Ansys Announces Q1 Financial Results

/ Q1 2024 Results

Revenue of $466.6 million

GAAP diluted earnings per share of $0.40 and non-GAAP diluted earnings per share of $1.39

GAAP operating profit margin of 9.3% and non-GAAP operating profit margin of 32.2%

Operating cash flows of $282.8 million and unlevered operating cash flows of $292.7 million

Annual Contract Value (ACV) of $407.4 million

Deferred revenue and backlog of $1,369.5 million on March 31, 2024

|

|

|

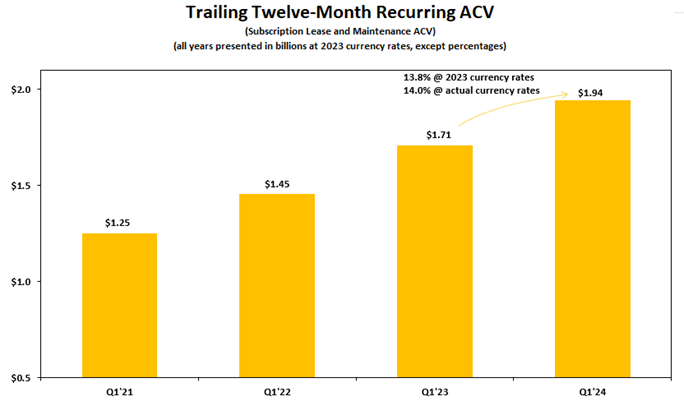

PITTSBURGH, May 01, 2024 (GLOBE NEWSWIRE) -- ANSYS, Inc. (NASDAQ: ANSS), today reported first quarter 2024 revenue of $466.6 million, a decrease of 8% in reported and constant currency, when compared to the first quarter of 2023. For the first quarter of 2024, the Company reported diluted earnings per share of $0.40 and $1.39 on a GAAP and non-GAAP basis, respectively, compared to $1.15 and $1.85 on a GAAP and non-GAAP basis, respectively, for the first quarter of 2023. Additionally, the Company reported first quarter ACV growth of 2% in reported currency or 3% in constant currency, when compared to the first quarter of 2023.

For 2024, quarterly ACV and revenue growth rates will be variable across the quarters and are affected by the performance comparisons to 2023. As discussed in the Q4 2023 press release, we expected that Q1 2024 ACV and revenue results would be the lowest amongst the 2024 quarters. Our actual results for the first quarter met our expectations. We continue to expect double-digit ACV and revenue growth in the remaining quarters of the year, and expect FY 2024 ACV to grow double-digit.

On January 15, 2024, the Company entered into a definitive agreement with Synopsys, Inc. (Synopsys) under which Synopsys will acquire Ansys. The transaction is anticipated to close in the first half of 2025, subject to approval by Ansys shareholders, the receipt of required regulatory approvals and other customary closing conditions. As previously announced, in light of the pending transaction with Synopsys, Ansys has suspended quarterly earnings conference calls and no longer provides quarterly or annual guidance.

|

|

|

The non-GAAP financial results highlighted represent non-GAAP financial measures. Reconciliations of these measures to the comparable GAAP measures for the three months ended March 31, 2024 and 2023 can be found later in this release.

|

|

|

/ Summary of Financial Results

Ansys’ first quarter 2024 and 2023 financial results are presented below. The 2024 and 2023 non-GAAP results exclude the income statement effects of stock-based compensation, excess payroll taxes related to stock-based compensation, amortization of acquired intangible assets, expenses related to business combinations and adjustments for the income tax effect of the excluded items.

Our results are as follows:

