If You're Retired, Consider Buying These 2 Stocks

If you have shifted into retirement, then your investment needs and goals have drastically changed. At this point, you are probably focused on income, security, and protecting your assets. It's hard to find investments that do all of those things, but not impossible. That's why you should be looking at growing utility Dominion Energy Inc (NYSE: D) and precious metals streamer Franco-Nevada Corp (NYSE: FNV). Here's what you need to know about this very diverse pair of companies.

Powering through good and bad

Dominion is one of the largest utilities in the United States, providing customers with electricity and natural gas. Its business is fairly broad, with transmission assets, generation, and gas infrastructure. But, for the most part, its top line is dependent on regulated and fee-based businesses. That makes this utility, like most utilities, a fairly stable business. One of the best examples of this is the stock's low beta of around 0.25, suggesting it's roughly 75% less volatile as the broader market.

Planning for retirement requires a bit of strategic thinking. Image source: Getty Images.

That said, slow and steady growth is the norm here. That's because Dominion has to invest in its facilities over time to grow its top and bottom lines. This allows it to ask regulators for rate increases across much of its business and expands capacity in its non-regulated businesses. The company's growth plans include around $4 billion a year in capital spending, which is projected to boost earnings by as much as 8% a year through 2020. Investments here include things like a new power plant, storm hardening power lines, and building natural gas pipelines. In addition, Dominion sometimes makes acquisitions that expand its asset base, too. The big story right now is the utility's offer to buy competitor SCANA Corporation.

Since power is a necessity, Dominion's spending will generally take place through the inevitable ups and downs of the stock market -- another reason why it's a fairly consistent business. And that consistency backs a robust and market-beating 4.5% yield. Meanwhile, management has increased its dividend for 15 consecutive years. And the projected growth in earnings noted above is expected to support 10% annual dividend hikes through 2020, an added bonus.

A rock in a storm

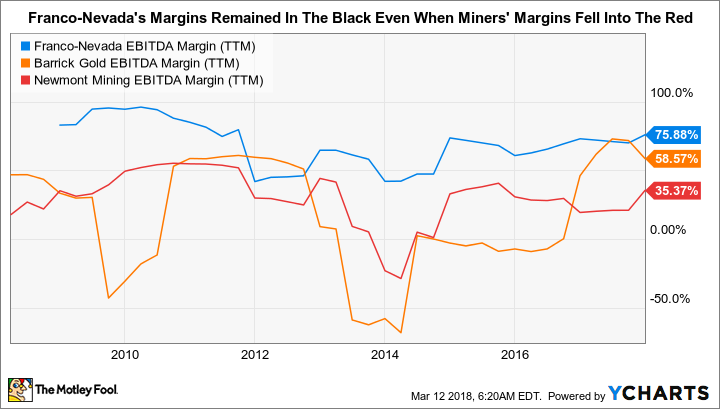

While a slow-and-steady tortoise like Dominion is a great addition to a portfolio, you'll also want to have some insurance. For that, gold and silver streaming company Franco-Nevada is a solid option. To simplify a complicated business, the company provides cash to miners for the right to buy precious metals at reduced rates in the future. Franco-Nevada's low precious metals costs support wide margins in both good years and bad, meaning it tends to weather the ups and downs in the gold and silver markets better than miners.

FNV EBITDA Margin (TTM) data by YCharts.

But it's those ups and downs that are the real benefit, here. That's because precious metals tend to do well when investors are fearful of the future and stocks are selling off. When you add gold and silver to a portfolio, it materially increases diversification. The full benefit of this, though, is only available if you can hold through the cycle.

This is where Franco-Nevada's dividend comes into play. As noted above, the company's business model allows for wide margins in both good years and bad. That, in turn, has allowed the streaming company to increase its dividend every year since it came public in late 2007. That's roughly a decade of dividend hikes, a record most miners can't come close to matching. The yield is only 1.3%, but those annual increases provide something to hold onto when gold and silver prices are weak, and Franco-Nevada's shares are lagging.

Two cornerstone investments

If you are retired, you need to think a little differently about your portfolio. Income, security, and the protection of your capital are likely to become increasingly important to you. Dominion is a somewhat boring, high-yield utility with solid growth prospects. It's the type of investment that helps you sleep well at night while bolstering your social security checks. Franco-Nevada, meanwhile, provides a little bit of income and exposure to precious metals. That's an insurance policy of sorts for when the market inevitably hits a downdraft and investors are scrambling for stores of wealth like gold and silver. Take the time to get to know both of these companies, and you might find that one or both have a place in your retirement portfolio.

More From The Motley Fool

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool recommends Dominion Energy, Inc. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance