Announcing: Hexatronic Group (STO:HTRO) Stock Increased An Energizing 294% In The Last Five Years

It hasn't been the best quarter for Hexatronic Group AB (publ) (STO:HTRO) shareholders, since the share price has fallen 11% in that time. But that scarcely detracts from the really solid long term returns generated by the company over five years. We think most investors would be happy with the 294% return, over that period. We think it's more important to dwell on the long term returns than the short term returns. The more important question is whether the stock is too cheap or too expensive today.

Check out our latest analysis for Hexatronic Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Hexatronic Group's earnings per share are down 4.1% per year, despite strong share price performance over five years.

So it's hard to argue that the earnings per share are the best metric to judge the company, as it may not be optimized for profits at this point. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

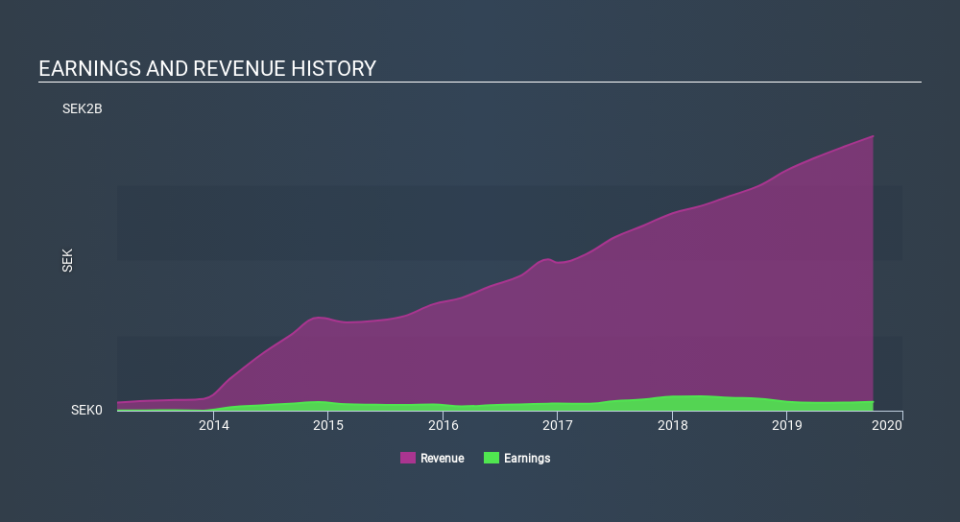

The modest 0.7% dividend yield is unlikely to be propping up the share price. On the other hand, Hexatronic Group's revenue is growing nicely, at a compound rate of 25% over the last five years. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Hexatronic Group the TSR over the last 5 years was 322%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Hexatronic Group shareholders gained a total return of 5.6% during the year. But that return falls short of the market. On the bright side, the longer term returns (running at about 33% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. It's always interesting to track share price performance over the longer term. But to understand Hexatronic Group better, we need to consider many other factors. For example, we've discovered 3 warning signs for Hexatronic Group that you should be aware of before investing here.

Hexatronic Group is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance