Ansys Inc (ANSS) Q1 2024 Earnings: Revenue and EPS Fall Short of Analyst Expectations

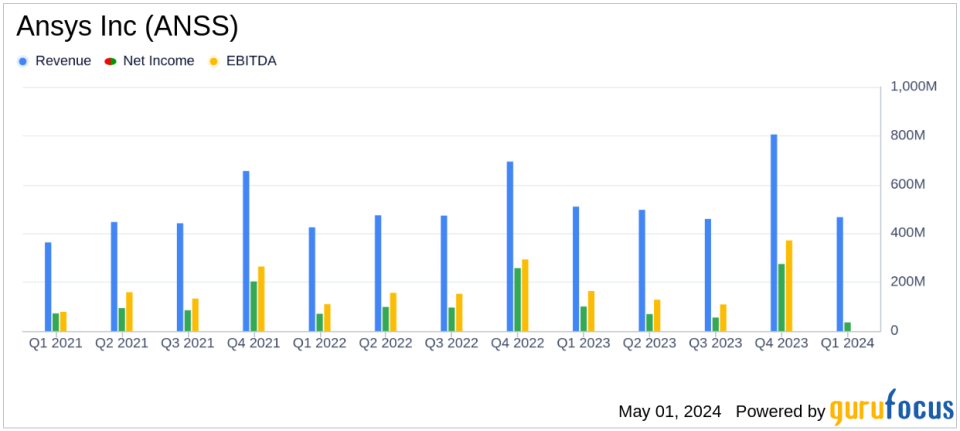

Revenue: Reported at $466.6 million, down 8% year-over-year, falling short of estimates of $549.38 million.

GAAP Net Income: Totaled $34.78 million, a decrease of 65.4% compared to the previous year, far below estimates of $170.09 million.

GAAP EPS: Recorded at $0.40, a sharp decline from $1.15 year-over-year, far below the estimated $1.91.

Non-GAAP EPS: Came in at $1.39, down from $1.85 in the prior year, far below the estimated $1.91.

Operating Cash Flow: Increased to $282.8 million, demonstrating strong cash generation capabilities.

Deferred Revenue and Backlog: Reached $1.369 billion, indicating healthy future revenue potential.

Annual Contract Value (ACV): Grew slightly to $407.4 million, up 2-3% in reported and constant currency respectively.

Ansys Inc (NASDAQ:ANSS) disclosed its first-quarter financial performance for 2024 on May 1, revealing figures that did not meet analyst expectations. The company reported a revenue of $466.6 million and an adjusted (non-GAAP) earnings per share (EPS) of $1.39, both falling short compared to the anticipated $549.38 million in revenue and $1.91 EPS. For a detailed review, refer to the company's 8-K filing.

Ansys, a leading engineering software company, is well-known for its advanced simulation capabilities that serve industries such as aerospace, defense, and automotive. The company employs over 4,000 individuals and has a customer base exceeding 50,000 globally.

Financial Performance Insights

The reported revenue of $466.6 million represents an 8% decrease in both reported and constant currency terms compared to the first quarter of 2023. This decline is notably below the analyst estimates, which may concern investors looking for growth signals. GAAP diluted EPS saw a significant reduction to $0.40 from the previous year's $1.15, marking a 65.2% decrease. This decline in profitability can be attributed to various market and operational challenges, including adverse currency fluctuations and competitive pressures in the industry.

Despite these challenges, Ansys reported a robust gross margin of 85.3% and an operating cash flow of $282.8 million, indicating efficient management and operational resilience. The Annual Contract Value (ACV) stood at $407.4 million, showing a modest growth of 2-3% in constant currency terms.

Strategic Developments and Market Position

Amidst these financial figures, Ansys also announced a significant corporate development. The company has entered into a definitive agreement for acquisition by Synopsys, Inc., expected to close in the first half of 2025. This pending transaction has led Ansys to suspend its quarterly earnings conference calls and withdraw its financial guidance, which could add to the uncertainty currently faced by its investors.

Furthermore, the company's backlog, including deferred revenue, stood at $1,369.5 million as of March 31, 2024, providing some visibility into future revenue, albeit under the shadow of the upcoming acquisition.

Analysis and Forward Outlook

The Q1 results reflect a challenging start to the year for Ansys, with significant deviations from expected financial metrics. The company's performance is crucial not just for its stakeholders but also for potential investors considering the broader implications of its acquisition by Synopsys. As the market awaits more detailed updates and potential strategic shifts post-acquisition, Ansys's ability to navigate these challenges while maintaining its innovation edge will be critical.

For value investors, the current scenario presents a mix of risks and opportunities. The underlying strength of Ansyss technological offerings and market position must be weighed against the immediate financial trends and the strategic outcomes of the impending acquisition.

For more detailed financial analysis and future updates on Ansys Inc (NASDAQ:ANSS), stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Ansys Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance