Apple Set to Beat Q1 Earnings Estimates: Tech ETFs to Buy

Technology giant Apple AAPL is set to release first-quarter fiscal 2020 results on Jan 28 after market close. Since Apple accounts for more than 19% of total market capitalization of the entire technology sector in the S&P 500 Index, it is worth taking a look at its fundamentals ahead of its quarterly results.

Apple has been hitting record highs lately. It has returned about 28% over the past three months, on par with the industry’s gain. The momentum is expected to continue if the company beats estimates in the soon-to-be reported quarter (read: Apple at All-Time High, Poised for an Upbeat Q1: ETFs to Benefit).

Inside Our Methodology

Apple has a Zacks Rank #2 (Buy) and an Earnings ESP of +4.08%. According to our methodology, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Apple saw positive earnings estimate revision of a couple of cents over the past 30 days for the fiscal first quarter. Analysts raising estimates right before earnings — with the most up-to-date information possible — is a pretty good indicator for the stock. Additionally, the company has a strong track record of positive earnings surprise. It delivered an average positive earnings surprise of 3.64% in the trailing four quarters.

Further, the Zacks Consensus Estimate indicates a modest year-over-year increase of 8.37% for earnings and 4.07% for revenues (see: all the Technology ETFs here).

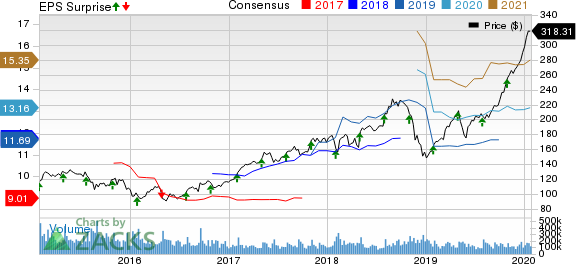

Apple Inc. Price, Consensus and EPS Surprise

Apple Inc. price-consensus-eps-surprise-chart | Apple Inc. Quote

Though AAPL has a solid Momentum Score of B, it has Value and Growth Score of D and C, respectively. The stock belongs to a top-ranked Zacks Industry (top 44%). According to the analysts polled by Zacks, more than 65% of the analysts provided a Strong Buy or a Buy rating for Apple ahead of its earnings with a price target of $302.19.

What’s Hot?

Analysts are betting on a solid holiday quarter based on strong sales of iPhone 11, Apple Watch and AirPods wireless earbuds. As such, many of them have raised their price targets on the stock ahead of its Q1 earnings.

ETFs in Focus

ETFs having the highest allocation to this tech titan will be in focus going into its earnings announcement. While there are several ETFs in the space with Apple in their top 10 holdings, we have highlighted the ones that have Apple as the top or the second firm with a double-digit allocation:

Select Sector SPDR Technology ETF XLK – The fund has AUM of $28.5 billion and has a Zacks ETF Rank #1 (Strong Buy). Apple makes up for 20.1% of the assets (read: 5 Low-Cost Tech ETFs for Investors).

MSCI Information Technology Index ETF FTEC – This fund has a Zacks ETF Rank #1 and has AUM of $3.5 billion. Apple has 18.9% allocation.

Vanguard Information Technology ETF VGT – It has AUM of $27.6 billion and sports a Zacks ETF Rank #1. Here, AAPL takes 18.5% share (read: Top-Ranked ETFs, Stocks From Top Sector of the Last Decade).

iShares Dow Jones US Technology ETF IYW – The fund has amassed $5.1 billion in its asset base and carries a Zacks ETF Rank #1. Apple accounts for 18% of the assets.

iShares Global Tech ETF IXN - The product has accumulated $3.4 billion in its asset base. Apple accounts for 16% allocation.

Want key ETF info delivered straight to your inbox?

Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing ETFs, each week. Get it free >>

Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Vanguard Information Technology ETF (VGT): ETF Research Reports

iShares Global Tech ETF (IXN): ETF Research Reports

Fidelity MSCI Information Technology Index ETF (FTEC): ETF Research Reports

Technology Select Sector SPDR ETF (XLK): ETF Research Reports

iShares U.S. Technology ETF (IYW): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Yahoo Finance

Yahoo Finance