Aperol spritz puts fizz in Majestic Wine

Demand for Aperol spritz cocktails has helped Majestic Wine swing into profit despite facing a tough UK market.

The Aim-listed business recorded a pre-tax profit of £8.3m for the year to April 2, up from a £1.5m loss in 2017, as it promised to make good of the brutal conditions for retailers.

Chief executive Rowan Gormley said: “If the UK is headed for a retail crisis, as some commentators are suggesting, then we are planning for a great crisis.”

He said its sister business Naked Wines had driven profitable growth during the 2008 financial crash because it continued to invest in acquiring customers.

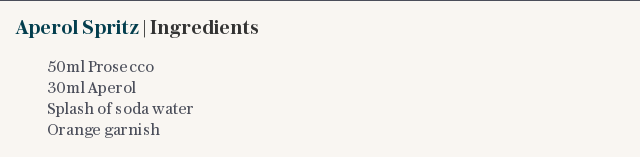

The comments came as Majestic Wine’s sales of Aperol, the northern Italian aperitif, increased by 98pc last year thanks to the growing popularity of the Aperol spritz, a combination of Prosecco and Aperol.

Sub-brand Lay & Wheeler also sold out of the 2016 Les Setilles Bourgogne Blanc chardonnay produced by Olivier Leflaive after it was served at the Royal Wedding evening reception.

Group sales grew by 2pc to £476.1m over the period, largely boosted by Naked Wines' sales jumping 11pc to £156.1m.

Underlying sales at Majestic Wine stores grew by 1.9pc, while efforts to drive down costs helped ease the pressure on margins.

Mr Gormley said the stores had been squeezed by a “perfect storm of cost pressure” caused by the weak pound, hikes to duty on wine, and the shortest harvest in 50 years during 2017.

He said many wine companies had decided to absorb the costs, meaning the average price of a bottle of wine had gone up by 20p instead of 60p since 2015.

Meanwhile Majestic is bucking the trend of its rivals to continue spending on marketing.

“We are increasing the amount of money we are spending on new customer acquisition from £14m to £28m, while most of our competition is going the other way around,” he said.

“That leaves opportunities for us that we intend to exploit to the full.”

Mr Gormley said in April that Majestic Wine expected profits to suffer a dent of up to £3m in 2019 as it opts to bolster investment in marketing rather than opening stores.

Investors sent shares in Majestic Wine up 1.8pc to £4.58 in lunchtime trade, as the full-year results came in line with expectations.

Jonathan Pritchard of Peel Hunt said Majestic Wines' growth plans “now need to start showing signs of reaping fruit” in order for the share price to grow significantly.

Yahoo Finance

Yahoo Finance