Antero's (AR) Q1 Earnings Miss Estimates on Lower Gas Price

Antero Resources Corporation AR reported first-quarter adjusted earnings of 48 cents per share, missing the Zacks Consensus Estimate of 54 cents. The bottom line declined from the year-ago quarter’s earnings of $1.14 per share.

Total quarterly revenues of $1,408 million beat the Zacks Consensus Estimate of $1,206 million. Also, the top line increased from the year-ago quarter’s $787 million.

Weak quarterly earnings can be attributed to a decline in natural-gas-equivalent price realization. This was partially offset by higher production.

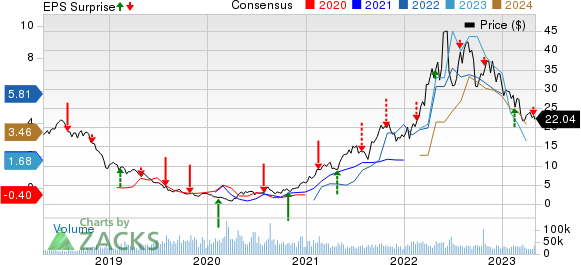

Antero Resources Corporation Price, Consensus and EPS Surprise

Antero Resources Corporation price-consensus-eps-surprise-chart | Antero Resources Corporation Quote

Overall Production

Total production through the March quarter was 295 billion cubic feet equivalent (Bcfe), which increased 4% from 285 Bcfe a year ago. Natural gas production (accounting for 65.8% of the total output) fell 3% year over year to 194 Bcf.

Oil production in the first quarter was 831 thousand barrels (MBbls), up 15% from 724 MBbls. Its production of 6,141 MBbls of C2 Ethane was 53% higher than 4,005 MBbls in the year-ago quarter. The company’s output of 9,857 MBbls of C3+ NGLs in the quarter was 2% higher than 9,638 MBbls a year ago.

Realized Prices (Excluding Derivative Settlements)

Weighted natural-gas-equivalent price realization in the quarter was $4.13 per thousand cubic feet equivalent (Mcfe), lower than the year-earlier figure of $6.04. Realized prices for natural gas declined 31% to $3.45 per Mcf from $5.01 a year ago.

The company’s oil price realization in the quarter was $62.35 per barrel (Bbl), down 29% from $87.45 a year ago. Its realized price for C3+ NGLs declined to $42.95 per Bbl from $61.55. Realized price for C2 Ethane decreased 30% to $11.73 per Bbl from $16.74 a year ago.

Operating Expenses

Total operating expenses increased to $1,076.9 million from $991.4 million in the year-ago period.

Average lease operating costs were 10 cents per Mcfe, up 67% year over year. The same for gathering and compression increased 1% to 72 cents per Mcfe.

Transportation expenses declined 6% from the prior-year quarter to 66 cents per Mcfe. Processing costs increased 21% year over year to 81 cents.

Capex & Financials

In first-quarter 2023, Antero Resources spent $267 million on drilling and completion operations. As of Mar 31, 2023, it had no cash and cash equivalents. It had long-term debt of $1.3 billion.

Guidance

For 2023, Antero Resources has guided its net daily natural gas-equivalent production at 3.25-3.3 Bcfe/d. Of the total, 185-195 MBbl/d will likely be liquids. Also, AR projects its net daily natural gas production at 2.1-2.15 Bcf/d.

Zacks Rank & Stocks to Consider

Currently, Antero Resources carries a Zacks Rank #3 (Hold). Better-ranked players in the energy space include Marathon Petroleum Corporation MPC, Sunoco LP SUN and Enterprise Products Partners LP EPD. While Marathon Petroleum and Sunoco sport a Zacks Rank #1 (Strong Buy), Enterprise Products carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Marathon Petroleum operates the largest refining system in the nation. In the past seven days, MPC has witnessed upward earnings estimate revisions for 2023.

Sunoco has a stable business model while distributing motor fuel to approximately 10,000 convenience stores. For this year, SUN has witnessed upward earnings estimate revisions in the past seven days.

Enterprise Products has a stable business model and is not significantly exposed to the volatility in oil and gas prices. It generates stable fee-based revenues from its extensive pipeline network that spreads across more than 50,000 miles, transporting natural gas, natural gas liquids, crude oil petrochemicals and refined products.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Enterprise Products Partners L.P. (EPD) : Free Stock Analysis Report

Sunoco LP (SUN) : Free Stock Analysis Report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report

Antero Resources Corporation (AR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance