'The Financial Ombudsman failed us – now we want our cases reviewed'

Telegraph Money readers are calling for the Financial Ombudsman Service to review their cases, after an undercover journalist appeared to show staff at the dispute resolution service failing to understand the financial services they were investigating.

The Dispatches documentary recorded an employee admitting that they rushed through cases to meet targets, and ruled in favour of the banks because it was easier than persuading businesses to pay out.

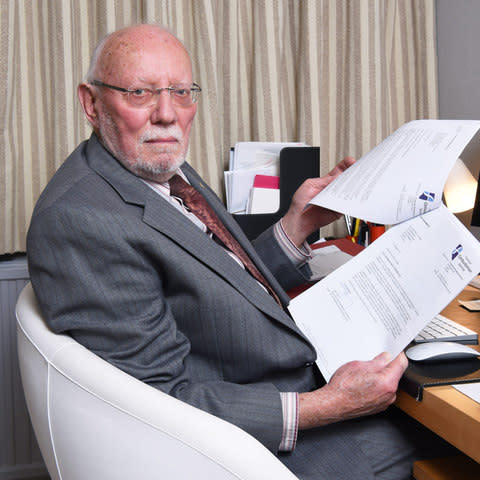

Two Telegraph readers, Donald Kelly, a retired professor, and Barrie Cooper, both fell victim to similar solicitor scams.

The FOS ruled against them both, after they complained that the banks involved should have stopped the fraudsters stealing tens of thousands of pounds.

'The ombudsman delivered two contradictory views in 12 months'

Telegraph Money reported in 2016 how Prof Kelly and his wife Patricia, who lost £47,508 to a fake solicitor when buying a home, felt hopeful when the ombudsman said it felt Lloyds Bank – the fraudster’s bank – should repay the stolen sum plus interest in its provisional decision.

But more than a year later the ombudsman changed its mind. The case was passed to a new person and the FOS ordered Lloyds to offer only £500 compensation.

The ombudsman offered an additional £700 because of its poor handling of the case.

At the time Prof Kelly branded the ombudsman “crassly incompetent”.

The FOS responded by saying it was “really disappointed that this case took so long” and recognised it could have “handled things better”.

Remarking on the documentary, Prof Kelly said: “Nothing surprised me. From my experience the FOS is dysfunctional and clearly lacks proper training for individual staff whose background is often inadequate for dealing with complex forensic matters.”

Lloyds said it complied with all relevant regulation when opening the account and responded promptly when it was notified about the scam.

'I asked for a review of my case in October'

Fraud victim Mr Cooper had already asked for his case to be reviewed in October as he felt significant parts of his complaint were overlooked.

Since the Dispatches programme, he has written to the ombudsman again. But the FOS says its decisions are final.

Mr Cooper, 82, was tricked into paying more than £50,000 into the account of a criminal posing as his solicitor in February 2016.

He argued that TSB, the fraudster’s bank, enabled the crime by allowing the criminal, who was not the account holder, to move large sums out of the account without question.

When he uncovered the ruse Mr Cooper alerted his own bank, First Direct, which contacted TSB. TSB blocked the account after calling the criminal, who failed to pass its verification process on the phone.

But by this time £46,738 of Mr Cooper’s funds had been transferred to other people.

Most of the recipients of the funds were new payees and had been set up within days of Mr Cooper making the payment, according to the FOS report.

Mr Cooper said he feels TSB failed to “act properly” with regard to this and the ombudsman is “toothless” for not acknowledging it.

“TSB should never have allowed the funds to be moved out of the account by someone who wasn’t the account holder,” he said.

TSB said it had a “complex and multi-layered framework” in place to detect and prevent fraud. However it admitted it cannot stop all scams, which are becoming more sophisticated.

The bank said it had no reason to question the significant payments in and out of their criminal customer’s account in the report and did not see why it should refund Mr Cooper. The adjudicator and ombudsman agreed.

The FOS’s powers are limited. It can only consider investigating “payment services” and the “ancillary activities” surrounding it.

The running and general management of the account and account opening procedures are not considered.

Mr Cooper eventually received £7,283 back, although he said this payment was never explained.

The FOS refused to comment on Mr Cooper’s experience.

It said it was talking to and supporting people who are getting in touch with concerns about their own individual cases.

A ‘wake-up call’ for the industry

MPs and campaigners are now pressuring the FOS for answers. Nicky Morgan MP, who chairs the Treasury Committee, has written to Caroline Wayman, the chief executive of the FOS, questioning the “poor decision making at the FOS”, the “alleged errors” and “improper handling of cases”.

Ms Morgan also questioned whether the FOS has the ability to reopen cases that might have been handled incorrectly.

Ros Altmann, the Tory peer and former pensions minister, who featured in the documentary, has called for “urgent action”.

She said the documentary should be “an important wake-up call to the industry” and that a more thorough investigation by Parliament was warranted.

The FOS has said its board will be conducting an internal review, but James Daley, founder of Fairer Finance, the consumer campaign group, said there was “room for an external inquiry”.

He said this would need to come from the Government, as the board are implicated in the failings that “happened on their watch”.

The FOS has published a statement on its website claiming that the Dispatches programme gave an “unfair impression” of the service.

It said its role was to investigate disputes between financial business and customers and make “impartial decisions” based on what’s “fair and reasonable” in each case and added that it would be conducting an internal review of concerns raised.

Yahoo Finance

Yahoo Finance