Here's Why You Should Hold on to Cerner (CERN) Stock for Now

Cerner Corporation CERN is a popular name in the HCIT (Healthcare Information Technology) space. The stock has returned 0.7%, compared with the industry’s rally of 8.4% in a year’s time. Also, the current return is lower than the S&P 500’s 14.8%.

With a market capitalization of approximately $19.22 billion, the company has missed earnings estimates in the first, third and fourth quarters of fiscal 2017. The company’s earnings met with estimates in the second quarter of fiscal 2017. At present, Cerner is grappling with stiff competition in the niche space and regulatory headwinds. The mixed sentiments justify the stock’s Zacks Rank #3 (Hold).

Here we take a detailed look at the company’s performance and operations to analyze why investors should hold on to this stock.

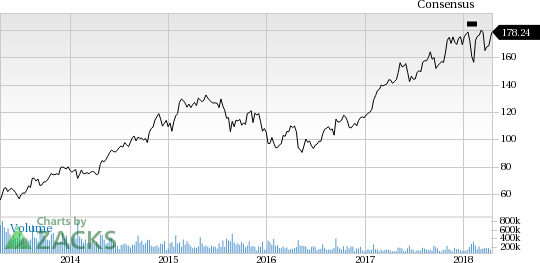

Cerner Corporation Price and Consensus

Cerner Corporation Price and Consensus | Cerner Corporation Quote

What’s Acting in Favor of Cerner?

Cerner is one of the best known HCIT giants with a large client base and a comprehensive array of solutions for patients. It is one of the major EHR (Electronic Health Record) vendors gaining significant market traction. In the past, Cerner had used Amazon Web Services (AWS) for storage, computer networking and databases and on-demand disaster recovery. Cerner's HealtheIntent platform facilitates the gathering and retrieval of and access to patient EHRs.

Lately, Cerner has been witnessing a series of developments in its EHR platform. The company was selected by the Illinois Rural Community Care Organization (IRCCO) to implement Cerner HealtheIntent across its accountable care organizations (ACO). California-based Kern Medical has also selected Cerner to implement Cerner Millennium integrated EHR and Cerner HealtheIntent to support improved health outcomes.

Furthermore, Texas-based Rankin County Hospital District has implemented an EHR with Cerner for improved patient experiences. Munising Memorial Hospital in Michigan has chosen Cerner for the implementation of a new integrated EHR to upgrade the hospital’s system with sophisticated health technology.

Moreover, in the past five years, Cerner’s revenues have risen gradually at a CAGR of 7.4%, with fiscal 2017 revenues coming in at $5,142 million.

Cerner has also been expanding its services through strategic buyouts and partnerships. Recently, Adventist Health announced the extension of its partnership with Cerner. Additionally, over the last few years, the acquisitions of Resource Systems, Clairvia, Anasazi Software, PureWellness, Labotix and InterMedHx have helped improve Cerner’s market share.

Downside Scenario

At present, Cerner faces aggressive competition in the industry. Reputed names such as Allscripts Healthcare Solutions, Epic Systems, GE Healthcare Technologies, McKesson Corp and Quality Systems pose significant challenges apart from hurting pricing and margins.

The company’s long-term debt and declining operating margin raise concern. In the fourth quarter of fiscal 2017, gross margin was flat year over year, while operating margins contracted 280 basis points year over year.

Furthermore, the industry Cerner operates in is highly regulated by the government. With rapid evolution of product standards and requirements, any change in government regulation may have an adverse impact on Cerner's products.

Bottom Line

Unhindered by the issues, analysts are optimistic about Cerner. For the current quarter, the Zacks Consensus Estimate for revenues is pinned at $1.34 billion, reflecting a year-over-year rise of 6%.

Thus, investors might want to hold on to the stock, courtesy of Cerner’s edge over peers. We also believe that strategic partnerships and a strong EHR platform will continue to drive overall growth for the company.

Key Picks

A few better-ranked stocks in the broader medical space are Bio-Rad Laboratories BIO, Myriad Genetics Inc. MYGN and Abiomed, Inc. ABMD.

Bio-Rad Laboratories sports a Zacks Rank #1 (Strong Buy). It has long-term expected earnings growth rate of 15%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Myriad Genetics has long-term expected earnings growth rate of 10%. The stock carries a Zacks Rank #2 (Buy).

Abiomed has long-term expected earnings growth rate of 31.5%. The stock carries a Zacks Rank #2.

Can Hackers Put Money INTO Your Portfolio?

Earlier this year, credit bureau Equifax announced a massive data breach affecting 2 out of every 3 Americans. The cybersecurity industry is expanding quickly in response to this and similar events. But some stocks are better investments than others.

Zacks has just released Cybersecurity! An Investor’s Guide to help Zacks.com readers make the most of the $170 billion per year investment opportunity created by hackers and other threats. It reveals 4 stocks worth looking into right away.

Download the new report now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cerner Corporation (CERN) : Free Stock Analysis Report

ABIOMED, Inc. (ABMD) : Free Stock Analysis Report

Bio-Rad Laboratories, Inc. (BIO) : Free Stock Analysis Report

Myriad Genetics, Inc. (MYGN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance