Here's Why You Should Buy EOG Resources Stock Right Now

On Mar 15, EOG Resources, Inc. EOG was upgraded to a Zacks Rank #1 (Strong Buy).

Why the Upgrade?

For first-quarter 2018, the Zacks Consensus Estimate for earnings per share has been revised higher from 82 cents to 88 cents over the last 30 days. The consensus estimate for 2018 earnings was revised to $4.11 from $3.60 over the same period.

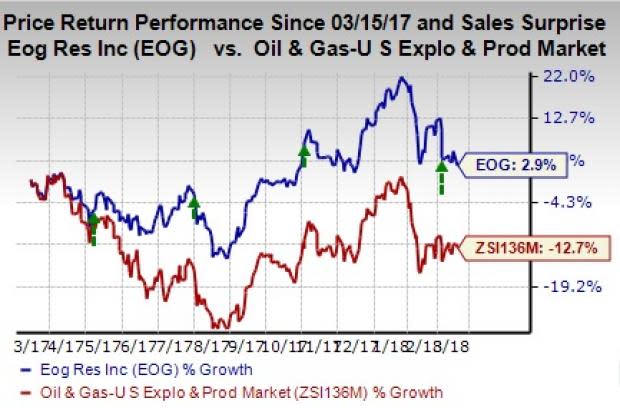

Moreover, the leading oil and gas explorer has an impressive earnings surprise history, the average positive earnings surprise being 25.7% for the last four quarters.

Along with the announcement of fourth-quarter results last month, EOG Resources reported an increase in total net proved reserves. Through 2017, the company saw an 18% increase in net proved reserves to 2,527 million barrels of oil equivalent (MMBoe), which entails higher future oil and gas production.

We appreciate the company’s decision to complete higher wells during 2018. This year, EOG Resources plans for the completion of 690 net oil and gas wells versus 536 last year. Importantly, the company believes that a minimum of 90% of the completed wells will be premium. Such wells contribute 30% after tax return even if crude and natural gas traded lower at $40 per barrel and $2.50 per MMBtu respectively, per EOG Resources.

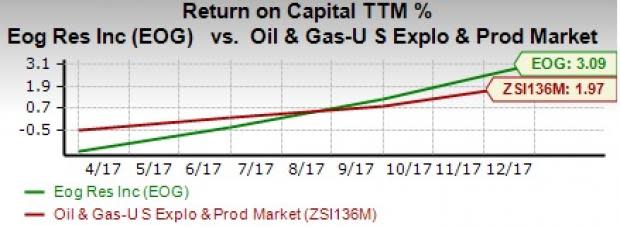

EOG Resources has set a capital budget of $5.4 billion to $5.8 billion for 2018. Majority of the budget is expected to be spent for oil-rich resources like Eagle Ford, Delaware Basin and the Bakken. The decision seems impressive given that the company has a trailing 12-month return on capital investment of 3.1%, significantly higher than 1.9% of the Zacks Oil & Gas-U.S Exploration industry.

Also, the upstream energy firm has gained 2.9% over the past year against the industry’s 12.7% decline.

Other Stocks to Consider

Other Zacks #1 Ranked players in the energy space include ConocoPhillips COP, Pioneer Natural Resources Company PXD and Concho Resources Inc. CXO. You can see the complete list of today’s Zacks #1 Rank stocks here.

Headquartered in Houston, TX, ConocoPhillips is a major upstream energy player. The company is expected to witness year-over-year earnings growth of 380% in 2018.

Headquartered at Irving, TX, Pioneer Natural Resources is an upstream energy firm. The company has an average positive earnings surprise of 66.9% for the last four quarters.

Headquartered in Midland, TX, Concho is also an upstream energy company. The firm will likely see year-over-year earnings growth of 73.2% in 2018.

Can Hackers Put Money INTO Your Portfolio?

Earlier this month, credit bureau Equifax announced a massive data breach affecting 2 out of every 3 Americans. The cybersecurity industry is expanding quickly in response to this and similar events. But some stocks are better investments than others.

Zacks has just released Cybersecurity! An Investor’s Guide to help Zacks.com readers make the most of the $170 billion per year investment opportunity created by hackers and other threats. It reveals 4 stocks worth looking into right away.

Download the new report now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pioneer Natural Resources Company (PXD) : Free Stock Analysis Report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

Concho Resources Inc. (CXO) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance