Ann Taylor Parent's Bankruptcy Is the Scariest Yet

(Bloomberg Opinion) -- In the latest example of how the world of brick-and-mortar retail is being overwhelmed by the pandemic, specialty apparel conglomerate Ascena Retail Group Inc. — corporate parent of Ann Taylor, Lane Bryant and other chains — filed for Chapter 11 bankruptcy protection. The company said Thursday its restructuring plan will allow it to reduce its debt by $1 billion. It also will close an unspecified number of stores across all of its major banners, including shuttering all of its Catherines plus-size apparel locations.

Ascena may not have the cultural primacy of some of the other prominent names in the industry that have recently filed for bankruptcy. It doesn’t have the long, storied heritage of Brooks Brothers, the preppy clothier that opened its first shop more than 200 years ago. It didn’t define a fashion moment like J. Crew did a decade ago when Michelle Obama was sporting its embellished cardigans. It’s not a household name like J.C. Penney.

But make no mistake: Ascena’s bankruptcy is the scariest yet for the industry in the Covid-19 era, because the company’s collapse has the potential to create more devastating ripple effects than were caused by almost any of the other retail washouts that preceded it.

Ascena had nearly 2,800 stores as of February, a staggeringly large portfolio that includes Loft and kids’ shop Justice. That makes it a highly important tenant for many mall operators. The company accounted for 4.7% of annualized base rent at Tanger Factory Outlet Centers Inc., according to that operator’s latest quarterly filing, a share that makes Ascena its second-largest tenant behind only Gap Inc. For Simon Property Group Inc., only Gap and Victoria’s Secret parent L Brands Inc. account for a greater share of annual base rent than Ascena. It is in the top 10 for Brookfield Property Partners and Acadia Realty Trust.

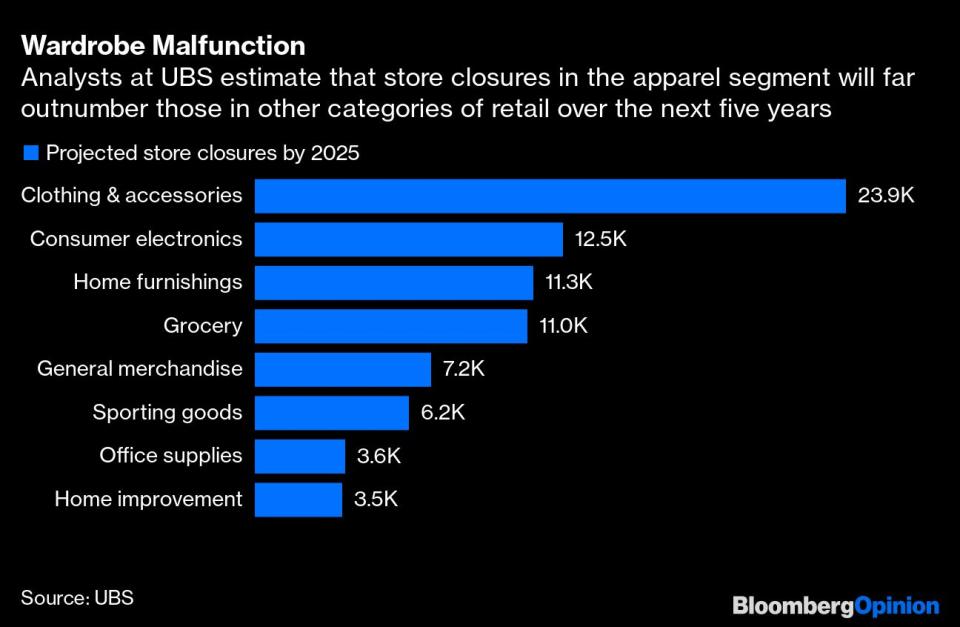

Ascena has not detailed exactly how many stores it will close. It committed to closing all of its Catherines outposts, which numbered almost 300 as of February. It said it will shutter a “significant” portion of its more than 800 Justice stores, and a “select” number of its Ann Taylor, Loft, Lane Bryant and Lou & Grey locations. Whatever the final number is, because Ascena is so omnipresent, it could leave landlords with loads of vacancies that will be difficult to fill with so few retailers in expansion mode right now. The sheer size of its store fleet means it has the potential to do more harm than could be inflicted by J. Crew, which only has about 490 stores total and hasn’t committed to a major store closure program, or Brooks Brothers, which said it is to close about one-fifth of its 250 locations. J.C. Penney is almost as ubiquitous as Ascena, with more than 840 stores at the end of its latest fiscal year. But so far, the department-store chain has only moved to close less than a third of them. And, importantly, J.C. Penney stores are essentially all located in enclosed malls, limiting the extent to which its struggles can weigh on other parts of the retail world. Ascena, however, is virtually everywhere. Ann Taylor and Justice stores are fixtures in traditional malls; Lane Bryant and Catherines chains are often in strip-shopping centers. Loft stores are found in mixed-use developments, while factory outposts of the Ann Taylor and Loft brands are mainstays in outlet malls. That means a wider variety of chains count it as a co-tenant and could feel pain from being next to an empty storefront. It is far from surprising that Ascena has ended up in bankruptcy. I wrote a column more than two years ago putting the company on retail death watch because its problems were so wide-ranging and far gone. It has been saddled with a heavy debt load ever since its 2015 deal to buy Ann Inc., the name of the company that then included Ann Taylor and Loft. It has routinely struggled to deliver comparable sales growth amid strategic misfires ranging from making clothes its customers didn’t want to promotional pricing that chipped away its profit margin. I have long wondered why its Lane Bryant and Catherines chains haven’t scored more customers, considering that the plus-size apparel market is woefully underserved. Covid lockdowns haven’t helped, it’s true — masses of professional women working from home in their casual clothes during the pandemic has certainly made for a tough turn for Ann Taylor. But the chain was hurting long before this crisis, part of a bewildering collective failure of the retail industry to make attire women want to wear at the office. The Ascena bankruptcy isn’t even the first one this month that resulted, in part, from that ineptitude: RTW Retailwinds Inc., the corporate parent of the New York & Co. chain, also filed for bankruptcy protection in July and said it plans to close “a significant portion, if not all” of its stores. There will be plenty more retail bankruptcies and store closures in the coming months that will be at least partly attributable to the pandemic’s impact on shopping. Clothing chains, I expect, will comprise an outsize portion of them.

Customers may have returned to stores at a faster clip than some retailers anticipated, but traffic generally remains at levels the industry was not built to sustain.

Meanwhile, the U.S. is seeing an uptick in Covid-19 cases, which could dissuade some shoppers from stepping foot into a store again anytime soon. The June unemployment rate was 11.1%, and at least for now, no additional stimulus checks are headed to consumers’ bank accounts. That leaves clothing retailers in an especially difficult position – and it almost certainly means more of them will be joining Ascena in bankruptcy.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Sarah Halzack is a Bloomberg Opinion columnist covering the consumer and retail industries. She was previously a national retail reporter for the Washington Post.

For more articles like this, please visit us at bloomberg.com/opinion

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

Yahoo Finance

Yahoo Finance