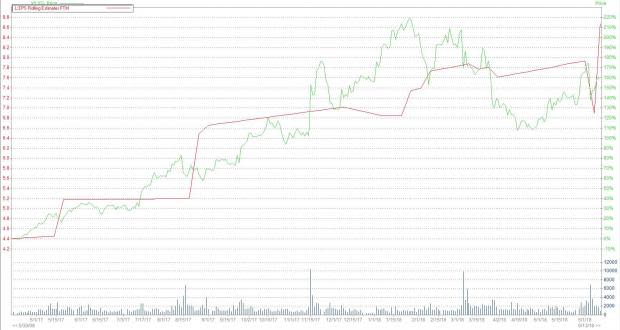

The below chart demonstrates the price performance for HSC and 12-month forward EPS estimate (in red), starting from the stock’s first long stretch as a #1 in April of last year.

As we can see, YY was a massive winner for those that followed the Zacks Rank. The stock has gained about since earning a #1 (Strong Buy) last April, including a 51% surge since being added to the #1 list again in August. This helps display the predictive power of the Zacks Rank.

Want more market analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

YY Inc. (YY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance