'Can I get a refund for my £960 unused childcare vouchers?'

After leaving my previous job, I discovered that my Edenred childcare voucher account is in credit by just over £960.

My children are now 12 and 15 and so no longer uattend after school clubs. They also dislike the idea of holiday clubs, so I don't see how I will be able to spend the credit in future.

Is there any way of reclaiming the tax-deduced amount?

J. King, email

Edenred, one of the main providers of childcare vouchers, states in its FAQs that it does not offer refunds for unused childcare vouchers - but there could be a way to get your money back if your employer permits it.

But don't be too hopeful: many employers won't help in these circumstances.

When approached by Telegraph Money, an Edenred spokesman suggested taking the matter up with your old company as childcare vouchers are a "contractual benefit between an employee and their employer".

It's a complicated situation because of the way the vouchers are purchased.

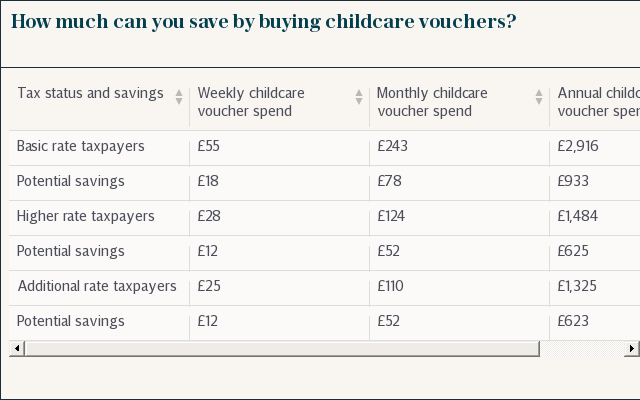

Parents can buy up to £243 worth of childcare vouchers via a "Salary Sacrifice" scheme organised by their employer.

The vouchers are bought before tax and NICs are deducted. Basic rate taxpayers who maximise their allowance could save up to £933 year.

The vouchers can then be used to pay for registered nurseries, childminders and after school clubs.

According to the Child Voucher Providers Association, which works to develop systems of best practice and of which Edenred is a member, if an employee permits it, the vouchers must be refunded through your employers payroll to make sure the correct tax is retrospectively applied.

This could be more complicated considering that fact you've now left your company where you would have sacrificed £960 out of your pre-tax salary.

The CVPA, which can only comment on the practices of its members who adhere to its code of practice, said if your ex-employer agrees to pay you back, it will notify the childcare voucher provider which will process the refund.

This must be done through your old company's payroll.

But your company must agree to reimburse you first and this will depend its own terms and conditions.

Other childcare voucher providers say they do not ordinarily offer refunds - although the information is vague.

Kiddivouchers said: "Under HMRC rules, refunds are only allowed if you are unable to use your vouchers as a result of exceptional and unforeseeable circumstances." These will be at the discretion of the employer.

Early Years Vouchers said refunds are permitted in cases of overpayment, but under "normal circumstances" it will not offer employees their money back.

Busy Bees Benefits said it would "facilitate the cancellation and refund of vouchers only via your employer and with their prior consent."

Computershare Voucher Services says it will refund vouchers if the employee allows it. However all refunds must be made through the company's payroll.

For more on different childcare schemes, see here.

Yahoo Finance

Yahoo Finance