| GAAP | ||||||||

(in thousands, except per share data and percentages) | Q1 2024 |

| Q1 2023 |

| % Change | ||||

Revenue | $ | 466,605 |

|

| $ | 509,447 |

|

| (8.4)% |

Net income | $ | 34,778 |

|

| $ | 100,622 |

|

| (65.4)% |

Diluted earnings per share | $ | 0.40 |

|

| $ | 1.15 |

|

| (65.2)% |

Gross margin |

| 85.3 | % |

|

| 86.7 | % |

|

|

Operating profit margin |

| 9.3 | % |

|

| 25.1 | % |

|

|

Effective tax rate |

| 15.1 | % |

|

| 16.7 | % |

|

|

| Non-GAAP | ||||||||

(in thousands, except per share data and percentages) | Q1 2024 |

| Q1 2023 |

| % Change | ||||

Net income | $ | 121,996 |

|

| $ | 161,763 |

|

| (24.6)% |

Diluted earnings per share | $ | 1.39 |

|

| $ | 1.85 |

|

| (24.9)% |

Gross margin |

| 90.9 | % |

|

| 91.2 | % |

|

|

Operating profit margin |

| 32.2 | % |

|

| 39.8 | % |

|

|

Effective tax rate |

| 17.5 | % |

|

| 17.5 | % |

|

|

| Other Metrics | |||||||

(in thousands, except percentages) | Q1 2024 |

| Q1 2023 |

| % Change | |||

ACV | $ | 407,405 |

| $ | 399,407 |

| 2.0 | % |

Operating cash flows | $ | 282,817 |

| $ | 260,766 |

| 8.5 | % |

Unlevered operating cash flows | $ | 292,667 |

| $ | 269,516 |

| 8.6 | % |

Supplemental Financial Information |

/ Annual Contract Value

(in thousands, except percentages) | Q1 2024 |

| Q1 2024 in Constant Currency |

| Q1 2023 |

| % Change |

| % Change in Constant Currency | |||||

ACV | $ | 407,405 |

| $ | 410,433 |

| $ | 399,407 |

| 2.0 | % |

| 2.8 | % |

Recurring ACV includes both subscription lease ACV and all maintenance ACV (including maintenance from perpetual licenses). It excludes perpetual license ACV and service ACV.

/ Revenue

(in thousands, except percentages) | Q1 2024 |

| Q1 2024 in Constant Currency |

| Q1 2023 |

| % Change |

| % Change in Constant Currency | |||

Revenue | $ | 466,605 |

| $ | 470,508 |

| $ | 509,447 |

| (8.4)% |

| (7.6)% |

REVENUE BY LICENSE TYPE |

(in thousands, except percentages) | Q1 2024 |

| % of Total |

| Q1 2023 |

| % of Total |

| % Change |

| % Change in Constant Currency | ||||||

Subscription Lease | $ | 94,800 |

| 20.3 | % |

| $ | 147,922 |

| 29.0 | % |

| (35.9)% |

| (35.5)% | ||

Perpetual |

| 65,521 |

| 14.0 | % |

|

| 71,230 |

| 14.0 | % |

| (8.0)% |

| (7.7)% | ||

Maintenance1 |

| 289,340 |

| 62.0 | % |

|

| 268,593 |

| 52.7 | % |

| 7.7 | % |

| 8.8 | % |

Service |

| 16,944 |

| 3.6 | % |

|

| 21,702 |

| 4.3 | % |

| (21.9)% |

| (21.3)% | ||

Total | $ | 466,605 |

|

|

| $ | 509,447 |

|

|

| (8.4)% |

| (7.6)% | ||||

1Maintenance revenue is inclusive of both maintenance associated with perpetual licenses and the maintenance component of subscription leases.

REVENUE BY GEOGRAPHY |

(in thousands, except percentages) | Q1 2024 |

| % of Total |

| Q1 2023 |

| % of Total |

| % Change |

| % Change in Constant Currency | ||||||

Americas | $ | 208,697 |

| 44.7 | % |

| $ | 256,915 |

| 50.4 | % |

| (18.8)% |

| (18.8)% | ||

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Germany |

| 36,198 |

| 7.8 | % |

|

| 38,674 |

| 7.6 | % |

| (6.4)% |

| (7.6)% | ||

Other EMEA |

| 82,417 |

| 17.7 | % |

|

| 82,404 |

| 16.2 | % |

| — | % |

| (1.5)% | |

EMEA |

| 118,615 |

| 25.4 | % |

|

| 121,078 |

| 23.8 | % |

| (2.0)% |

| (3.4)% | ||

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Japan |

| 36,532 |

| 7.8 | % |

|

| 38,086 |

| 7.5 | % |

| (4.1)% |

| 7.1 | % | |

Other Asia-Pacific |

| 102,761 |

| 22.0 | % |

|

| 93,368 |

| 18.3 | % |

| 10.1 | % |

| 11.5 | % |

Asia-Pacific |

| 139,293 |

| 29.9 | % |

|

| 131,454 |

| 25.8 | % |

| 6.0 | % |

| 10.2 | % |

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Total | $ | 466,605 |

|

|

| $ | 509,447 |

|

|

| (8.4)% |

| (7.6)% | ||||

REVENUE BY CHANNEL |

| Q1 2024 |

| Q1 2023 | ||

Direct revenue, as a percentage of total revenue | 66.5 | % |

| 76.3 | % |

Indirect revenue, as a percentage of total revenue | 33.5 | % |

| 23.7 | % |

/ Deferred Revenue and Backlog

(in thousands) | March 31, 2024 |

| December 31, 2023 |

| March 31, 2023 | |||

Current Deferred Revenue | $ | 433,167 |

| $ | 457,514 |

| $ | 396,331 |

Current Backlog |

| 433,106 |

|

| 439,879 |

|

| 428,913 |

Total Current Deferred Revenue and Backlog |

| 866,273 |

|

| 897,393 |

|

| 825,244 |

|

|

|

|

|

| |||

Long-Term Deferred Revenue |

| 21,434 |

|

| 22,240 |

|

| 20,738 |

Long-Term Backlog |

| 481,746 |

|

| 552,951 |

|

| 511,502 |

Total Long-Term Deferred Revenue and Backlog |

| 503,180 |

|

| 575,191 |

|

| 532,240 |

|

|

|

|

|

| |||

Total Deferred Revenue and Backlog | $ | 1,369,453 |

| $ | 1,472,584 |

| $ | 1,357,484 |

/ Currency

The first quarter of 2024 revenue, operating income, ACV and deferred revenue and backlog, as compared to the first quarter of 2023, were impacted by fluctuations in the exchange rates of foreign currencies against the U.S. Dollar. The currency fluctuation impacts on revenue, GAAP and non-GAAP operating income, ACV, and deferred revenue and backlog based on 2023 exchange rates are reflected in the tables below. Amounts in brackets indicate an adverse impact from currency fluctuations.

(in thousands) | Q1 2024 | ||

Revenue | $ | (3,903 | ) |

GAAP operating income | $ | (3,398 | ) |

Non-GAAP operating income | $ | (3,178 | ) |

ACV | $ | (3,028 | ) |

Deferred revenue and backlog | $ | (19,615 | ) |

The most meaningful currency impacts are typically attributable to U.S. Dollar exchange rate changes against the Euro and Japanese Yen. Historical exchange rates are reflected in the charts below.

| Period-End Exchange Rates | ||

As of | EUR/USD |

| USD/JPY |

March 31, 2024 | 1.08 |

| 151 |

December 31, 2023 | 1.10 |

| 141 |

March 31, 2023 | 1.08 |

| 133 |

| Average Exchange Rates | ||

Three Months Ended | EUR/USD |

| USD/JPY |

March 31, 2024 | 1.09 |

| 148 |

March 31, 2023 | 1.07 |

| 132 |

/ GAAP Financial Statements

ANSYS, INC. AND SUBSIDIARIES |

Condensed Consolidated Balance Sheets |

(Unaudited) |

(in thousands) | March 31, 2024 |

| December 31, 2023 | ||

ASSETS: |

|

|

| ||

Cash & short-term investments | $ | 1,070,609 |

| $ | 860,390 |

Accounts receivable, net |

| 650,044 |

|

| 864,526 |

Goodwill |

| 3,797,859 |

|

| 3,805,874 |

Other intangibles, net |

| 806,375 |

|

| 835,417 |

Other assets |

| 825,527 |

|

| 956,668 |

Total assets | $ | 7,150,414 |

| $ | 7,322,875 |

LIABILITIES & STOCKHOLDERS’ EQUITY: |

|

|

| ||

Current deferred revenue | $ | 433,167 |

| $ | 457,514 |

Long-term debt |

| 753,970 |

|

| 753,891 |

Other liabilities |

| 553,634 |

|

| 721,106 |

Stockholders’ equity |

| 5,409,643 |

|

| 5,390,364 |

Total liabilities & stockholders’ equity | $ | 7,150,414 |

| $ | 7,322,875 |

ANSYS, INC. AND SUBSIDIARIES |

Condensed Consolidated Statements of Income |

(Unaudited) |

|

| Three Months Ended | ||||||

(in thousands, except per share data) |

| March 31, |

| March 31, | ||||

Revenue: |

|

|

|

| ||||

Software licenses |

| $ | 160,321 |

|

| $ | 219,152 |

|

Maintenance and service |

|

| 306,284 |

|

|

| 290,295 |

|

Total revenue |

|

| 466,605 |

|

|

| 509,447 |

|

Cost of sales: |

|

|

|

| ||||

Software licenses |

|

| 10,044 |

|

|

| 11,744 |

|

Amortization |

|

| 22,484 |

|

|

| 19,618 |

|

Maintenance and service |

|

| 36,139 |

|

|

| 36,290 |

|

Total cost of sales |

|

| 68,667 |

|

|

| 67,652 |

|

Gross profit |

|

| 397,938 |

|

|

| 441,795 |

|

Operating expenses: |

|

|

|

| ||||

Selling, general and administrative |

|

| 219,643 |

|

|

| 188,584 |

|

Research and development |

|

| 128,811 |

|

|

| 120,335 |

|

Amortization |

|

| 6,145 |

|

|

| 5,181 |

|

Total operating expenses |

|

| 354,599 |

|

|

| 314,100 |

|

Operating income |

|

| 43,339 |

|

|

| 127,695 |

|

Interest income |

|

| 10,995 |

|

|

| 4,078 |

|

Interest expense |

|

| (12,369 | ) |

|

| (10,758 | ) |

Other expense, net |

|

| (1,007 | ) |

|

| (177 | ) |

Income before income tax provision |

|

| 40,958 |

|

|

| 120,838 |

|

Income tax provision |

|

| 6,180 |

|

|

| 20,216 |

|

Net income |

| $ | 34,778 |

|

| $ | 100,622 |

|

Earnings per share – basic: |

|

|

|

| ||||

Earnings per share |

| $ | 0.40 |

|

| $ | 1.16 |

|

Weighted average shares |

|

| 87,067 |

|

|

| 86,930 |

|

Earnings per share – diluted: |

|

|

|

| ||||

Earnings per share |

| $ | 0.40 |

|

| $ | 1.15 |

|

Weighted average shares |

|

| 87,780 |

|

|

| 87,431 |

|

/ Glossary of Terms

Annual Contract Value (ACV): ACV is a key performance metric and is useful to investors in assessing the strength and trajectory of our business. ACV is a supplemental metric to help evaluate the annual performance of the business. Over the life of the contract, ACV equals the total value realized from a customer. ACV is not impacted by the timing of license revenue recognition. ACV is used by management in financial and operational decision-making and in setting sales targets used for compensation. ACV is not a replacement for, and should be viewed independently of, GAAP revenue and deferred revenue as ACV is a performance metric and is not intended to be combined with any of these items. There is no GAAP measure comparable to ACV. ACV is composed of the following:

the annualized value of maintenance and subscription lease contracts with start dates or anniversary dates during the period, plus

the value of perpetual license contracts with start dates during the period, plus

the annualized value of fixed-term services contracts with start dates or anniversary dates during the period, plus

the value of work performed during the period on fixed-deliverable services contracts.

When we refer to the anniversary dates in the definition of ACV above, we are referencing the date of the beginning of the next twelve-month period in a contractually committed multi-year contract. If a contract is three years in duration, with a start date of July 1, 2024, the anniversary dates would be July 1, 2025 and July 1, 2026. We label these anniversary dates as they are contractually committed. While this contract would be up for renewal on July 1, 2027, our ACV performance metric does not assume any contract renewals.

Example 1: For purposes of calculating ACV, a $100,000 subscription lease contract or a $100,000 maintenance contract with a term of July 1, 2024 – June 30, 2025, would each contribute $100,000 to ACV for fiscal year 2024 with no contribution to ACV for fiscal year 2025.

Example 2: For purposes of calculating ACV, a $300,000 subscription lease contract or a $300,000 maintenance contract with a term of July 1, 2024 – June 30, 2027, would each contribute $100,000 to ACV in each of fiscal years 2024, 2025 and 2026. There would be no contribution to ACV for fiscal year 2027 as each period captures the full annual value upon the anniversary date.

Example 3: A perpetual license valued at $200,000 with a contract start date of March 1, 2024 would contribute $200,000 to ACV in fiscal year 2024.

Backlog: Deferred revenue associated with installment billings for periods beyond the current quarterly billing cycle and committed contracts with start dates beyond the end of the current period.

Deferred Revenue: Billings made or payments received in advance of revenue recognition.

Subscription Lease or Time-Based License: A license of a stated product of our software that is granted to a customer for use over a specified time period, which can be months or years in length. In addition to the use of the software, the customer is provided with access to maintenance (unspecified version upgrades and technical support) without additional charge. The revenue related to these contracts is recognized ratably over the contract period for the maintenance portion and up front for the license portion.

Perpetual / Paid-Up License: A license of a stated product and version of our software that is granted to a customer for use in perpetuity. The revenue related to this type of license is recognized up front.

Maintenance: A contract, typically one year in duration, that is purchased by the owner of a perpetual license and that provides access to unspecified version upgrades and technical support during the duration of the contract. The revenue from these contracts is recognized ratably over the contract period.

/ Reconciliations of GAAP to Non-GAAP Measures (Unaudited)

| Three Months Ended | ||||||||||||||||||

| March 31, 2024 | ||||||||||||||||||

(in thousands, except percentages and per share data) | Gross Profit |

| % of Revenue |

| Operating Income |

| % of Revenue |

| Net Income |

| EPS - Diluted1 | ||||||||

Total GAAP | $ | 397,938 |

| 85.3 | % |

| $ | 43,339 |

| 9.3 | % |

| $ | 34,778 |

|

| $ | 0.40 |

|

Stock-based compensation expense |

| 3,343 |

| 0.7 | % |

|

| 58,664 |

| 12.7 | % |

|

| 58,664 |

|

|

| 0.66 |

|

Excess payroll taxes related to stock-based awards |

| 378 |

| 0.1 | % |

|

| 5,362 |

| 1.1 | % |

|

| 5,362 |

|

|

| 0.06 |

|

Amortization of intangible assets from acquisitions |

| 22,484 |

| 4.8 | % |

|

| 28,629 |

| 6.1 | % |

|

| 28,629 |

|

|

| 0.33 |

|

Expenses related to business combinations |

| — |

| — | % |

|

| 14,261 |

| 3.0 | % |

|

| 14,261 |

|

|

| 0.16 |

|

Adjustment for income tax effect |

| — |

| — | % |

|

| — |

| — | % |

|

| (19,698 | ) |

|

| (0.22 | ) |

Total non-GAAP | $ | 424,143 |

| 90.9 | % |

| $ | 150,255 |

| 32.2 | % |

| $ | 121,996 |

|

| $ | 1.39 |

|

1 Diluted weighted average shares were 87,780.

| Three Months Ended | ||||||||||||||||||

| March 31, 2023 | ||||||||||||||||||

(in thousands, except percentages and per share data) | Gross Profit |

| % of Revenue |

| Operating Income |

| % of Revenue |

| Net Income |

| EPS - Diluted1 | ||||||||

Total GAAP | $ | 441,795 |

| 86.7 | % |

| $ | 127,695 |

| 25.1 | % |

| $ | 100,622 |

|

| $ | 1.15 |

|

Stock-based compensation expense |

| 2,878 |

| 0.6 | % |

|

| 44,171 |

| 8.7 | % |

|

| 44,171 |

|

|

| 0.50 |

|

Excess payroll taxes related to stock-based awards |

| 284 |

| 0.1 | % |

|

| 4,076 |

| 0.8 | % |

|

| 4,076 |

|

|

| 0.05 |

|

Amortization of intangible assets from acquisitions |

| 19,618 |

| 3.8 | % |

|

| 24,799 |

| 4.8 | % |

|

| 24,799 |

|

|

| 0.28 |

|

Expenses related to business combinations |

| — |

| — | % |

|

| 2,192 |

| 0.4 | % |

|

| 2,192 |

|

|

| 0.03 |

|

Adjustment for income tax effect |

| — |

| — | % |

|

| — |

| — | % |

|

| (14,097 | ) |

|

| (0.16 | ) |

Total non-GAAP | $ | 464,575 |

| 91.2 | % |

| $ | 202,933 |

| 39.8 | % |

| $ | 161,763 |

|

| $ | 1.85 |

|

1 Diluted weighted average shares were 87,431.

| Three Months Ended | ||||||

(in thousands) | March 31, |

| March 31, | ||||

Net cash provided by operating activities | $ | 282,817 |

|

| $ | 260,766 |

|

Cash paid for interest |

| 11,939 |

|

|

| 10,606 |

|

Tax benefit |

| (2,089 | ) |

|

| (1,856 | ) |

Unlevered operating cash flows | $ | 292,667 |

|

| $ | 269,516 |

|

/ Use of Non-GAAP Measures

We provide non-GAAP gross profit, non-GAAP gross profit margin, non-GAAP operating income, non-GAAP operating profit margin, non-GAAP net income, non-GAAP diluted earnings per share and unlevered operating cash flows as supplemental measures to GAAP regarding our operational performance. These financial measures exclude the impact of certain items and, therefore, have not been calculated in accordance with GAAP. A detailed explanation of each of the adjustments to these financial measures is described below. This press release also contains a reconciliation of each of these non-GAAP financial measures to its most comparable GAAP financial measure, as applicable.

We use non-GAAP financial measures (a) to evaluate our historical and prospective financial performance as well as our performance relative to our competitors, (b) to set internal sales targets and spending budgets, (c) to allocate resources, (d) to measure operational profitability and the accuracy of forecasting, (e) to assess financial discipline over operational expenditures and (f) as an important factor in determining variable compensation for management and employees. In addition, many financial analysts that follow us focus on and publish both historical results and future projections based on non-GAAP financial measures. We believe that it is in the best interest of our investors to provide this information to analysts so that they accurately report the non-GAAP financial information. Moreover, investors have historically requested, and we have historically reported, these non-GAAP financial measures as a means of providing consistent and comparable information with past reports of financial results.

While we believe that these non-GAAP financial measures provide useful supplemental information to investors, there are limitations associated with the use of these non-GAAP financial measures. These non-GAAP financial measures are not prepared in accordance with GAAP, are not reported by all our competitors and may not be directly comparable to similarly titled measures of our competitors due to potential differences in the exact method of calculation. We compensate for these limitations by using these non-GAAP financial measures as supplements to GAAP financial measures and by reviewing the reconciliations of the non-GAAP financial measures to their most comparable GAAP financial measures.

The adjustments to these non-GAAP financial measures, and the basis for such adjustments, are outlined below:

Amortization of intangible assets from acquisitions. We incur amortization of intangible assets, included in our GAAP presentation of amortization expense, related to various acquisitions we have made. We exclude these expenses for the purpose of calculating non-GAAP gross profit, non-GAAP gross profit margin, non-GAAP operating income, non-GAAP operating profit margin, non-GAAP net income and non-GAAP diluted earnings per share when we evaluate our continuing operational performance because these costs are fixed at the time of an acquisition, are then amortized over a period of several years after the acquisition and generally cannot be changed or influenced by us after the acquisition. Accordingly, we do not consider these expenses for purposes of evaluating our performance during the applicable time period after the acquisition, and we exclude such expenses when making decisions to allocate resources. We believe that these non-GAAP financial measures are useful to investors because they allow investors to (a) evaluate the effectiveness of the methodology and information used by us in our financial and operational decision-making, and (b) compare our past reports of financial results as we have historically reported these non-GAAP financial measures.

Stock-based compensation expense. We incur expense related to stock-based compensation included in our GAAP presentation of cost of maintenance and service; research and development expense; and selling, general and administrative expense. This non-GAAP adjustment also includes excess payroll tax expense related to stock-based compensation. Although stock-based compensation is an expense and viewed as a form of compensation, we exclude these expenses for the purpose of calculating non-GAAP gross profit, non-GAAP gross profit margin, non-GAAP operating income, non-GAAP operating profit margin, non-GAAP net income and non-GAAP diluted earnings per share when we evaluate our continuing operational performance. Specifically, we exclude stock-based compensation during our annual budgeting process and our quarterly and annual assessments of our performance. The annual budgeting process is the primary mechanism whereby we allocate resources to various initiatives and operational requirements. Additionally, the annual review by our Board of Directors during which it compares our historical business model and profitability to the planned business model and profitability for the forthcoming year excludes the impact of stock-based compensation. In evaluating the performance of our senior management and department managers, charges related to stock-based compensation are excluded from expenditure and profitability results. In fact, we record stock-based compensation expense into a stand-alone cost center for which no single operational manager is responsible or accountable. In this way, we can review, on a period-to-period basis, each manager’s performance and assess financial discipline over operational expenditures without the effect of stock-based compensation. We believe that these non-GAAP financial measures are useful to investors because they allow investors to (a) evaluate our operating results and the effectiveness of the methodology used by us to review our operating results, and (b) review historical comparability in our financial reporting as well as comparability with competitors’ operating results.

Expenses related to business combinations. We incur expenses for professional services rendered in connection with business combinations, which are included in our GAAP presentation of selling, general and administrative expense. We also incur other expenses directly related to business combinations, including compensation expenses and concurrent restructuring activities, such as employee severances and other exit costs. These costs are included in our GAAP presentation of selling, general and administrative and research and development expenses. We exclude these acquisition-related expenses for the purpose of calculating non-GAAP operating income, non-GAAP operating profit margin, non-GAAP net income and non-GAAP diluted earnings per share when we evaluate our continuing operational performance, as we generally would not have otherwise incurred these expenses in the periods presented as a part of our operations. We believe that these non-GAAP financial measures are useful to investors because they allow investors to (a) evaluate our operating results and the effectiveness of the methodology used by us to review our operating results, and (b) review historical comparability in our financial reporting as well as comparability with competitors’ operating results.

Non-GAAP tax provision. We utilize a normalized non-GAAP annual effective tax rate (AETR) to calculate non-GAAP measures. This methodology provides better consistency across interim reporting periods by eliminating the effects of non-recurring items and aligning the non-GAAP tax rate with our expected geographic earnings mix. To project this rate, we analyzed our historic and projected non-GAAP earnings mix by geography along with other factors such as our current tax structure, recurring tax credits and incentives, and expected tax positions. On an annual basis we re-evaluate and update this rate for significant items that may materially affect our projections.

Unlevered operating cash flows. We make cash payments for the interest incurred in connection with our debt financing which are included in our GAAP presentation of operating cash flows. We exclude this cash paid for interest, net of the associated tax benefit, for the purpose of calculating unlevered operating cash flows. Unlevered operating cash flow is a supplemental non-GAAP measure that we use to evaluate our core operating business. We believe this measure is useful to investors and management because it provides a measure of our cash generated through operating activities independent of the capital structure of the business.

Non-GAAP financial measures are not in accordance with, or an alternative for, GAAP. Our non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures and should be read only in conjunction with our consolidated financial statements prepared in accordance with GAAP.

We have provided a reconciliation of the non-GAAP financial measures to the most directly comparable GAAP financial measures as listed below:

GAAP Reporting Measure | Non-GAAP Reporting Measure |

Gross Profit | Non-GAAP Gross Profit |

Gross Profit Margin | Non-GAAP Gross Profit Margin |

Operating Income | Non-GAAP Operating Income |

Operating Profit Margin | Non-GAAP Operating Profit Margin |

Net Income | Non-GAAP Net Income |

Diluted Earnings Per Share | Non-GAAP Diluted Earnings Per Share |

Operating Cash Flows | Unlevered Operating Cash Flows |

Constant currency. In addition to the non-GAAP financial measures detailed above, we use constant currency results for financial and operational decision-making and as a means to evaluate period-to-period comparisons by excluding the effects of foreign currency fluctuations on the reported results. To present this information, the 2024 results for entities whose functional currency is a currency other than the U.S. Dollar were converted to U.S. Dollars at rates that were in effect for the 2023 comparable period, rather than the actual exchange rates in effect for 2024. Constant currency growth rates are calculated by adjusting the 2024 reported amounts by the 2024 currency fluctuation impacts and comparing the adjusted amounts to the 2023 comparable period reported amounts. We believe that these non-GAAP financial measures are useful to investors because they allow investors to (a) evaluate the effectiveness of the methodology and information used by us in our financial and operational decision-making, and (b) compare our reported results to our past reports of financial results without the effects of foreign currency fluctuations.

/ About Ansys

Our Mission: Powering Innovation that Drives Human Advancement™

When visionary companies need to know how their world-changing ideas will perform, they close the gap between design and reality with Ansys simulation. For more than 50 years, Ansys software has enabled innovators across industries to push boundaries by using the predictive power of simulation. From sustainable transportation to advanced semiconductors, from satellite systems to life-saving medical devices, the next great leaps in human advancement will be powered by Ansys.

/ Forward-Looking Information

This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 (the Exchange Act). Forward-looking statements are statements that provide current expectations or forecasts of future events based on certain assumptions. Forward-looking statements are subject to risks, uncertainties, and factors relating to our business which could cause our actual results to differ materially from the expectations expressed in or implied by such forward-looking statements.

Forward-looking statements use words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “intend,” “likely,” “may,” “outlook,” “plan,” “predict,” “project,” “should,” “target,” or other words of similar meaning. Forward-looking statements include those about market opportunity, including our total addressable market, the proposed transaction with Synopsys, Inc., including the expected date of closing and the potential benefits thereof, and other aspects of future operation. We caution readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date they are made. We undertake no obligation to update forward-looking statements, whether as a result of new information, future events or otherwise.

The risks associated with the following, among others, could cause actual results to differ materially from those described in any forward-looking statements:

our ability to complete the proposed transaction with Synopsys on anticipated terms and timing, including obtaining stockholder and regulatory approvals, and other conditions related to the completion of the transaction;

the realization of the anticipated benefits of the proposed transaction with Synopsys, including potential disruptions to our and Synopsys’ businesses and commercial relationships with others resulting from the announcement or completion of the proposed transaction and uncertainty as to the long-term value of Synopsys’ common stock;

restrictions during the pendency of the proposed transaction with Synopsys that could impact our ability to pursue certain business opportunities or strategic transactions, including tuck-in M&A;

adverse conditions in the macroeconomic environment, including inflation, recessionary conditions and volatility in equity and foreign exchange markets; political, economic and regulatory uncertainties in the countries and regions in which we operate;

impacts from tariffs, trade sanctions, export controls or other trade barriers, including export control restrictions and licensing requirements for exports to China;

impacts resulting from the conflict between Israel and Hamas, including impacts from changes to diplomatic relations and trade policy between the United States and other countries resulting from the conflict; impacts from changes to diplomatic relations and trade policy between the United States and Russia or the United States and other countries that may support Russia or take similar actions due to the conflict between Russia and Ukraine;

constrained credit and liquidity due to disruptions in the global economy and financial markets, which may limit or delay availability of credit under our existing or new credit facilities, or which may limit our ability to obtain credit or financing on acceptable terms or at all;

our ability to timely recruit and retain key personnel in a highly competitive labor market, including potential financial impacts of wage inflation and potential impacts due to the proposed transaction with Synopsys;

our ability to protect our proprietary technology; cybersecurity threats or other security breaches, including in relation to breaches occurring through our products and an increased level of our activity that is occurring from remote global off-site locations; and disclosure and misuse of employee or customer data whether as a result of a cybersecurity incident or otherwise;

increased volatility in our revenue due to the timing, duration and value of multi-year subscription lease contracts; and our reliance on high renewal rates for annual subscription lease and maintenance contracts;

declines in our customers’ businesses resulting in adverse changes in procurement patterns; disruptions in accounts receivable and cash flow due to customers’ liquidity challenges and commercial deterioration; uncertainties regarding demand for our products and services in the future and our customers’ acceptance of new products; delays or declines in anticipated sales due to reduced or altered sales and marketing interactions with customers; and potential variations in our sales forecast compared to actual sales;

our ability and our channel partners’ ability to comply with laws and regulations in relevant jurisdictions; and the outcome of contingencies, including legal proceedings, government or regulatory investigations and tax audit cases;

uncertainty regarding income tax estimates in the jurisdictions in which we operate; and the effect of changes in tax laws and regulations in the jurisdictions in which we operate;

the quality of our products, including the strength of features, functionality and integrated multiphysics capabilities; our ability to develop and market new products to address the industry’s rapidly changing technology; failures or errors in our products and services; and increased pricing pressure as a result of the competitive environment in which we operate;

investments in complementary companies, products, services and technologies; our ability to complete and successfully integrate our acquisitions and realize the financial and business benefits of the transactions; and the impact indebtedness incurred in connection with any acquisition could have on our operations;

investments in global sales and marketing organizations and global business infrastructure; and dependence on our channel partners for the distribution of our products;

current and potential future impacts of a global health crisis, natural disaster or catastrophe, and the actions taken to address these events by our customers, suppliers, regulatory authorities and our business, on the global economy and consolidated financial statements, and other public health and safety risks; and government actions or mandates;

operational disruptions generally or specifically in connection with transitions to and from remote work environments; and the failure of our technological infrastructure or those of the service providers upon whom we rely including for infrastructure and cloud services;

our intention to repatriate previously taxed earnings and to reinvest all other earnings of our non-U.S. subsidiaries;

plans for future capital spending; the extent of corporate benefits from such spending including with respect to customer relationship management; and higher than anticipated costs for research and development or a slowdown in our research and development activities;

our ability to execute on our strategies related to environmental, social, and governance matters, and meet evolving and varied expectations, including as a result of evolving regulatory and other standards, processes, and assumptions, the pace of scientific and technological developments, increased costs and the availability of requisite financing, and changes in carbon markets; and

other risks and uncertainties described in our reports filed from time to time with the Securities and Exchange Commission (SEC).

Important Information and Where to Find It

This document refers to a proposed transaction between Synopsys and Ansys. In connection with the proposed transaction, Synopsys filed with the SEC, and the SEC has declared effective on April 17, 2024, a registration statement on Form S-4 (File No. 333-277912), that included a prospectus with respect to the shares of common stock of Synopsys to be issued in the proposed transaction and a proxy statement of Ansys and is referred to as the proxy statement/prospectus. Each party may also file other documents regarding the proposed transaction with the SEC. This document is not a substitute for the proxy statement/prospectus or registration statement or any other document that Synopsys or Ansys may file with the SEC. The definitive proxy statement/prospectus will be mailed to all Ansys stockholders. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders may obtain free copies of the registration statement, proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Synopsys or Ansys through the website maintained by the SEC at www.sec.gov.

The documents filed by Synopsys with the SEC also may be obtained free of charge at Synopsys’ website at https://investor.synopsys.com/overview/default.aspx or upon written request to Synopsys at Synopsys, Inc., 675 Almanor Avenue, Sunnyvale, California 94085, Attention: Investor Relations. The documents filed by Ansys with the SEC also may be obtained free of charge at Ansys’ website at https://investors.ansys.com/ or upon written request to kelsey.debriyn@ansys.com.

Participants in the Solicitation

Synopsys, Ansys and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Ansys’ stockholders in connection with the proposed transaction.

Information about Ansys’ directors and executive officers and their ownership of Ansys’ common stock is set forth in Ansys’ proxy statement for its 2024 Annual Meeting of Stockholders on Schedule 14A filed with the SEC on April 10, 2024. To the extent that holdings of Ansys’ securities have changed since the amounts printed in Ansys’ proxy statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Information about Synopsys’ directors and executive officers is set forth in Synopsys’ proxy statement for its 2024 Annual Meeting of Stockholders on Schedule 14A filed with the SEC on February 16, 2024 and Synopsys’ subsequent filings with the SEC. Additional information regarding the direct and indirect interests of those persons and other persons who may be deemed participants in the proposed transaction may be obtained by reading the proxy statement/prospectus filed by Synopsys and declared effective by the SEC on April 17, 2024, and any other relevant documents that are filed with the SEC relating to the proposed transaction. You may obtain free copies of these documents as described in the preceding paragraph.

No Offer or Solicitation

This document is for informational purposes only and is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Ansys and any and all ANSYS, Inc. brand, product, service and feature names, logos and slogans are registered trademarks or trademarks of ANSYS, Inc. or its subsidiaries in the United States or other countries. All other brand, product, service and feature names or trademarks are the property of their respective owners.

Visit https://investors.ansys.com for more information.

Contact: |

|

|

Investors: |

| Kelsey DeBriyn |

|

| 724.820.3927 |

|

| |

Media: |

| Mary Kate Joyce |

|

| 724.820.4368 |

|

| |

|

|

|

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/303eebdb-54ac-4fd3-a637-a4c458705027

https://www.globenewswire.com/NewsRoom/AttachmentNg/ba732b53-ae5e-4a05-b6e3-4a3ff790a1b1

https://www.globenewswire.com/NewsRoom/AttachmentNg/89711153-9c56-4b1e-85b0-6b794b5aef10

ANSS-F

Yahoo Finance

Yahoo Finance