A 'safe' way to invest in growing companies that aren't on the stock market

This year has seen yet more companies steering away from the stock market and instead choosing to remain private. For the small shareholder seeking access to high-growth, fledgling businesses this comes as a disappointment.

Volatile markets resulted in a number of flotations being cancelled at the last minute. When owners say “market conditions weren’t right” they usually mean the market wasn’t prepared to pay them a high enough price.

One option is to invest in private equity listed companies or investment trusts, which in turn take stakes in these unquoted companies.

The private equity investment trust sector often trades at share prices which deeply undervalue their holdings, part of a hangover from problems that arose during the financial crisis.

This adds another layer of risk to an already risky type of asset.

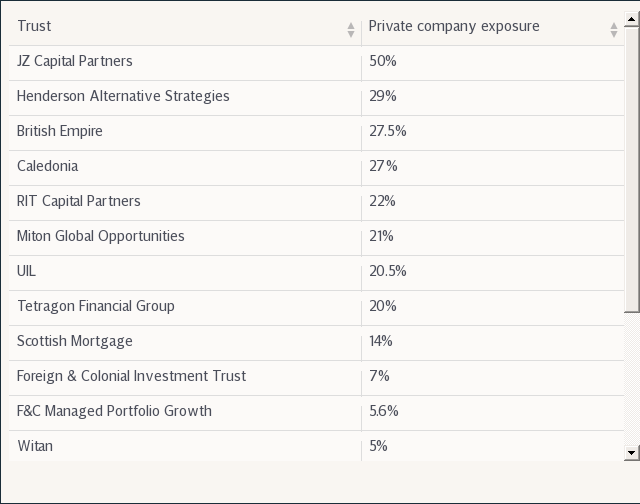

Another option is to invest in trusts with a broader remit but where a decent allocation is made to unquoted investments. As more companies have stayed private, many trusts have increased these allocations.

For example, Scottish Mortgage, the £6.5bn trust, hugely popular with smaller shareholders, asked investors for approval in 2016 to increase the amount it can have in unquoted companies to 25pc, up from 15pc. Currently it has 14pc in unlisted companies.

James Budden, of Baillie Gifford, the asset manager behind Scottish Mortgage, said that private companies require less investment than previously, as they rent more of their infrastructure rather than own it. In turn, this means they have less need to sell their stock on the open market.

“Many investors, just like us as fund managers, want to access companies when they are growing. If this is when they are unquoted there is an obvious problem,” he said.

Scottish Mortgage invested in technology giant Alibaba while it was still private, and has seen a couple of its other private investments bought out by listed companies: Middle Eastern ecommerce site Souq by Amazon, for example, and travel website Skyscanner by Ctrip. Scottish Mortgage also invests in Airbnb, Spotify and Dropbox.

The table, above, shows investment trusts with large allocations to unlisted companies.

Peter Webster, who works on the Henderson Alternative Strategies Trust, said: “Traditionally these unquoted firms are smaller businesses that have high growth potential and deliver greater returns to investors.”

Paul Niven, manager of Foreign & Colonial Investment Trust, which has 7pc in private companies, said: “Including an element of unquoted investments alongside our quoted portfolio enables us to take advantage of the ‘illiquidity premium’ that a private equity investment can provide.

“Indeed, our experience over many years has demonstrated the benefits of accessing private market opportunities.”

Some of these companies invest in private equity trusts, rather than taking direct stakes in private companies. Henderson Alternative Strategies Trust, for example, has its 29pc private equity exposure via listed private equity companies, such as HarbourVest Global Private Equity, and a specialist private equity “fund of funds”.

A number of these trusts will also have a higher net asset value than initially appears, based on delayed valuations.

Valuations of unquoted companies are more a matter of opinion, and will be updated much less frequently than listed companies.

In essence, the “discount” or “premium” you will see quoted, often with great precision, is likely to be an outdated estimate.

Yahoo Finance

Yahoo Finance