AON's Q3 Earnings and Revenues Surpass Estimates, Rise Y/Y

Aon plc AON reported third-quarter 2021 operating earnings of $1.74 per share, which outpaced the Zacks Consensus Estimate by 4.2%. The bottom line climbed 14% year over year.

Results benefited from higher revenues and solid contributions from its Reinsurance Solutions, Retirement Solutions, Health Solutions and Wealth Solutions segments.

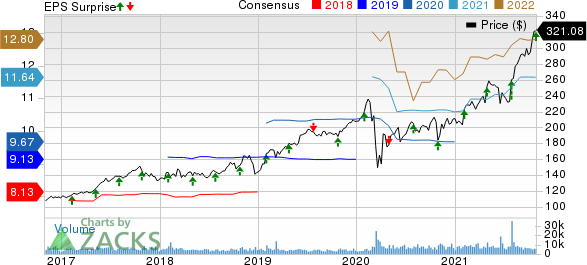

Aon plc Price, Consensus and EPS Surprise

Aon plc price-consensus-eps-surprise-chart | Aon plc Quote

Total revenues improved 13% year over year to $2.7 billion, which comprised organic revenue growth of 12% and a 2% favorable impact from forex translation, partially offset by 1% unfavorable impact from buyouts, divestitures and other. This upside can primarily be attributed to improved performances at Reinsurance Solutions, Retirement Solutions, Health Solutions, and Wealth Solutions. The top line outpaced the consensus mark by 4.6%.

Total operating expenses surged 80% year over year to $3.5 billion due to a $1.3 billion increase in charges related to terminating the combination with Willis Towers Watson and related costs, an increase in expense associated with organic revenue growth, a negative impact from the repatterning of discretionary expenses and an unfavorable impact from foreign currency translation.

Adjusted operating margin contracted 30 bps to 22.1%.

Organic Revenue Catalysts

Commercial Risk Solutions: Organic revenues improved 13% year over year on the back of new business generation, robust retention and management of the renewal book portfolio. Strength in retail brokerage reflects double-digit growth in the United States, Latin America, and Asia and the Pacific. The results also reflected solid growth globally in the affinity business across both consumer and business solutions. The segment reported a year-over-year rise of 14% in total revenues to $1.5 billion.

Reinsurance Solutions: Organic revenues improved 8% year over year, courtesy of net new business generation globally, as well as double-digit growth in facultative placements, partially offset by a modest decline in capital markets transactions. Total revenues climbed 10% year over year to $353 million.

Health Solutions: Organic revenues improved 16% year over year, driven by double-digit growth in Human Capital attributable to rewards and assessments solutions. In health and benefits brokerage, solid growth globally in the core was driven by strong retention and management of the renewal book portfolio, as well as growth in the more discretionary areas, primarily voluntary benefits and project-related work. Total revenues of the segment climbed 17% year over year to $497 million.

Wealth Solutions: Organic revenues improved 4% year over year, driven by strong growth in delegated investment management and modest growth in Retirement Consulting, driven by higher utilization rates and project-related work. Total revenues of the segment climbed 7% year over year to $351 million.

Financial Position

The company exited the third quarter with cash and cash equivalents of $0.6 billion, which decreased 31.1% from the level at 2020 end. As of Sep 30, 2021, Aon had total assets worth $31.8 billion, down 0.1% from the level on Dec 31, 2020.

Cash flow from operations was down 38% year over year to $1.3 billion in the first nine months of 2021. Free cash flow decreased 40% year over year to $1.1 billion for the first nine months of 2021.

As of Sep 30, 2021, long-term debt was $8.3 billion, which increased 13.3% from the level at 2020 end.

Share Repurchase Update

The company bought back 4.4 million Class A Ordinary shares for around $1.3 billion in the quarter under review. It had about $3.7 billion of remaining authorization under its share repurchase program as of Sep 30, 2021.

Zacks Rank

Aon currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Brokers

Of the insurance brokers that have reported third-quarter results, the bottom line of Brown & Brown, Inc. BRO, Willis Towers Watson Public Limited Company WLTW and Marsh & McLennan Companies, Inc. MMC beat the respective Zacks Consensus Estimate.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

Aon plc (AON) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Willis Towers Watson Public Limited Company (WLTW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance