Here's Why Paycom (PAYC) Stock Should Be in Your Portfolio

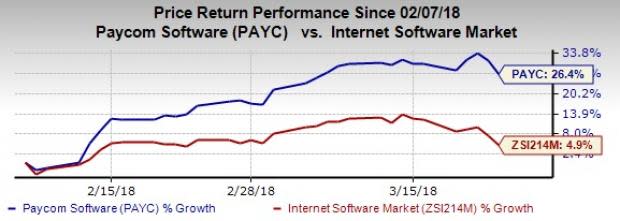

Paycom Software PAYC has been performing quite well since it reported impressive fourth-quarter 2017 results. The stock has gained 26.4% since the earnings release, substantially outperforming the 4.9% rally of the industry it belongs to.

In the last reported quarter, the company’s non-GAAP earnings per share came in at 29 cents per share, which beat the Zacks Consensus Estimate of 23 cents. Also, reported earnings increased from 18 cents earned in the year-ago quarter.

Paycom Software reported revenues of $114.03 million, which increased 30% from the year-ago quarter. Revenues also surpassed the Zacks Consensus Estimate of $113 million.

The company also provided encouraging guidance. For first-quarter fiscal 2018, Paycom Software expects revenues in the range of $150-$152 million. The company anticipates revenues in the range of $541-$543 million for fiscal 2018.

Paycom Software, Inc. Revenue (TTM)

Paycom Software, Inc. Revenue (TTM) | Paycom Software, Inc. Quote

Factors Influencing the Stock

Client addition largely contributed to the company’s better-than-expected top-line results. Also, “client retention rate,” which has been hovering around 91% for almost six years in a row, was a positive.

Notably, management is particularly optimistic about the sales team’s performance, which has resulted in the increase of the sales team count to 46. The much positive feedback received by the company’s application that was launched last year on Apple’s AAPL App Store and Google’s GOOGL Play Store is another positive.

Additionally, pertaining to the shift to ASC 606 accounting standard, projected margins have also increased. Previously, the company recognized commission related expenses in the quarter in which a contract was signed. Per the new standards, the commission expense will be recognized ratably over the period till which the contract is valid. This will lower sales and marketing expenses, which will boost margins.

Paycom is also paying attention to increasing shareholder value with share buyback initiatives. The company recently amended an in-progress share repurchase program with an increase in allocated capital and extension of expiration date. These shareholder-friendly steps are also proving worthy.

With an increasing number of companies becoming aware of the benefits of new age human resource technologies, the company is optimistic about the accelerated adoption of its cloud-based human capital management (HCM) software solution delivered as Software-as-a-Service (SaaS). This is expected to drive the momentum of this Zacks Rank #1 (Strong Buy) stock.

Another stock worth considering in the broader technology sector is Facebook FB, which also sports a Zacks Rank #1.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term growth rate of Facebook is projected to be 26.2%.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Facebook, Inc. (FB) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Paycom Software, Inc. (PAYC) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance