Here's Why You Should Steer Clear of Fresenius Medical Now

Things have been pretty rough for Fresenius Medical Care FMS of late, as is evident from the downbeat guidance. The company is currently an underperformer in the competitive MedTech space.

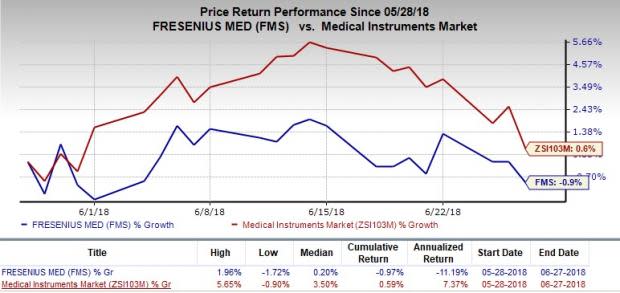

In the past month, the stock has declined 0.9% comparing unfavorably with the industry’s 0.6%. The current level is also lower than the S&P 500 index’s decline of 0.5%.

In the last 60 days, the Zacks Consensus Estimate for the company’s current-quarter earnings per share plunged 17.8% to 60 cents. The stock has a Growth Score of F, which dampens investor confidence in the stock. Our research shows that stocks with a Growth Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2 (Buy), outperform most stocks.

Further, the company’s Zacks Rank #5 (Strong Sell) only reflects its innate weakness.

Consequently, it will be wise to dump the stock as the chances of near-term recovery are low.

Fresenius Medical Care Price and Consensus

Fresenius Medical Care Price and Consensus | Fresenius Medical Care Quote

Why Should You Offload?

Soft Segmental Performance

Fresenius Medical’s core Health Care Services segment revenues dropped 3% in the first quarter of 2018. Geographically, North America revenues declined 5% at constant currency (cc) on a year-over-year basis, owing to the shift of calcimimetic drugs into the clinical environment. The region also registered organic growth of only 1%.

Furthermore, the Care Coordination unit of the Dialysis Care business declined 14% at cc, including a 13% negative impact resulting from foreign currency translation.

Organic growth at the unit was down 9%.

Guidance Downbeat

For 2018, Fresenius Medical estimates revenue growth of 5% and 7% at cc, lower than the previous guidance of 8%.

Notably, the Zacks Consensus Estimate is pegged at $21.32 billion, reflecting a rise of 6.2% year over year.

The company further expects to reduce its EBITDA by end of 2018.

Stiff Competition

Fresenius Medical has numerous competitors in the field of health care services as well as the sale of dialysis products. Cutthroat competition in the niche markets is likely to mar sales opportunities and dent market share.

Stocks to Consider

A few better-ranked stocks in the broader medical space are Genomic Health GHDX, Abiomed ABMD and Integer Holdings Corporation ITGR.

Genomic Health has an expected earnings growth rate of 187.5% for the current quarter. The stock sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Abiomed has a projected long-term earnings growth rate of 27%. The stock sports a Zacks Rank #1.

Integer Holdings has a projected long-term earnings growth rate of 15%. The stock carries a Zacks Rank #2.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fresenius Medical Care (FMS) : Free Stock Analysis Report

ABIOMED, Inc. (ABMD) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Genomic Health, Inc. (GHDX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance