Here's Why You Should Hold On to Check Point (CHKP) Stock

Check Point Software Technologies Ltd. CHKP has an impressive earnings surprise history, having surpassed the Zacks Consensus Estimate in each of the trailing four quarters, with an average positive surprise of 3.6%.

With expected long-term earnings per share growth rate of 9.7% and a market cap of $16.1 billion, it seems to be a stock that investors need to hold on to if they are looking to reap long-term gains.

Let’s take a look at the factors aiding the company’s performance.

Check Point’s information technology (IT) security solutions have been experiencing rapid adoption. This is evident from the company’s impressive top-line performance in fourth-quarter 2017. Revenues in the quarter came in at $506 million, up 4% year over year and marginally above the mid-point of the company’s guidance of $485-$525 million (mid-point $505 million).

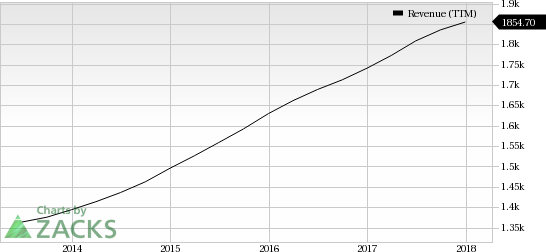

Check Point Software Technologies Ltd. Revenue (TTM)

Check Point Software Technologies Ltd. Revenue (TTM) | Check Point Software Technologies Ltd. Quote

Also, management was particularly positive about the performance of Infinity platform, which was launched in the third quarter. Talking about deal size, the number of new customers — who signed deals worth $1 million or more — totaled 110, up 11% from the year-ago quarter.

We believe a better control on spending has kept Check Point consistently profitable when compared to its peers like Palo Alto Networks PANW, Fortinet FTNT and Cisco CSCO. Notably, the company spends only a quarter of its revenues toward sales and marketing while its peers spend about 40-60% of the same. This makes a huge difference as with just a 6.5% rise in revenues Check Point’s non-GAAP EPS grew 13% in 2017.

Meanwhile, Check Point’s ongoing issues related to the changes it made in its U.S. sales force makes us skeptical about the company’s near-term performance. Per management, its fourth-quarter revenues have been hurt by significant changes made in the U.S. sales force that has not yet reached full potential.

However, this seems to be a temporary issue. Given its wide range of cyber security solutions, Check Point is likely to make the most of growth opportunity in the global threat intelligence market, which, per Grand View Research, is expected to reach $12.6 by 2025 with a CAGR of 17.4% through 2017 to 2025.

Zacks Rank

Check Point has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks #1 Rank (Strong Buy) stocks here.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

Check Point Software Technologies Ltd. (CHKP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance