What's in the Cards for SAP SE (SAP) This Earnings Season?

SAP SE SAP is expected to report first-quarter 2018 results before the market opens on Apr 24.

Notably, the stock has delivered an average positive earnings surprise of 5.56% for the last four quarters. In the last reported quarter, the company came up with a positive earnings surprise of 15.56%.

The Zacks Consensus Estimate for first-quarter earnings is pegged at 87 cents per share, indicating an 11.5% increase on a year-over-year basis. Revenues are estimated to be around $6.51 billion, indicating a 15.7% increase from the year-ago quarter.

Factors to Consider

SAP’s Cloud and Software businesses have been consistent growth drivers for quite some time. Impressive growth in S/4HANA and other Cloud initiatives has supported the company’s top line.

Its human capital management applications have also added to revenues backed by accelerated adoption of SuccessFactors Employee Central. These are expected to continue being beneficial for the company.

In March 2018, the company launched SAP S/4HANA in Brazil. The company is hopeful that the product will likely secure a sturdy response from the market, as the country has always promptly embraced new technologies.

However, flat customer spending projections overall have affected the company’s performance. Also, over the past few quarters, many of its emerging markets have faced fiscal imbalances along with general economic slowdown, which remain a concern for the company.

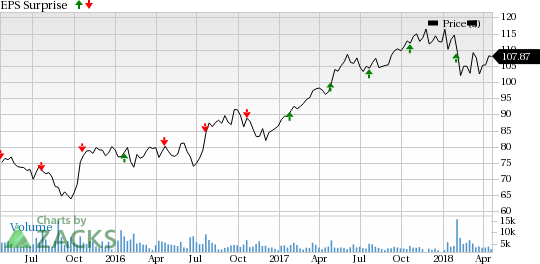

SAP SE Price and EPS Surprise

SAP SE Price and EPS Surprise | SAP SE Quote

What the Zacks Model Says

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. Sell-rated stocks (Zacks Rank #4 or 5) are best avoided.

SAP has a Zacks Rank #3 and an Earnings ESP of 0.00%. This indicates that the company is unlikely to beat estimates. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are some stocks, which you may consider as our model shows that it has the right combination of elements to post an earnings beat in its upcoming release:

Paycom Software, Inc. PAYC has an Earnings ESP of +0.33% and sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Western Digital Corporation WDC has an Earnings ESP of +2.20% and carries a Zacks Rank #1.

Advanced Micro Devices, Inc. AMD has an Earnings ESP of +1.19% and has a Zacks Rank #3.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Western Digital Corporation (WDC) : Free Stock Analysis Report

Paycom Software, Inc. (PAYC) : Free Stock Analysis Report

SAP SE (SAP) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance