Announcing: Paylocity Holding (NASDAQ:PCTY) Stock Soared An Exciting 464% In The Last Five Years

We think all investors should try to buy and hold high quality multi-year winners. And we've seen some truly amazing gains over the years. Don't believe it? Then look at the Paylocity Holding Corporation (NASDAQ:PCTY) share price. It's 464% higher than it was five years ago. If that doesn't get you thinking about long term investing, we don't know what will. Also pleasing for shareholders was the 31% gain in the last three months.

View our latest analysis for Paylocity Holding

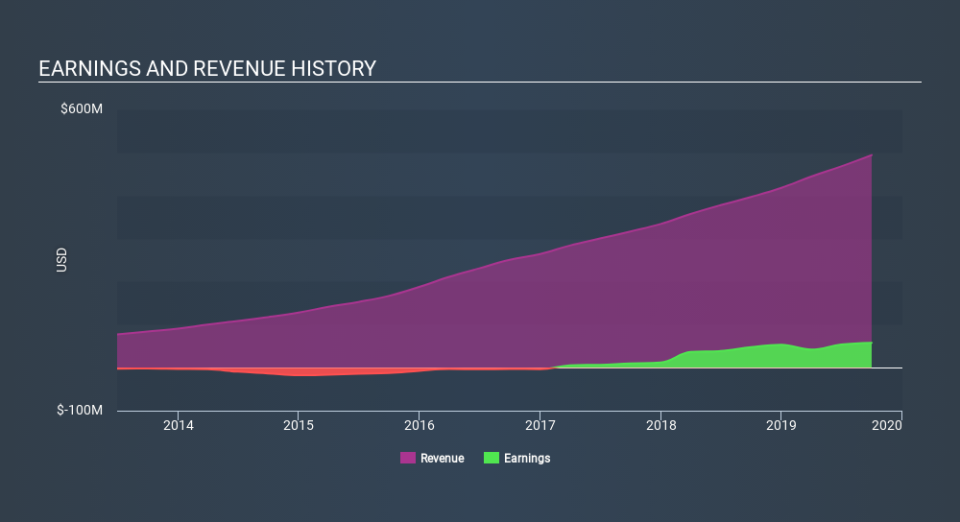

We don't think that Paylocity Holding's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last 5 years Paylocity Holding saw its revenue grow at 26% per year. That's well above most pre-profit companies. Arguably, this is well and truly reflected in the strong share price gain of 41%(per year) over the same period. It's never too late to start following a top notch stock like Paylocity Holding, since some long term winners go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Paylocity Holding is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

It's good to see that Paylocity Holding has rewarded shareholders with a total shareholder return of 109% in the last twelve months. That gain is better than the annual TSR over five years, which is 41%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Before spending more time on Paylocity Holding it might be wise to click here to see if insiders have been buying or selling shares.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance