Annaly's (NLY) Q4 Earnings Beat Estimates on Improving NII

Annaly Capital Management, Inc. NLY reported fourth-quarter 2019 core earnings, excluding premium amortization adjustment (PAA), of 26 cents per share, beating the Zacks Consensus Estimate of 24 cents and the prior quarter’s 21 cents. However, the figure compares unfavorably with the year-ago tally of 29 cents.

Net interest income (NII) came in at $454.2 million, marking a surge from the prior quarter’s $152.4 million as well as the year-ago period’s $272.9 million.

Notably, the company’s capital allocation to credit increased to 26% from 23%, driven by $1.8 billion in new credit assets.

For full-year 2019, core earnings, excluding PAA, per share came in at $1.00 compared with the $1.20 reported in the prior year.

Moreover, following the end of the quarter, definitive agreements were signed, per which Annaly will acquire its external manager, Annaly Management Company LLC, and change to being an internally-managed REIT.

Quarter in Detail

During the fourth quarter, Annaly Residential Credit Group accomplished a $465.5-million residential whole loan securitization as well as purchased $957 million of residential whole loans. Further, $596 million in new investments were closed by Annaly Commercial Real Estate Group, leading the tally of total assets to $2.3 billion, denoting a rise of 31% from the prior quarter. Moreover, Annaly Middle Market Lending Group closed $238.7 million of loans in the quarter.

In the reported quarter, average yield on interest-earning assets (excluding PAA) was 3.25%, slightly down from the prior quarter’s 3.26%.

However, net interest spread (excluding PAA) of 1.24% for the fourth quarter increased from the 0.98% reported in the prior quarter. Net interest margin (excluding PAA) in the quarter came in at 1.41% compared with the 1.10% witnessed in third-quarter 2019.

Also, Annaly’s book value per share came in at $9.66 as of Dec 31, 2019, up from $9.21 as of the prior-quarter end. Additionally, book value per share compared favorably with $9.39 as of Dec 31, 2018. At the end of the December-end quarter, the company’s capital ratio was 12%, up from the 11.2% reported at the end of third-quarter 2019.

Leverage was 7.1:1 as of Dec 31, 2019, compared with 7.3:1 as of Sep 30, 2019. The company offered an annualized core return on an average equity (excluding PAA) of 10.56% in the October-December period, up from the prior quarter’s 8.85%.

Annaly Capital currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

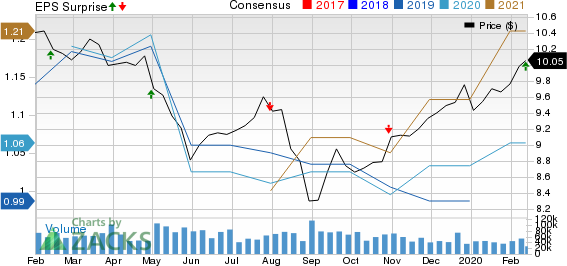

Annaly Capital Management Inc Price, Consensus and EPS Surprise

Annaly Capital Management Inc price-consensus-eps-surprise-chart | Annaly Capital Management Inc Quote

We, now, look forward to the earnings releases of Starwood Property Trust, Inc. STWD, New York Mortgage Trust, Inc. NYMT and MFA Financial, Inc. MFA later this month.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MFA Financial, Inc. (MFA) : Free Stock Analysis Report

New York Mortgage Trust, Inc. (NYMT) : Free Stock Analysis Report

STARWOOD PROPERTY TRUST, INC. (STWD) : Free Stock Analysis Report

Annaly Capital Management Inc (NLY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance