What's behind Britain's car sales 'correction' - and will it turn into a crash?

For anyone thinking about a new car, now might be a pretty good time to negotiate a deal. Sales are slumping, with some big dealer groups warning about pressure on their profits. This means that buyers are in a strong position to drive a hard bargain.

“It’s definitely a softening market,” says Professor David Bailey, an automotive industry expert at Aston University. “It’s been overtrading for some time on the back of financial innovation – mainly the personal contract plans (PCPs) that almost every car is bought on these days. I’m not sure it’s a crash but it is definitely a correction.”

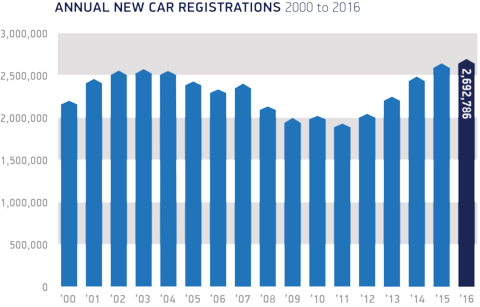

The car industry is asking itself whether the correction will become a crash. The risk has developed in plain sight. In 2016, the industry celebrated all-time record sales, with British drivers buying 2.7m new cars. Many expressed amazement at the market’s ability to defy economic gravity. Having watched over years of sales rises, Mike Hawes, chief executive of industry body the Society of Motor Manufacturers and Traders (SMMT), joked that his personal view was that he had “given up” on forecasting demand as it seemed to be immune to wider economic concerns.

But all good things must come to an end. Although 2017 started steadily, sales went off a cliff in April as new vehicle registrations – a proxy for sales – plunged 20pc. Such a precipitous decline was largely blamed on new vehicle duty rules kicking in, with sales having been “pulled forward” into the previous few months as motorists rushed to beat the higher levies. In the months since, sales have fallen at an average rate of 8pc, and industry sources say the SMMT will this week downgrade its sales forecast for the full year for a third time.

The first hard evidence of how bad things have become came when Pendragon, one of the UK’s biggest car dealers with about 220 outlets, issued a profit warning and chief executive Trevor Finn declared that Britain had reached “peak car”. Finn says: “It’s not one single reason you can point to for this, it’s a confluence of things – Brexit, higher vehicle duty, confusion about diesel, maybe even good barbecue weather.” Pendragon also put some of the blame on manufacturers. According to Finn, some premium car brands have continued forcing supply into the market, further driving down margins.

Finn’s experiences were echoed by peer Inchcape a few days later. Stefan Bombard, chief executive of the international dealer group, stressed that the UK was responsible for only about 15pc of the company’s profits meaning strength in global markets insulated it. Still, he confirmed Inchcape was seeing the same sort of pressure on margins in Britain. However, an executive at another dealer group says the picture is different, describing the market as “not the disaster some are making it out to be”.

One issue facing the industry is the speed at which it reacts to change. Britain has historically been nicknamed “treasure island”, because of its appetite for vehicles. Combine this with the pound’s strength before the EU referendum and it’s easy to understand why Britain is a key market.

However, in an industry where car makers often decide years in advance how they will distribute production, when a market takes a sharp turn, it can take a long time for supply to match demand. James Baggott, editor-in-chief of Car Dealer magazine, says he’s hearing the same from dealers. “Car plants are geared up years in advance and making these finite adjustments to their supply chains is very difficult and takes a long time,” he says.

Bailey adds that in some cases dealers might sell cars at very low margins or even a loss, but packaged with servicing deals where they can make profits. “If there aren’t enough cars producing after-market income, that’s hurting dealers,” he says. The growth of electric vehicles is only likely to exacerbate this situation. Mechanically less complex, electric cars need less servicing, causing further pain for dealers looking to make money in the after-market.

Confusion over the fate of diesel has also had a huge impact on sales. Government announcing new petrol and diesel cars would be banned from 2040 hit confidence, and moves such as the “T charge” on older cars in London have only made the situation worse. The SMMT is campaigning to heighten awareness that the latest diesel cars are as clean as petrol vehicles.

How people buy cars has changed, too. Although a car remains the second biggest purchase most people make after a house, the advent of PCPs means that instead of looking at the “sticker price” on the windscreen, buyers are sold on the monthly cost they pay.

In the summer the Bank of England flagged up concerns about car finance. In its stability report, the Bank reported on the surge in consumer credit over the past five years, with car finance now making up 29pc of the £198bn total. Mark Carney, governor of the Bank, was careful not to paint car finance as a “bubble” that could set off a new financial crisis but the Bank did note borrowers were 10 times more likely to default on consumer credit than mortgages.

Faced with a toughening market, the industry is seeking ways to boost its performance. One is “pre-registering”, where dealers themselves register cars with the DVLA to inflate sales, then sell on the cars to consumers at a discount as used cars. “Pre-registering is back with a vengeance,” says Baggott. “Manufacturers facing missing their targets are offering some ridiculous deals.”

However, one executive said some manufacturers have recognised tough times and lowered their targets for sales accordingly.

Other signals of trouble in the UK car market might come from how dealerships appear externally. In Pendragon’s profit warning Finn said the company was running a “strategic review of premium brands” to look at “the investment appeal of their dealer proposition”. This could be seen as calling time on the mega-showroom.

One consequence of the tougher market is likely to be further consolidation. “The big boys who have the balance sheets to ride it out and take all these extra cars being forced on them will survive,” predicts Baggott. “Smaller players could be squeezed out and taken over.”

What all this means for Britain’s car industry remains to be seen.

With 80pc of the 1.7m cars produced in UK plants last year going for export, the impact of lower domestic demand doesn’t necessarily mean plants shutting down and jobs going. Dealers are likely to feel more pressure, and growing online sales will only intensify the issue. But for a savvy buyer, now is the time to strike.

“Things are going downhill fast and it’s going to get worse for the industry,” says Baggott. “That means there are great deals out there.”

Yahoo Finance

Yahoo Finance